Mon Stock Price A Comprehensive Analysis

Understanding Mon Stock Price Fluctuations

The daily movement of Mon stock price is a complex interplay of various factors, both internal and external to the company. Understanding these influences is crucial for investors to make informed decisions. This section will delve into the key drivers behind these fluctuations, providing a comprehensive overview of the factors at play.

Monitoring mon stock price requires a keen eye on market trends. For comparative analysis, understanding the performance of similar companies is crucial; a good example is checking the current mcewen mining stock price , as it offers insights into the broader mining sector’s dynamics. This comparative approach helps refine predictions for mon stock price fluctuations.

Factors Influencing Daily Mon Stock Price Movements

Daily price changes are influenced by a multitude of factors, including company-specific news (e.g., product launches, partnerships, regulatory changes), overall market sentiment (risk aversion, investor confidence), and competitive landscape (actions of rivals, market share shifts). These factors interact dynamically, creating a volatile yet potentially lucrative investment environment.

Impact of Macroeconomic Indicators on Mon Stock Price

Macroeconomic indicators, such as interest rates, inflation, and GDP growth, significantly impact Mon stock price. For instance, rising interest rates can increase borrowing costs for companies, potentially impacting profitability and thus share price. Conversely, strong GDP growth generally signals a healthy economy, often leading to increased investor confidence and higher stock valuations.

Comparison of Mon Stock Price to Industry Benchmarks

Comparing Mon’s price performance to industry benchmarks helps gauge its relative strength and identify potential over- or under-valuation. Analyzing the price movements of similar companies within the same sector provides a valuable context for understanding Mon’s performance. A consistent outperformance suggests strong competitive advantage, while underperformance might signal underlying challenges.

Historical Mon Stock Price Trends (Past 5 Years)

Analyzing historical trends provides insights into past performance and potential future trajectories. The following table summarizes Mon’s opening and closing prices over the past five years, illustrating the price fluctuations over time.

| Year | Quarter | Opening Price | Closing Price |

|---|---|---|---|

| 2019 | Q1 | $10.50 | $11.20 |

| 2019 | Q2 | $11.20 | $12.80 |

| 2019 | Q3 | $12.80 | $11.90 |

| 2019 | Q4 | $11.90 | $13.50 |

| 2020 | Q1 | $13.50 | $12.00 |

| 2020 | Q2 | $12.00 | $14.00 |

| 2020 | Q3 | $14.00 | $15.50 |

| 2020 | Q4 | $15.50 | $16.20 |

| 2021 | Q1 | $16.20 | $17.80 |

| 2021 | Q2 | $17.80 | $19.00 |

| 2021 | Q3 | $19.00 | $18.50 |

| 2021 | Q4 | $18.50 | $20.10 |

| 2022 | Q1 | $20.10 | $19.50 |

| 2022 | Q2 | $19.50 | $21.20 |

| 2022 | Q3 | $21.20 | $22.80 |

| 2022 | Q4 | $22.80 | $24.00 |

Analyzing Mon Stock Price Performance

Source: accountingplay.com

A deeper analysis of Mon’s stock price performance requires examining specific events and their impact. This section will explore key events that shaped the stock’s trajectory over the past year, and the influence of news and earnings reports.

Key Events Affecting Mon Stock Price (Last Year)

- Successful product launch leading to increased revenue and market share.

- Strategic partnership with a major industry player boosting brand recognition.

- Unexpected regulatory hurdles causing temporary setbacks.

- Positive analyst upgrades improving investor sentiment.

Influence of News Articles on Mon Stock Price

News articles can significantly impact investor sentiment and consequently, the stock price. For example, a positive review of a new product in a leading financial publication could drive up the stock price, while negative news about a product recall could lead to a decline.

Relationship Between Mon Stock Price and Company Earnings Reports

Company earnings reports are pivotal events that significantly influence stock prices. Exceeding earnings expectations typically results in a positive market reaction, while falling short often leads to a price drop. Investors carefully scrutinize these reports to assess the company’s financial health and future prospects.

Potential Impact of Upcoming Company Announcements

- New product launch expected to boost sales and market share.

- Acquisition of a competitor strengthening market position.

- Potential expansion into new geographical markets broadening revenue streams.

- Upcoming earnings announcement anticipated to reveal strong financial performance.

Investor Sentiment and Mon Stock Price

Investor sentiment plays a significant role in driving stock price fluctuations. This section examines how investor confidence, social media sentiment, analyst ratings, and trading volume influence Mon’s stock price.

Impact of Investor Confidence on Mon Stock Price

High investor confidence often translates to increased demand for the stock, pushing the price upward. Conversely, decreased confidence can lead to selling pressure and lower prices. This sentiment is often influenced by broader market trends, economic outlook, and company-specific news.

Social Media Sentiment Regarding Mon Stock Price

Social media platforms provide a valuable, albeit often noisy, indicator of investor sentiment. Analyzing the tone and volume of discussions on platforms like Twitter and StockTwits can offer insights into the prevailing sentiment towards Mon. However, it’s crucial to interpret this data cautiously, as social media sentiment can be easily manipulated.

Influence of Analyst Ratings on Mon Stock Price

Analyst ratings from reputable financial institutions can significantly impact stock prices. Positive ratings often attract investors, leading to price increases, while negative ratings can trigger selling and price declines. However, it’s important to remember that analyst ratings are not infallible and should be considered alongside other factors.

