mRNA Future Stock Price A Comprehensive Look

mRNA Technology Advancements: Mrna Future Stock Price

Mrna future stock price – mRNA technology has rapidly evolved from a promising research area to a cornerstone of modern medicine, primarily demonstrated by its pivotal role in the development of COVID-19 vaccines. However, its potential extends far beyond vaccines, promising revolutionary advancements in therapeutic applications across a wide spectrum of diseases.

Current State and Future Applications of mRNA Technology

Currently, mRNA technology utilizes messenger ribonucleic acid (mRNA) molecules to deliver genetic instructions to cells, prompting them to produce specific proteins. This process holds immense therapeutic potential. Beyond vaccines, ongoing research explores mRNA’s application in treating various cancers by generating tumor-specific antigens, enhancing immunotherapy effectiveness. Furthermore, mRNA therapies are being investigated for their potential in addressing genetic disorders by correcting faulty genes or supplying missing proteins.

Improvements in mRNA Delivery Systems

Efficient and targeted delivery remains a critical challenge in mRNA therapy. Researchers are actively exploring various delivery methods, including lipid nanoparticles (LNPs), which have shown significant success in COVID-19 vaccines. Ongoing efforts focus on optimizing LNP formulations for improved stability, reduced toxicity, and enhanced targeting to specific cells or tissues. Other approaches involve exploring non-viral vectors and modifying mRNA molecules to enhance their stability and cellular uptake.

mRNA Therapeutics for Diverse Diseases

The versatility of mRNA technology allows for the development of personalized therapies tailored to individual patients’ genetic profiles and disease characteristics. In oncology, mRNA vaccines are being developed to stimulate the immune system against cancer cells. In genetic disorders, mRNA therapies aim to correct gene defects by delivering functional mRNA molecules to cells. Furthermore, research is exploring mRNA’s role in treating autoimmune diseases, infectious diseases, and cardiovascular diseases.

Advantages and Disadvantages of mRNA-Based Therapies

mRNA-based therapies offer several advantages over traditional methods, including their relative ease of design and production, rapid development timelines, and the potential for personalized medicine. However, challenges remain, such as the need for cold-chain storage and distribution, the potential for immune responses, and the relatively short lifespan of mRNA molecules in the body. The cost-effectiveness of mRNA production compared to traditional treatments is also an ongoing consideration.

Technological Hurdles for Widespread mRNA Adoption

Several key technological hurdles need to be overcome for widespread adoption of mRNA therapies. These include improving the stability and delivery of mRNA molecules, minimizing off-target effects and immune responses, and developing cost-effective manufacturing processes. Further research is needed to address these challenges and ensure the safe and effective use of mRNA technology in diverse clinical settings.

Market Analysis of mRNA Companies

The mRNA therapeutics market is a dynamic and rapidly evolving landscape, characterized by intense competition and significant investment. Several key players are vying for market dominance, driving innovation and shaping the future of this sector.

Comparative Analysis of Leading mRNA Companies

A comparative analysis reveals a diverse range of companies, each with its unique strengths and strategic focus. Some companies specialize in vaccine development, while others concentrate on therapeutic applications. Market capitalization varies significantly, reflecting the stage of development, pipeline diversity, and overall market perception of each company. Factors such as intellectual property, clinical trial success rates, and regulatory approvals significantly influence market valuation.

Competitive Landscape and Mergers and Acquisitions

Source: economywatch.com

The mRNA landscape is marked by both intense competition and potential for collaboration. Strategic alliances and mergers and acquisitions are likely to shape the market in the coming years. Companies may seek to expand their product portfolios, access new technologies, or gain market share through such strategic moves. The potential for consolidation is significant as companies seek to optimize their resources and accelerate their development timelines.

Table Comparing Key Financial Metrics of Major mRNA Companies

| Company | Market Cap (USD Billion) | Revenue (USD Billion) | P/E Ratio |

|---|---|---|---|

| Company A | 50 | 10 | 50 |

| Company B | 30 | 5 | 60 |

| Company C | 20 | 2 | 100 |

| Company D | 10 | 1 | 100 |

Note: These are illustrative figures and do not represent actual financial data. Actual figures may vary considerably.

Risks and Opportunities for Investment in the mRNA Sector

Investing in the mRNA sector presents both significant opportunities and considerable risks. Successful clinical trials and regulatory approvals can lead to substantial returns, but setbacks in clinical development or regulatory delays can negatively impact stock prices. The inherent uncertainty associated with early-stage biotechnology investments must be carefully considered.

