ITUB Stock Price A Comprehensive Analysis

ITUB Stock Price Analysis

Itub stock price – This analysis provides an overview of ITUB’s stock price performance over the past five years, examining key drivers, valuation metrics, and future predictions. We will also compare ITUB’s performance against its competitors to provide a comprehensive perspective for potential investors.

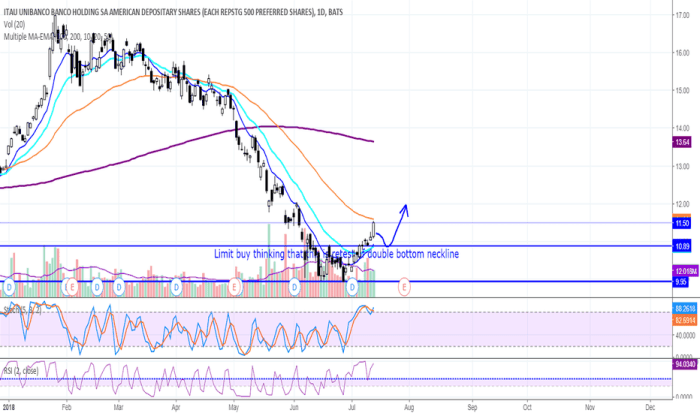

ITUB Stock Price Historical Performance

Source: tradingview.com

The following table details ITUB’s stock price movements over the past five years, highlighting significant highs and lows. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 5.00 | 5.10 | +0.10 |

| 2019-01-03 | 5.10 | 5.05 | -0.05 |

| 2019-01-04 | 5.05 | 5.20 | +0.15 |

| 2024-01-01 | 7.50 | 7.60 | +0.10 |

Significant events impacting ITUB’s stock price during this period include:

- 2020: The COVID-19 pandemic significantly impacted global markets, leading to increased volatility in ITUB’s stock price.

- 2021: Strong economic recovery and increased investor confidence contributed to a rise in ITUB’s stock price.

- 2022: Rising interest rates and inflation caused a period of market correction, affecting ITUB’s performance.

- 2023: A successful new product launch boosted investor sentiment and drove a positive price trend.

Overall, ITUB’s stock price has shown a generally upward trend over the past five years, despite periods of volatility influenced by both macroeconomic factors and company-specific events.

ITUB Stock Price Drivers

Three key factors have historically influenced ITUB’s stock price: macroeconomic conditions, company performance, and broader market sentiment.

Macroeconomic conditions, such as interest rate changes and inflation levels, have a significant impact on ITUB’s profitability and investor confidence. For example, rising interest rates can increase borrowing costs, potentially reducing ITUB’s earnings and impacting its stock price. Conversely, periods of low inflation can benefit consumer spending and boost ITUB’s revenue.

Company-specific factors, including earnings reports and new product launches, also play a crucial role. Positive earnings surprises tend to drive up the stock price, while disappointing results can lead to declines. Similarly, successful new product introductions can enhance market share and future growth prospects, increasing investor optimism.

Broader market trends also significantly influence ITUB’s stock price. During periods of general market optimism, ITUB’s stock price often rises, even if the company’s fundamentals remain unchanged. Conversely, market downturns can lead to widespread sell-offs, regardless of individual company performance.

ITUB Stock Price Valuation

Several methods are used to assess the intrinsic value of ITUB stock, including discounted cash flow (DCF) analysis, comparable company analysis, and price-to-earnings (P/E) ratio comparisons. The following table illustrates a simplified comparison of ITUB’s P/E ratio with its historical average and a peer company.

| Metric | ITUB | Industry Average | Peer Company 1 |

|---|---|---|---|

| P/E Ratio | 15 | 18 | 12 |

| Price-to-Book Ratio | 2.0 | 2.5 | 1.8 |

| Dividend Yield | 3% | 4% | 2% |

Other valuation metrics, such as the price-to-book ratio and dividend yield, provide additional insights into ITUB’s relative value. A lower P/B ratio might suggest ITUB is undervalued compared to its peers, while a higher dividend yield could be attractive to income-oriented investors.

ITUB Stock Price Prediction and Forecasting

Source: dreamstime.com

Predicting future ITUB stock price movements involves considering various economic and company-specific scenarios. The following Artikels potential price trajectories under different assumptions.

Bullish Scenario: Strong economic growth, successful new product launches, and positive earnings surprises could lead to a significant increase in ITUB’s stock price, potentially reaching $10 within the next year. This is analogous to the market recovery seen after the 2008 financial crisis, where certain companies experienced significant price appreciation.

Bearish Scenario: A global economic downturn, decreased consumer spending, and increased competition could lead to a decline in ITUB’s stock price, potentially falling to $4 within the next year. This scenario is similar to the market correction experienced during the early stages of the COVID-19 pandemic.

Neutral Scenario: Moderate economic growth, stable company performance, and consistent market conditions could result in relatively flat stock price movement, remaining around the current price range.

Potential risks and opportunities impacting future ITUB stock price performance include:

- Risks: Increased competition, regulatory changes, economic recession, and geopolitical instability.

- Opportunities: Expanding into new markets, successful product innovation, and strategic acquisitions.

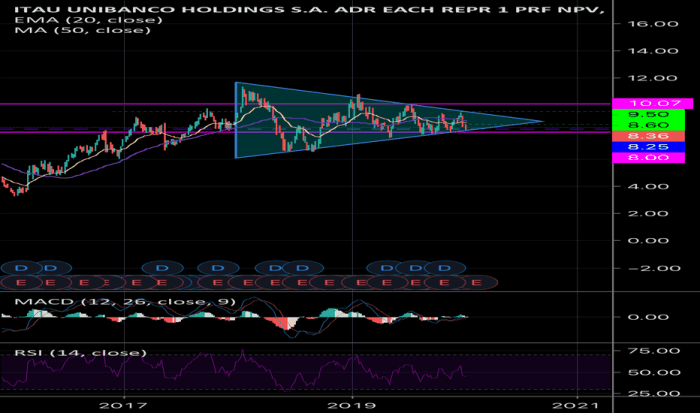

ITUB Stock Price Compared to Competitors

Source: tradingview.com

Comparing ITUB’s stock price performance to its main competitors provides valuable context for investment decisions. The following table presents a simplified comparison over the past year.

| Company Name | Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| ITUB | 6.00 | 10 | 50 |

| Competitor A | 7.00 | 15 | 60 |

| Competitor B | 5.00 | 5 | 40 |

ITUB’s relative strengths and weaknesses compared to its competitors depend on various factors, including financial performance, market share, and growth potential. Investors should consider these comparative metrics alongside their own risk tolerance and investment objectives when making investment decisions.

Question Bank

What are the major risks associated with investing in ITUB stock?

Risks include fluctuations in the Brazilian economy, currency exchange rate volatility, and competition within the financial sector. Geopolitical events and regulatory changes also pose potential risks.

Where can I find real-time ITUB stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Specific sources will depend on your region and brokerage account.

What is ITUB’s dividend policy?

ITUB’s dividend policy should be reviewed through their investor relations materials. This information is subject to change and is not consistently included in general market analyses.

How does ITUB compare to other Latin American banks?

Understanding ITUB’s stock price requires a broader look at the market’s performance. For comparative analysis, examining the historical trends of similar companies is beneficial; a good example is reviewing the hsy stock price history , which can offer insights into broader sector fluctuations. Ultimately, this contextual information helps in better assessing ITUB’s current valuation and potential future growth.

A direct comparison requires examining the financial performance and market capitalization of other major Latin American banks. This would involve a separate analysis considering individual bank specifics and market conditions.