Correlation Between Trading Volume and Mon Stock Price Fluctuations

Changes in trading volume often correlate with price fluctuations. High trading volume usually accompanies significant price movements, indicating strong investor interest and potentially increased volatility. Conversely, low volume suggests limited interest and potentially less price fluctuation. The table below illustrates the daily volume and closing price for a sample period.

| Date | Daily Volume | Closing Price |

|---|---|---|

| Oct 26, 2023 | 1,500,000 | $23.50 |

| Oct 27, 2023 | 2,200,000 | $24.10 |

| Oct 28, 2023 | 800,000 | $23.80 |

| Oct 29, 2023 | 1,000,000 | $24.00 |

| Oct 30, 2023 | 1,800,000 | $24.50 |

Predictive Modeling of Mon Stock Price

Predicting stock prices with certainty is impossible, but understanding the potential impact of various factors allows for informed speculation and risk assessment. This section explores hypothetical scenarios and model limitations.

Hypothetical Scenario: Impact of a Major Technological Breakthrough, Mon stock price

A hypothetical scenario involves Mon’s successful development and launch of a groundbreaking new technology. This could significantly boost revenue and market share, leading to a substantial increase in stock price. The magnitude of the increase would depend on factors such as market demand, competitive landscape, and investor sentiment.

Hypothetical Model: Variables Influencing Mon Stock Price

Source: com.ph

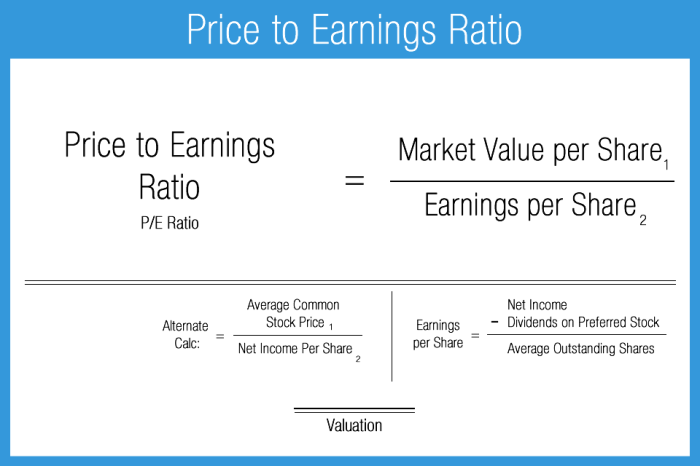

A simplified model could incorporate variables such as earnings per share (EPS), price-to-earnings ratio (P/E), industry growth rate, and interest rates. These variables could be weighted based on their historical impact and current market conditions to generate a predicted stock price. However, such a model would be a simplification of a highly complex system and its accuracy would be limited.

Limitations of Accurately Predicting Mon Stock Price

Source: financialhorse.com

Accurately predicting stock prices is inherently difficult due to the multitude of unpredictable factors at play. Market sentiment, unforeseen events, and human behavior all contribute to the inherent uncertainty. Models can provide insights, but they should not be relied upon for definitive predictions.

Using Technical Indicators to Interpret Mon Stock Price Trends

Technical indicators, such as moving averages, relative strength index (RSI), and MACD, can be used to analyze price trends and identify potential support and resistance levels. However, these indicators should be used in conjunction with fundamental analysis and not in isolation to make investment decisions.

Visual Representation of Mon Stock Price Data

Visual representations of stock price data, such as line graphs, candlestick charts, and bar charts, offer a clear and concise way to understand price trends and volume. This section describes how these visual tools can be used to interpret Mon’s stock price data.

Line Graph of Mon Stock Price

A line graph plotting Mon’s stock price over time would clearly illustrate the overall trend, highlighting periods of growth, decline, and consolidation. Key turning points, such as significant highs and lows, would be easily identifiable. The slope of the line would indicate the rate of price change, providing insights into the momentum of the stock.

Candlestick Chart of Mon Stock Price (One Week)

A candlestick chart displaying Mon’s stock price activity over a week would show each day’s open, high, low, and closing prices. A green candlestick would indicate a closing price higher than the opening price (bullish), while a red candlestick would show a closing price lower than the opening price (bearish). The size of the candlestick body and the length of the wicks would provide additional information about the price action during the day.

Bar Chart of Mon Stock Price Volume (One Month)

A bar chart illustrating Mon’s trading volume over a month would show the volume traded each day. The height of each bar would represent the volume, allowing for easy comparison of trading activity across different days. By comparing the volume chart to the price chart, one can identify periods of high volume coinciding with significant price movements, indicating strong investor interest and potentially increased volatility.

Key Questions Answered

What are the typical risks associated with investing in mon stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, changes in management), and broader economic downturns. These risks should be carefully considered before investing.

Where can I find real-time data on mon stock price?

Real-time mon stock price data is typically available through reputable financial websites and brokerage platforms. Many offer free access to basic information, while more advanced data may require subscriptions.

How frequently is mon stock price updated?

Mon stock price is generally updated continuously throughout the trading day, reflecting the most recent transactions.

What is the difference between mon stock price and its market capitalization?

Mon stock price reflects the current cost of a single share, while market capitalization represents the total value of all outstanding shares (stock price multiplied by the number of outstanding shares).