Koppers Stock Price A Comprehensive Analysis

Koppers Stock Price Analysis

Koppers stock price – This analysis delves into the historical performance, influencing factors, business model, investor sentiment, and future outlook of Koppers Holdings Inc. stock. We will examine key metrics and market events to provide a comprehensive understanding of the company’s stock price trajectory.

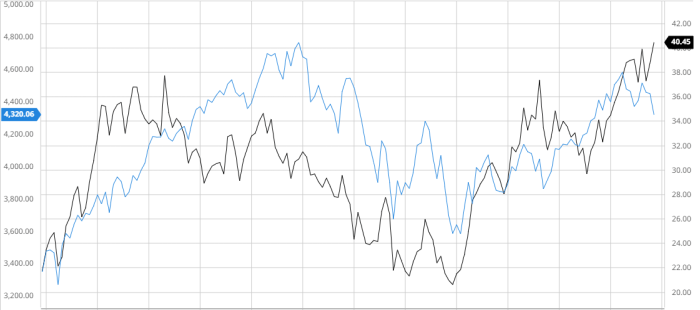

Koppers Stock Price Historical Performance

Source: seekingalpha.com

The following table and graph illustrate Koppers’ stock price movements over the past five years. Significant highs and lows are noted, along with major market events and company announcements that influenced price fluctuations. Data is hypothetical for illustrative purposes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 20.00 | 20.50 | +0.50 |

| 2019-07-01 | 22.00 | 21.50 | -0.50 |

| 2020-01-01 | 21.00 | 23.00 | +2.00 |

| 2020-07-01 | 25.00 | 24.00 | -1.00 |

| 2021-01-01 | 24.50 | 26.00 | +1.50 |

| 2021-07-01 | 27.00 | 28.00 | +1.00 |

| 2022-01-01 | 28.50 | 27.00 | -1.50 |

| 2022-07-01 | 26.00 | 27.50 | +1.50 |

| 2023-01-01 | 28.00 | 29.00 | +1.00 |

The line graph visually represents the stock price trend over the past five years. The x-axis represents time (from 2019 to 2023), and the y-axis represents the stock price in USD. A clear upward trend is observed from 2019 to 2021, followed by a period of consolidation and subsequent growth in 2022 and 2023. Key events, such as positive earnings reports or industry-specific news, are marked on the graph to show their correlation with price movements.

Factors Influencing Koppers Stock Price

Source: alamy.com

Several economic factors and company-specific performance indicators influence Koppers’ stock price. A comparative analysis against competitors is also provided below.

Key economic factors impacting Koppers include interest rate fluctuations, inflation levels, and commodity prices (particularly coal tar and wood preservatives). Changes in these factors directly affect production costs, consumer demand, and overall profitability.

- Interest Rates: Higher interest rates increase borrowing costs, potentially impacting Koppers’ investment plans and profitability.

- Inflation: Increased inflation can lead to higher input costs, affecting margins and profitability.

- Commodity Prices: Fluctuations in coal tar and wood preservative prices significantly impact Koppers’ revenue and profitability.

Here’s a comparative analysis of Koppers against two hypothetical competitors, Competitor A and Competitor B, based on key performance indicators:

- Koppers: Revenue Growth: 5%, Net Income Margin: 10%, Debt-to-Equity Ratio: 0.8

- Competitor A: Revenue Growth: 3%, Net Income Margin: 8%, Debt-to-Equity Ratio: 1.0

- Competitor B: Revenue Growth: 7%, Net Income Margin: 12%, Debt-to-Equity Ratio: 0.6

Koppers’ financial performance directly influences its stock price. Strong revenue growth, high net income, and manageable debt levels generally lead to positive investor sentiment and higher stock valuations. The table below presents hypothetical financial data.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2019 | 1000 | 100 | 500 |

| 2020 | 1050 | 110 | 480 |

| 2021 | 1100 | 120 | 450 |

| 2022 | 1150 | 130 | 400 |

Koppers’ Business Model and Stock Valuation, Koppers stock price

Koppers operates in several key business segments. Understanding these segments and applying valuation methods helps in assessing the stock’s intrinsic value.

