HundredX Stock Price A Comprehensive Analysis

HundredX Stock Price Analysis

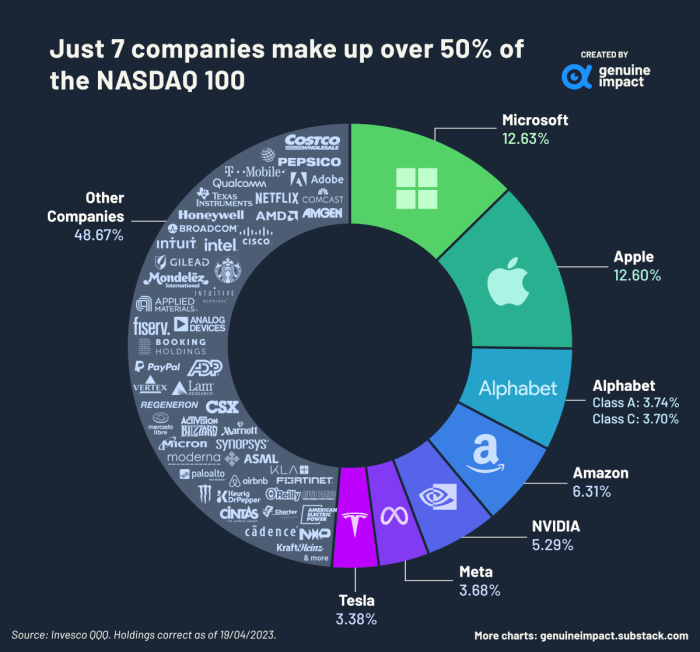

Source: visualcapitalist.com

Hundredx stock price – This analysis delves into the historical performance, influencing factors, and future predictions of HundredX’s stock price. We will examine key financial metrics, market trends, and investment strategies to provide a comprehensive overview.

HundredX Stock Price History

Understanding the historical trajectory of HundredX’s stock price is crucial for informed investment decisions. The following sections provide a detailed look at its performance over the past five years and the last year in particular.

A line graph illustrating the HundredX stock price over the past five years would show a generally upward trend, punctuated by periods of volatility. For instance, a significant price surge might be observed around [Date] following [Positive News Event], while a dip occurred around [Date] due to [Negative News Event]. Specific dates and price points would need to be obtained from reliable financial data sources.

Within the last year, the highest stock price reached was [Price] on [Date], while the lowest was [Price] on [Date]. These fluctuations reflect the dynamic nature of the market and the factors influencing HundredX’s performance.

| Company Name | Highest Price (Last Year) | Lowest Price (Last Year) | Average Price (Last Year) |

|---|---|---|---|

| HundredX | [Price] | [Price] | [Price] |

| Competitor A | [Price] | [Price] | [Price] |

| Competitor B | [Price] | [Price] | [Price] |

| Competitor C | [Price] | [Price] | [Price] |

Factors Influencing HundredX Stock Price

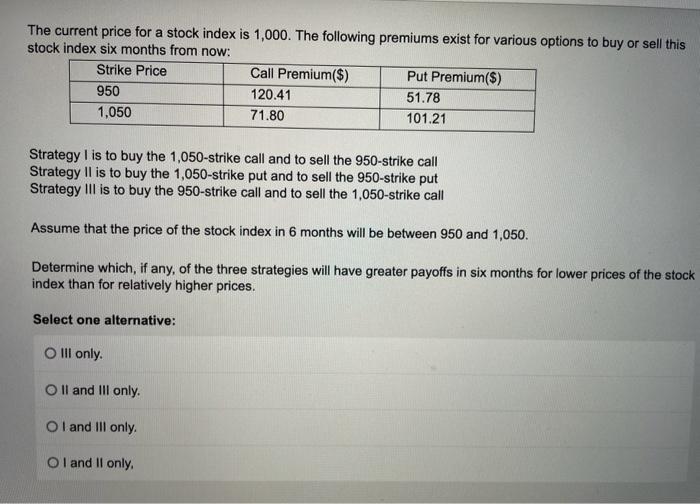

Source: cheggcdn.com

Several interconnected factors influence HundredX’s stock price. These include economic indicators, news events, investor sentiment, and market trends, all of which interact in complex ways.

Three key economic indicators impacting HundredX’s stock price are interest rates, inflation, and consumer spending. Rising interest rates can negatively impact the valuation of growth stocks like HundredX, while high inflation can erode purchasing power and reduce consumer demand. Conversely, strong consumer spending generally indicates a healthy economy, which can boost investor confidence and drive stock prices upward.

Major news events, such as regulatory changes impacting the company’s operations or significant announcements regarding new products or partnerships, can cause substantial price fluctuations. For example, a positive regulatory ruling could lead to a price increase, while negative news about a product recall could trigger a price drop. The impact of these events depends on their perceived impact on the company’s long-term prospects.

