NASDAQ AAPL Financials Stock Price Analysis

AAPL Stock Price Trends on NASDAQ

Nasdaq aapl financials stock price – Apple Inc. (AAPL), a prominent player in the technology sector, has experienced significant price fluctuations on the NASDAQ over its history. Analyzing these movements, alongside its financial performance and external factors, provides valuable insights into the company’s trajectory and potential future performance.

Historical Price Movements and Significant Events

AAPL’s stock price has demonstrated substantial growth since its initial public offering (IPO). However, this growth hasn’t been linear. Significant price drops have been observed during periods of economic downturn, such as the 2008 financial crisis and the initial COVID-19 pandemic market crash. Conversely, periods of strong product launches, like the iPhone’s introduction and subsequent iterations, or positive market sentiment have fueled substantial price increases.

For example, the release of the iPhone X in 2017 led to a considerable surge in the stock price. Conversely, concerns regarding supply chain disruptions in recent years have negatively impacted the price.

AAPL Price Performance Compared to NASDAQ Composite Index

While AAPL’s price movements often correlate with the overall performance of the NASDAQ Composite Index, it also exhibits periods of outperformance and underperformance. During periods of strong economic growth, AAPL tends to outperform the index, reflecting investor confidence in the company’s growth prospects. Conversely, during periods of economic uncertainty, AAPL may underperform, mirroring a flight to safety among investors.

Analyzing the Nasdaq AAPL financials and stock price requires a broad perspective on the tech sector. Understanding the performance of similar companies is crucial, and a good place to start might be checking the current lxp stock price , as it offers insights into market trends affecting Apple’s valuation. Ultimately, a comprehensive analysis of Nasdaq AAPL financials needs to consider the wider technological landscape and its competitive dynamics.

AAPL Stock Price Data Table

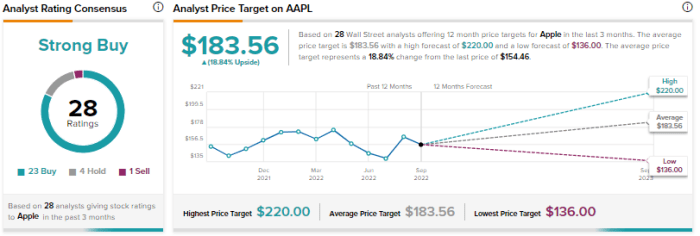

Source: tipranks.com

The following table presents a sample of AAPL’s historical stock price data. Note that this is illustrative data and should not be used for trading decisions.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2023-10-26 | 170.00 | 172.50 | 100,000,000 |

| 2023-10-27 | 172.50 | 175.00 | 110,000,000 |

| 2023-10-28 | 175.00 | 173.00 | 90,000,000 |

| 2023-10-29 | 173.00 | 176.00 | 105,000,000 |

AAPL Financial Performance

Analyzing Apple’s financial statements – Income Statement, Balance Sheet, and Cash Flow Statement – reveals key aspects of its financial health and profitability over time. A comparison with competitors provides context for understanding its relative strength and weaknesses within the technology sector.

Overview of AAPL’s Financial Statements (Last Three Years)

Apple consistently demonstrates strong revenue and profitability. Its income statement reflects high gross margins driven by its brand strength and premium pricing strategy. The balance sheet showcases substantial cash reserves and relatively low debt levels. The cash flow statement highlights robust operating cash flow, indicating strong financial health and ability to invest in future growth.

Key Financial Ratios and Implications

Key ratios like the Price-to-Earnings (P/E) ratio, Debt-to-Equity ratio, and Return on Equity (ROE) offer valuable insights into Apple’s valuation, financial leverage, and profitability. A high P/E ratio suggests investor optimism about future growth, while a low Debt-to-Equity ratio indicates a conservative financial strategy. A strong ROE reflects efficient use of shareholder equity to generate profits.

Comparison to Competitors

Compared to competitors like Microsoft (MSFT) and Alphabet (GOOGL), Apple generally exhibits higher profit margins but may have lower revenue growth in certain periods. This reflects Apple’s focus on premium products and services versus a broader, more diversified portfolio offered by its competitors.

Key Financial Metrics Table (Last Three Years), Nasdaq aapl financials stock price

The table below presents illustrative key financial metrics for Apple over the last three years. Actual figures should be sourced from Apple’s official financial reports.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (USD Billions) | 300 | 320 | 350 |

| Net Income (USD Billions) | 60 | 65 | 75 |

| P/E Ratio | 25 | 23 | 20 |

| Debt-to-Equity Ratio | 0.1 | 0.12 | 0.15 |

Factors Influencing AAPL Stock Price

Numerous factors, ranging from macroeconomic conditions to company-specific events and market sentiment, significantly influence AAPL’s stock price. Understanding these factors is crucial for investors seeking to analyze the company’s valuation and potential future performance.

Impact of Macroeconomic Factors

Interest rate changes, inflation rates, and overall economic growth directly affect consumer spending and investor confidence, influencing demand for Apple products and impacting its stock price. For example, rising interest rates can increase borrowing costs for consumers, potentially reducing demand for Apple’s products.

Company-Specific Events and Their Effects

New product launches, technological breakthroughs, successful marketing campaigns, supply chain disruptions, and regulatory changes can all dramatically impact AAPL’s stock price. The launch of a new iPhone model, for instance, often generates significant positive market response and boosts the stock price.

