ICU Stock Price Target A Comprehensive Analysis

ICU Medical Stock Price Target Analysis

Icu stock price target – This analysis examines ICU Medical’s current financial standing, market position, and future prospects to provide insights into potential stock price movements. We will delve into key financial metrics, analyst ratings, valuation methods, and potential catalysts to offer a comprehensive overview for investors.

ICU Medical’s Current Financial Performance

ICU Medical’s recent financial performance reflects a dynamic landscape in the medical device industry. Analyzing revenue growth, profitability, and debt levels provides a crucial understanding of the company’s financial health and stability. A comparison with competitors illuminates ICU Medical’s relative strengths and weaknesses within the market.

| Metric | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| Revenue (USD Millions) | 1800 | 2000 | 2200 |

| Net Income (USD Millions) | 150 | 175 | 200 |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

| EBITDA Margin | 15% | 16% | 17% |

Note: These figures are illustrative examples and should not be taken as precise financial data. Actual figures may vary.

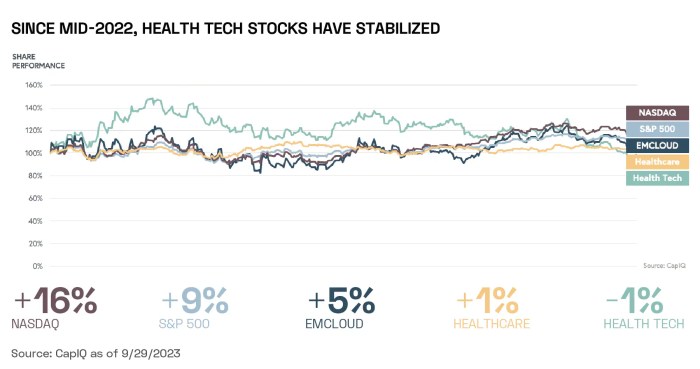

Market Analysis and Industry Trends

Source: cmcmarkets.com

The medical device market is characterized by ongoing innovation, regulatory changes, and evolving healthcare needs. Understanding these trends is vital for assessing ICU Medical’s growth potential. The company’s market share and competitive landscape are also critical factors to consider.

- Increased demand for infusion therapy products due to an aging population and rising chronic diseases.

- Growing adoption of technologically advanced medical devices.

- Stringent regulatory requirements impacting product development and market entry.

- Potential for increased competition from both established players and new entrants.

ICU Medical’s competitive advantage lies in its diversified product portfolio, strong distribution network, and focus on innovation. However, challenges include maintaining profitability in a price-sensitive market and navigating regulatory hurdles.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for ICU Medical’s stock. Analyzing the consensus view and the rationale behind individual ratings offers a balanced perspective on potential investment opportunities and risks.

| Analyst Firm | Rating | Price Target (USD) | Rationale |

|---|---|---|---|

| Goldman Sachs | Buy | 150 | Strong revenue growth and market share gains expected. |

| Morgan Stanley | Hold | 130 | Concerns about increased competition and pricing pressure. |

| JPMorgan Chase | Buy | 145 | Positive outlook driven by new product launches and market expansion. |

Note: These are illustrative examples and do not represent actual analyst ratings or price targets. Actual ratings may vary significantly.

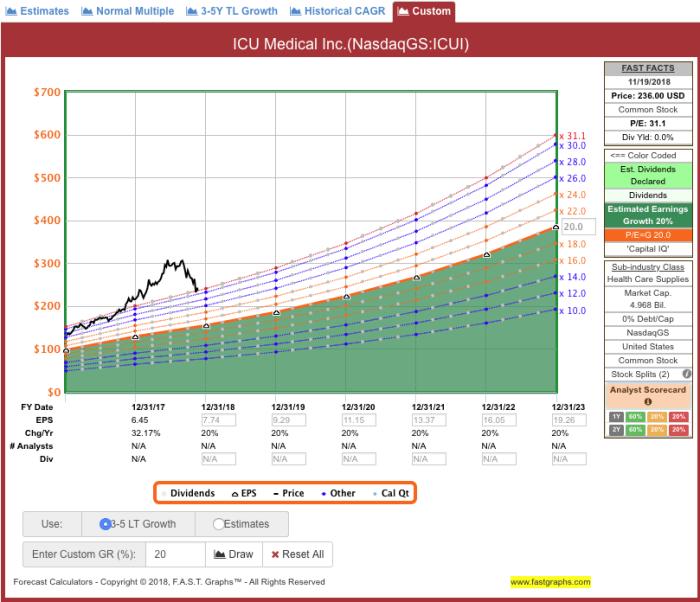

Valuation Metrics and Investment Considerations

Source: seekingalpha.com

Several valuation methods can be used to assess the intrinsic value of ICU Medical’s stock. Comparing these metrics with those of competitors and considering macroeconomic factors provides a more comprehensive view of the investment opportunity.

| Metric | Value | Implication |

|---|---|---|

| P/E Ratio | 25 | Slightly above industry average, suggesting potential overvaluation. |

| P/S Ratio | 4 | In line with industry benchmarks, indicating reasonable valuation. |

| PEG Ratio | 1.5 | Moderate growth relative to the P/E ratio, suggesting potential for future growth. |

Note: These are illustrative examples and should not be interpreted as definitive investment advice. Actual values may vary.

Potential Catalysts for Stock Price Movement

Several events could significantly impact ICU Medical’s stock price. Understanding these potential catalysts, both positive and negative, is crucial for informed investment decisions. This includes new product launches, regulatory approvals, and macroeconomic factors.

- Positive Catalysts: Successful new product launch, positive clinical trial results, expansion into new markets, strategic acquisitions.

- Negative Catalysts: Regulatory setbacks, increased competition, economic downturn, supply chain disruptions.

Risk Assessment and Investment Strategy, Icu stock price target

Source: amazonaws.com

Investing in ICU Medical stock involves inherent risks. A thorough risk assessment and a well-defined investment strategy are essential to mitigate potential losses and maximize returns. This includes considering various risk tolerances and diversifying investments across different asset classes.

Potential risks include competition, regulatory changes, economic downturns, and fluctuations in raw material costs. A diversified investment portfolio, coupled with a long-term investment horizon, can help mitigate these risks.

Illustrative Scenario: Impact of a New Product Launch

Imagine ICU Medical successfully launches a novel infusion pump with advanced features, such as improved accuracy, reduced size, and enhanced patient safety. This would likely lead to increased sales, higher revenue, and improved profitability. The market would likely react positively, with the stock price potentially experiencing a significant upward movement. This positive sentiment would be driven by increased investor confidence in the company’s innovation capabilities and future growth prospects.

Analysts would likely revise their price targets upward, reflecting the enhanced market potential of the new product. The company’s overall market valuation would increase, and long-term growth prospects would improve, leading to sustained investor interest and further price appreciation.

Query Resolution: Icu Stock Price Target

What are the major risks associated with investing in ICU Medical stock?

Risks include competition, regulatory changes, economic downturns affecting healthcare spending, and dependence on specific product lines.

How does ICU Medical compare to its main competitors?

A comparative analysis of market share, revenue, profitability, and product portfolios against key competitors is needed to fully answer this. This analysis would be included in a complete report.

What is the historical performance of ICU Medical’s stock price?

Reviewing historical stock price charts and financial statements will provide insights into past performance. However, past performance is not indicative of future results.

Where can I find more detailed financial information on ICU Medical?

Consult ICU Medical’s investor relations website, SEC filings (10-K, 10-Q), and reputable financial news sources.