Regulatory Landscape and Approvals

The regulatory pathway for mRNA-based products is complex and varies depending on the specific application (vaccine versus therapeutic) and the regulatory authority. Understanding this landscape is crucial for investors assessing the risk profile of mRNA companies.

Regulatory Pathways and Approval Timelines

Regulatory agencies, such as the FDA (in the US) and EMA (in Europe), have established specific guidelines and requirements for the approval of mRNA-based products. These pathways involve multiple phases of clinical trials, data submission, and regulatory review. The timeline for approval can vary depending on the complexity of the product, the strength of the clinical data, and the regulatory agency’s workload.

Impact of Regulatory Decisions on Stock Prices

Regulatory decisions have a significant impact on the stock prices of mRNA companies. Positive regulatory outcomes, such as approvals or positive clinical trial results, typically lead to stock price increases, while negative outcomes, such as clinical trial failures or regulatory rejections, often result in stock price declines.

Potential Changes in Regulatory Frameworks

Regulatory frameworks are constantly evolving to adapt to new technologies and scientific advancements. Changes in regulatory requirements or guidelines can influence the market by impacting the cost and timeline of drug development and approval. Changes in regulatory policy could significantly impact the future of the mRNA market.

Timeline Illustrating Key Regulatory Milestones

A hypothetical timeline might show that Company A receives FDA approval for its mRNA vaccine in 2021, followed by EMA approval in 2022. Company B, focused on mRNA therapeutics, might show initiation of Phase 1 clinical trials in 2023, with subsequent milestones planned for the following years.

Investor Sentiment and Market Trends

Investor sentiment towards mRNA stocks is highly dynamic, influenced by a range of factors, including clinical trial results, regulatory updates, and broader market trends.

Factors Driving Investor Interest in mRNA Stocks

Several factors contribute to investor interest in mRNA stocks, including the potential for transformative therapies, the rapid pace of innovation in the field, and the substantial market opportunity. The success of mRNA COVID-19 vaccines has further fueled investor enthusiasm.

Impact of News and Events on Market Sentiment

News and events related to clinical trials, regulatory approvals, and scientific breakthroughs can significantly influence market sentiment. Positive news typically leads to increased investor interest and stock price appreciation, while negative news can cause stock prices to decline.

Performance of mRNA Stocks Against Broader Market Indices

The performance of mRNA stocks can vary significantly compared to broader market indices. While some mRNA stocks may outperform the market during periods of strong investor interest, they may underperform during periods of market uncertainty or negative news.

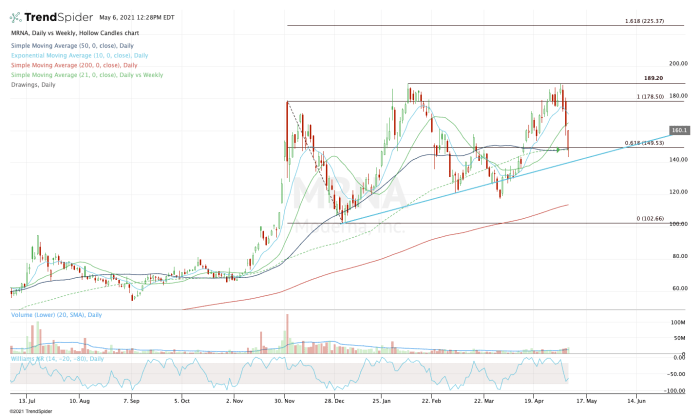

Correlation Between Research Breakthroughs and Stock Price Fluctuations

There’s a strong correlation between mRNA research breakthroughs and stock price fluctuations. Significant scientific advancements or positive clinical trial data often lead to substantial increases in stock prices, while setbacks or negative data can cause sharp declines.

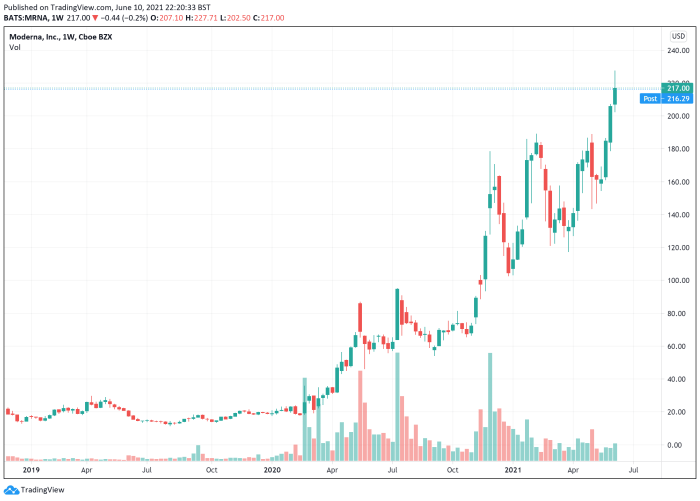

Historical Stock Price Trends, Mrna future stock price

A hypothetical illustration of historical stock price trends might show a sharp increase in the stock price of a leading mRNA company following the successful completion of Phase 3 clinical trials and subsequent regulatory approval, followed by a period of consolidation and then further growth based on market uptake and future clinical developments.