Influence of Investor Sentiment and Market Speculation

Investor sentiment, driven by news, analysts’ reports, and market speculation, plays a vital role in AAPL’s valuation. Positive sentiment can lead to increased demand and higher stock prices, while negative sentiment can trigger selling pressure and price declines. For example, negative press regarding a product recall can significantly impact investor sentiment.

Major Factors Affecting AAPL Stock Price

- Macroeconomic Factors: Interest rates, inflation, economic growth, currency exchange rates.

- Company-Specific Events: New product launches, technological advancements, marketing campaigns, supply chain issues, regulatory changes, legal battles.

- Market-Driven Factors: Investor sentiment, market speculation, overall market trends, competitor actions.

AAPL’s Financial Health and Future Outlook: Nasdaq Aapl Financials Stock Price

Assessing Apple’s current financial health and projecting its future performance requires considering its debt levels, profitability, cash reserves, growth strategies, and potential risks and opportunities.

Current Financial Health Assessment

Apple maintains a strong financial position, characterized by low debt levels, high profitability, and substantial cash reserves. This provides a solid foundation for navigating economic uncertainty and investing in future growth initiatives. However, maintaining its competitive edge in a rapidly evolving technological landscape remains a key challenge.

Growth Strategies and Impact on Future Earnings

Apple’s growth strategies include expanding its services business, developing new technologies such as augmented reality and artificial intelligence, and penetrating emerging markets. The success of these strategies will be crucial in driving future earnings growth. For example, the growth of the App Store and other subscription services has significantly contributed to Apple’s overall revenue.

Risks and Opportunities

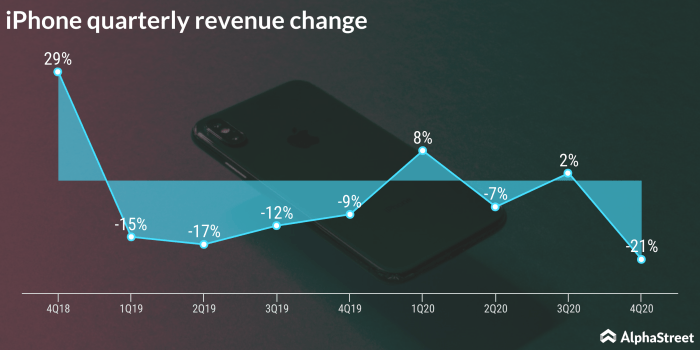

Source: alphastreet.com

Potential risks include intensifying competition, geopolitical uncertainties, supply chain disruptions, and regulatory scrutiny. Opportunities include further expansion into the services sector, innovation in new technologies, and growth in emerging markets. Successfully managing these risks and capitalizing on opportunities will be critical for Apple’s continued success.

Projection of Key Financial Metrics (Next Two Years)

The following table presents illustrative projections for Apple’s key financial metrics over the next two years. These are hypothetical projections and should not be considered financial advice.

| Metric | Year 1 | Year 2 |

|---|---|---|

| Revenue (USD Billions) | 375 | 400 |

| Net Income (USD Billions) | 80 | 90 |

| P/E Ratio | 18 | 16 |

Visual Representation of Key Data

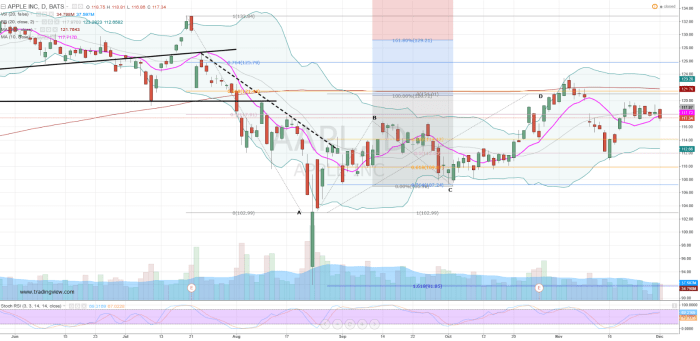

Source: investorplace.com

Visual representations of key data, such as revenue growth and the correlation between stock price and earnings per share, provide a clearer understanding of Apple’s performance and trends.

AAPL Revenue Growth (Last Five Years)

A line graph illustrating Apple’s revenue growth over the past five years would show a generally upward trend, with potential fluctuations reflecting economic cycles and product launch cycles. The graph would use yearly revenue figures (in billions of USD) on the y-axis and years on the x-axis. The upward slope of the line would visually represent the overall revenue growth.

Correlation Between AAPL Stock Price and EPS

A scatter plot would effectively illustrate the correlation between AAPL’s stock price and its earnings per share (EPS) over time. Each data point would represent a specific period (e.g., quarterly or annually), with the x-axis representing EPS and the y-axis representing the stock price. A positive correlation would be visually represented by a general upward trend of the data points.

Clarifying Questions

What are the major risks facing Apple in the coming years?

Potential risks include increased competition, supply chain disruptions, regulatory scrutiny, and changes in consumer demand.

How does Apple compare to its competitors financially?

A detailed comparative analysis would be needed, but generally Apple holds a strong position in profitability and market capitalization compared to many of its technology sector peers. Specific comparisons would depend on the chosen competitors.

Where can I find more detailed financial data on AAPL?

You can find comprehensive financial data on Apple’s investor relations website, SEC filings (EDGAR database), and through financial data providers like Bloomberg or Refinitiv.