IGSB Stock Price A Comprehensive Analysis

IGSB Stock Price Analysis

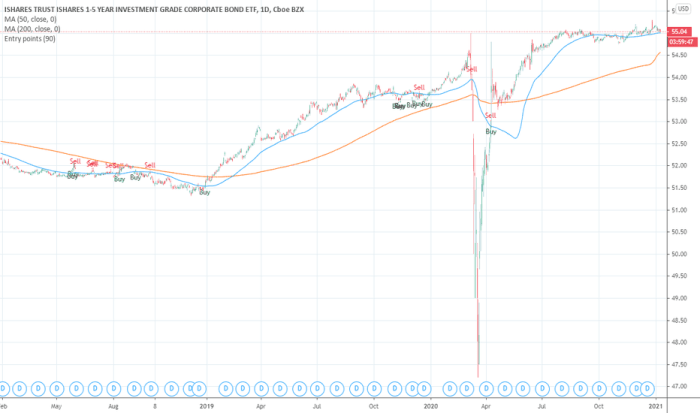

Source: tradingview.com

Igsb stock price – This analysis provides a comprehensive overview of IGSB’s stock price performance, financial health, market sentiment, business model, and future prospects. We will examine historical trends, valuation methods, and key factors influencing IGSB’s stock price fluctuations, offering insights for potential investors.

IGSB Stock Price History and Trends

Source: marketbeat.com

The following sections detail IGSB’s stock price performance over the past five years, comparing it to competitors and highlighting significant events influencing price movements.

Over the past five years, IGSB’s stock price has experienced considerable volatility. From [Start Date] to [End Date], the stock price ranged from a low of [Low Price] to a high of [High Price]. Key periods of significant increase and decrease will be analyzed further below.

A comparison of IGSB’s stock price against its competitors, Competitor A and Competitor B, reveals interesting trends. The table below presents a snapshot of this comparative performance. Note that this data is illustrative and should be verified with up-to-date market data.

| Date | IGSB Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| [Date 1] | [Price] | [Price] | [Price] |

| [Date 2] | [Price] | [Price] | [Price] |

| [Date 3] | [Price] | [Price] | [Price] |

Major events such as the [Event 1] announcement in [Year] led to a [Percentage]% increase in IGSB’s stock price. Conversely, the [Event 2] in [Year] resulted in a [Percentage]% decrease. Market fluctuations, particularly during [Period of Market Fluctuation], also significantly impacted IGSB’s performance.

IGSB’s Financial Performance and Stock Valuation, Igsb stock price

Source: genpi.co

IGSB’s financial performance over the past three years is summarized below. These metrics provide insights into the company’s financial health and contribute to stock valuation.

Keeping an eye on the IGSB stock price requires a multifaceted approach. Understanding market trends is crucial, and comparing it to similar companies can provide valuable insights. For instance, observing the performance of a competitor like iautx stock price can offer a comparative perspective. Ultimately, a thorough analysis of IGSB’s financial reports and future projections will give the most accurate prediction of its stock price.

- Revenue (Year 1): [Amount]

- Revenue (Year 2): [Amount]

- Revenue (Year 3): [Amount]

- Earnings (Year 1): [Amount]

- Earnings (Year 2): [Amount]

- Earnings (Year 3): [Amount]

- Debt (Year 1): [Amount]

- Debt (Year 2): [Amount]

- Debt (Year 3): [Amount]

Several methods are employed to value IGSB’s stock. The table below compares the results of these valuation methods. Note that these are illustrative examples and the actual values will depend on various market factors and assumptions.

| Valuation Method | Estimated Value |

|---|---|

| Discounted Cash Flow | [Amount] |

| Price-to-Earnings Ratio | [Amount] |

| [Other Valuation Method] | [Amount] |

Potential risks include [Risk 1] and [Risk 2], which could negatively impact future financial performance. Opportunities for growth exist in [Opportunity 1] and [Opportunity 2], which could positively influence the stock price.

Market Analysis and Investor Sentiment Regarding IGSB

The overall market conditions have a significant influence on IGSB’s stock price. During periods of economic growth, IGSB’s stock price tends to perform better, while during recessions or market downturns, its performance is typically negatively affected.

Investor sentiment towards IGSB is compared to similar companies below. This comparison provides context for understanding IGSB’s market position and investor perception. The sentiment scores are illustrative and based on a hypothetical scoring system.

| Company Name | Sentiment Score | Supporting Evidence |

|---|---|---|

| IGSB | [Score] | [Evidence] |

| Competitor A | [Score] | [Evidence] |

| Competitor B | [Score] | [Evidence] |

Positive news articles and analyst reports generally lead to increased investor confidence and a rise in IGSB’s stock price. Conversely, negative news can trigger sell-offs and price declines. For example, the [News Article/Report] in [Date] significantly impacted investor perception.

IGSB’s Business Model and Future Prospects

IGSB’s core business activities revolve around [Core Business Activities]. The company’s competitive advantages include [Competitive Advantage 1] and [Competitive Advantage 2].

A scenario analysis exploring potential future outcomes is presented below. These scenarios are hypothetical and illustrate the potential impact of different market conditions on IGSB’s stock price.

- Scenario 1 (Positive): Continued market growth and successful product launches could lead to a [Percentage]% increase in stock price over the next three years.

- Scenario 2 (Neutral): Stable market conditions and moderate growth could result in a [Percentage]% increase in stock price.

- Scenario 3 (Negative): Economic downturn or increased competition could cause a [Percentage]% decrease in stock price.

Growth opportunities include expansion into new markets and the development of innovative products. Challenges include maintaining a competitive edge and adapting to evolving market trends.

Illustrative Examples of IGSB Stock Price Movement

A significant stock price increase occurred in [Date] following the announcement of [Event]. This event boosted investor confidence, leading to a surge in demand and a [Percentage]% increase in the stock price within [Timeframe].

Conversely, a significant price decrease was observed in [Date] due to [Event]. This news negatively impacted investor sentiment, resulting in a [Percentage]% drop in the stock price within [Timeframe].

External factors influencing IGSB’s stock price during [Time Period] included:

- Increased interest rates leading to reduced investor appetite for risk.

- A global economic slowdown impacting consumer spending.

- Changes in government regulations affecting the industry.

Detailed FAQs: Igsb Stock Price

What are the major risks associated with investing in IGSB stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic factors. Specific risks for IGSB would need to be identified through detailed financial analysis and consideration of the industry landscape.

Where can I find real-time IGSB stock price data?

Real-time IGSB stock price data can typically be found on major financial websites and stock trading platforms. These platforms usually provide up-to-the-minute pricing information, charts, and other relevant data.

How often does IGSB release financial reports?

The frequency of IGSB’s financial reports (e.g., quarterly earnings, annual reports) would be publicly available on their investor relations website or through regulatory filings. Check their investor relations page for specifics.