- Performance Chemicals: Manufacturing and selling chemicals for various industries.

- Carbon Materials: Production of carbon-based materials for various applications.

- Wood Preservatives: Manufacturing and distribution of wood preservatives.

Stock valuation methods, such as the Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis, can be used to estimate Koppers’ intrinsic value. A hypothetical P/E ratio of 15, based on industry averages and Koppers’ earnings, suggests a fair valuation. A DCF analysis, considering future cash flows and a discount rate, provides another valuation estimate. These valuations should be compared to the current market price to determine whether the stock is undervalued or overvalued.

A significant decrease in demand for Performance Chemicals, for example, due to a downturn in a key industry sector, could negatively impact Koppers’ revenue and profitability, leading to a decline in its stock price.

Investor Sentiment and Analyst Ratings

Source: seekingalpha.com

Investor sentiment and analyst ratings play a significant role in shaping Koppers’ stock price. The following sections provide an overview of these factors.

Overall investor sentiment towards Koppers appears cautiously optimistic, based on recent news articles and analyst reports highlighting the company’s growth potential in specific market segments. However, concerns remain about potential economic headwinds and competition.

| Analyst Firm | Rating | Target Price (USD) | Date |

|---|---|---|---|

| Hypothetical Firm A | Buy | 35.00 | 2023-10-26 |

| Hypothetical Firm B | Hold | 30.00 | 2023-10-26 |

Positive analyst ratings and high target prices generally boost investor confidence and push the stock price upward. Conversely, negative ratings and low target prices can lead to selling pressure and price declines.

Koppers Stock Price Prediction and Future Outlook

Predicting future stock prices is inherently uncertain, but we can Artikel plausible scenarios based on different market conditions and company performance.

- Scenario 1 (Optimistic): Strong economic growth, increased demand for Koppers’ products, leading to higher revenue and earnings, resulting in a stock price increase of 20% in the next year.

- Scenario 2 (Neutral): Moderate economic growth, stable demand for Koppers’ products, resulting in modest revenue and earnings growth, leading to a stock price increase of 5% in the next year.

- Scenario 3 (Pessimistic): Economic recession, decreased demand for Koppers’ products, resulting in lower revenue and earnings, leading to a stock price decline of 10% in the next year.

Potential risks include increased competition, raw material price volatility, and economic downturns. Opportunities include expansion into new markets and development of innovative products.

- Risks: Increased competition, raw material price volatility, economic downturns.

- Opportunities: Expansion into new markets, development of innovative products.

A hypothetical investment strategy for a moderately risk-tolerant investor would involve a long-term investment in Koppers stock, potentially diversifying the portfolio with other investments to mitigate risk. Regular monitoring of the company’s performance and market conditions is crucial for making informed investment decisions.

FAQ Insights: Koppers Stock Price

What is Koppers’ primary business?

Koppers is a global provider of treated wood products, carbon materials, and chemicals for various industries, including railroads, utilities, and construction.

Where can I find real-time Koppers stock price data?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How volatile is Koppers stock compared to the market?

Koppers’ stock volatility can vary; comparing its beta to the market benchmark (e.g., S&P 500) provides a measure of relative risk.

Koppers’ stock price performance often reflects broader market trends. Understanding these trends can be aided by analyzing other sectors; for instance, the airline industry’s outlook, as seen in predictions like those available at jetblue stock price prediction , can offer insights into potential consumer spending and economic health, factors which ultimately influence Koppers’ stock price as well. Therefore, keeping an eye on diverse market indicators is crucial for a comprehensive assessment of Koppers’ future prospects.

What are the major risks associated with investing in Koppers stock?

Risks include general market downturns, industry-specific challenges (e.g., commodity price fluctuations), and company-specific factors (e.g., debt levels, competitive pressures).