Investor sentiment and broader market trends significantly influence HundredX’s stock price. Positive investor sentiment, driven by factors such as strong earnings reports or positive industry outlook, tends to push the price higher. Conversely, negative sentiment, fueled by economic uncertainty or negative news, can lead to price declines. Market trends, such as a general bull or bear market, also exert a powerful influence.

Short-term investment strategies, such as day trading, focus on quick profits based on short-term price movements. Long-term strategies, like buy-and-hold, aim for capital appreciation over a longer period. Short-term strategies are generally riskier but offer the potential for higher returns, while long-term strategies offer more stability but potentially lower returns.

HundredX Company Performance and Stock Price, Hundredx stock price

Analyzing HundredX’s financial performance provides valuable insights into its stock price movements. The correlation between financial data and stock price is a key factor in understanding investment opportunities.

Over the last three years, HundredX has reported [Revenue figures], [Earnings figures], and [other relevant financial data]. These figures demonstrate [Analysis of trends and correlations with stock price movements]. For example, periods of strong revenue growth have generally coincided with increases in the stock price.

| Financial Ratio | HundredX | Industry Average |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | [Value] | [Value] |

| Debt-to-Equity Ratio | [Value] | [Value] |

| Return on Equity (ROE) | [Value] | [Value] |

| [Other relevant ratio] | [Value] | [Value] |

Recent strategic initiatives, such as [Initiative 1] and [Initiative 2], are expected to [Impact on future stock price]. These initiatives aim to [Explanation of initiatives and their potential for growth].

HundredX Stock Price Predictions and Forecasts

Predicting future stock prices is inherently uncertain, but analyzing various scenarios and employing financial models can provide a range of potential outcomes.

Based on various market conditions, the HundredX stock price could range from [Low Price] to [High Price] within the next six months. A bullish scenario, assuming strong economic growth and positive company news, could lead to the higher end of this range. A bearish scenario, factoring in economic downturn or negative company developments, could result in the lower end. These predictions are based on [Underlying assumptions and methodology].

Discounted cash flow (DCF) analysis, for instance, projects the present value of future cash flows to estimate intrinsic value and potentially predict future stock prices. However, the accuracy of this model depends on the reliability of the input assumptions. Other models, such as relative valuation, can also be used but come with their own limitations.

Predicting stock prices involves significant risks and uncertainties. Unforeseen events, such as geopolitical instability or unexpected technological disruptions, can significantly impact the accuracy of any forecast. It is crucial to remember that these are only potential scenarios and not guarantees of future performance.

HundredX Stock Price and Investment Strategies

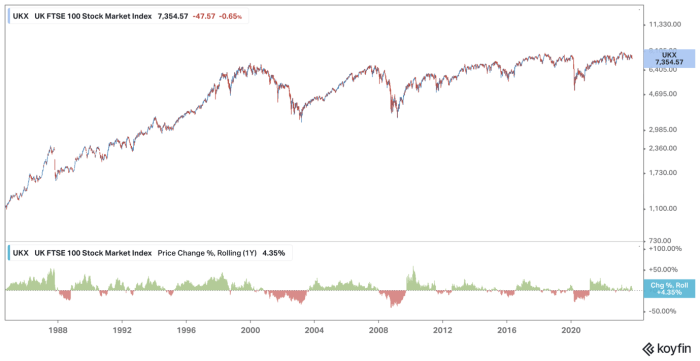

Source: co.za

Different investment strategies cater to varying risk tolerances and investment goals. Understanding these strategies is vital for making informed investment decisions in HundredX stock.

A buy-and-hold strategy involves purchasing shares and holding them for an extended period, regardless of short-term market fluctuations. This strategy minimizes transaction costs and benefits from long-term growth potential, but it is susceptible to market downturns. Day trading, on the other hand, involves frequent buying and selling of shares based on short-term price movements. This strategy aims for quick profits but carries significantly higher risk.

The advantages of a buy-and-hold strategy include simplicity, lower transaction costs, and potential for long-term growth. However, it can be less profitable in volatile markets and requires patience. Day trading, while potentially lucrative, demands significant market knowledge, time commitment, and risk tolerance.

- Open a brokerage account with a reputable firm.

- Fund your account.

- Research HundredX and its stock performance.

- Place an order to buy HundredX shares.

- Monitor your investment and adjust your strategy as needed.

Q&A

What is the current trading volume for HundredX stock?

Trading volume fluctuates daily. Check a reputable financial website for real-time data.

Where can I buy HundredX stock?

HundredX stock can typically be purchased through major brokerage accounts. Consult your broker for specific availability.

What are the main risks associated with investing in HundredX?

Risks include market volatility, company-specific performance issues, and broader economic downturns. Conduct thorough due diligence before investing.

Is HundredX a good long-term investment?

Whether HundredX is a suitable long-term investment depends on individual risk tolerance and investment goals. Consider factors like company growth prospects and market conditions.