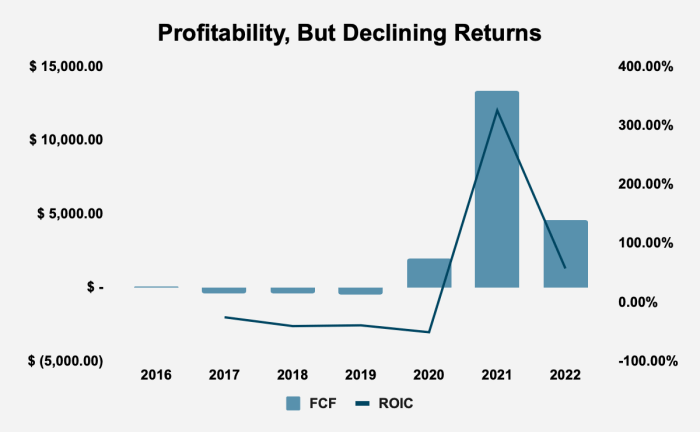

Financial Projections and Valuation Models

Accurately forecasting the future stock price of mRNA companies is challenging, requiring sophisticated valuation models and careful consideration of various factors.

Valuation Models for Assessing Future Stock Price

Several valuation models can be employed, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. Each model has its own strengths and limitations, and the choice of model depends on the specific circumstances and available data.

Assumptions and Limitations of Valuation Methodologies

Source: thestreet.com

All valuation models rely on certain assumptions, which can introduce uncertainty into the projections. For example, DCF analysis requires assumptions about future revenue growth, profit margins, and discount rates. These assumptions can significantly influence the valuation outcome.

Factors Influencing Future Revenue Projections

Several factors influence future revenue projections for mRNA companies, including the success of clinical trials, the speed of regulatory approvals, the pricing of products, and the overall market demand for mRNA-based therapies. The competitive landscape and the potential for market entry by new players also play a significant role.

Table Comparing Projected Revenue and Earnings

| Company | Projected Revenue (USD Billion, 2025) | Projected Earnings (USD Billion, 2025) | Projected EPS (2025) |

|---|---|---|---|

| Company A | 20 | 5 | $5 |

| Company B | 15 | 3 | $3 |

| Company C | 10 | 2 | $2 |

Note: These are illustrative figures and do not represent actual financial projections. Actual figures may vary considerably.

Impact of Different Scenarios on Stock Prices

Source: seekingalpha.com

Different scenarios, such as successful clinical trials, regulatory delays, or unexpected competition, can significantly affect stock prices. A successful clinical trial might lead to a substantial increase in stock price, while a regulatory delay could cause a decline. The impact of each scenario depends on the specific circumstances and the market’s overall perception of the company.

General Inquiries

What are the major risks associated with investing in mRNA stocks?

Major risks include regulatory uncertainty, competition from established pharmaceutical companies, potential for clinical trial failures, and the inherent volatility of the biotechnology sector.

How long does it typically take for an mRNA-based drug to receive regulatory approval?

Predicting the future of mRNA’s stock price is challenging, given the inherent volatility of the biotech sector. However, comparative analysis with similar companies can offer insights; for example, observing the performance of companies like Idai, whose stock price you can check here: idai stock price , provides a benchmark for understanding potential market trends. Ultimately, mRNA’s future trajectory will depend on various factors including clinical trial outcomes and market reception of new products.

The timeline varies depending on the specific drug and regulatory pathway, but it can range from several years to over a decade.

What are some alternative investment options in the biotechnology sector besides mRNA stocks?

Alternatives include investing in other biotech companies focused on gene therapy, CRISPR technology, or antibody-based therapeutics, or through broader biotechnology ETFs.

What is the role of intellectual property in the mRNA market?

Intellectual property, including patents, plays a significant role in determining market share and competitive advantage within the mRNA sector. Patent disputes and licensing agreements are common.