Nebius Stock Price A Comprehensive Analysis

Nebius Stock Price Analysis

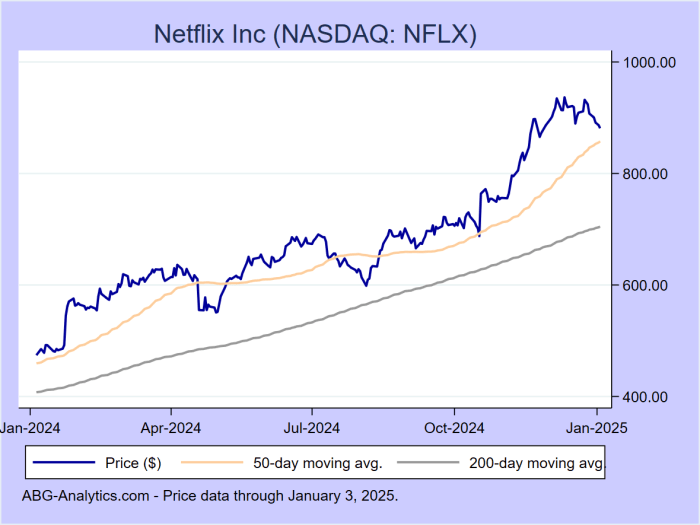

Source: abg-analytics.com

Nebius stock price – This analysis provides a comprehensive overview of Nebius’s stock price performance, influencing factors, prediction models, investor sentiment, and financial health. We will explore historical data, compare Nebius to its competitors, and examine potential future trends.

Nebius Stock Price Historical Performance

Analyzing Nebius’s stock price over the past five years reveals significant fluctuations influenced by various internal and external factors. The following timeline highlights key periods of growth and decline.

Timeline (Illustrative Example):

- 2019: Initial Public Offering (IPO) at $15 per share. Steady growth throughout the year, reaching a high of $22 by December.

- 2020: Significant dip to $10 per share in March due to the global pandemic. A recovery followed, ending the year at $18.

- 2021: Strong growth driven by a successful new product launch, peaking at $30 in November.

- 2022: Market correction led to a decline to $20. A slight recovery towards the end of the year.

- 2023 (Year-to-date): Fluctuations between $20 and $25, reflecting general market uncertainty.

A comparative analysis against competitors, Competitor A and Competitor B, over the past three years provides further context.

Nebius stock price fluctuations are often influenced by broader market trends. It’s interesting to compare its performance against similar industrial companies; for instance, understanding the current kaman corp stock price can offer valuable context. Ultimately, however, a thorough analysis of Nebius’s specific financial health is crucial for accurate price prediction.

| Date | Nebius Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2021-01-01 | $18 | $25 | $15 |

| 2021-07-01 | $25 | $30 | $20 |

| 2022-01-01 | $20 | $22 | $18 |

| 2022-07-01 | $22 | $28 | $21 |

| 2023-01-01 | $23 | $25 | $20 |

Major events such as the 2020 pandemic and the successful 2021 product launch significantly impacted Nebius’s stock price, demonstrating the interplay between macroeconomic conditions and company-specific performance.

Factors Influencing Nebius Stock Price

Several key factors influence Nebius’s stock price movements. These include macroeconomic indicators, industry trends, company-specific news, and inherent risks and opportunities.

Key Economic Indicators: Interest rate changes, inflation rates, and overall economic growth significantly correlate with Nebius’s stock price. For instance, periods of high inflation often lead to increased investor caution and lower stock valuations.

Industry Trends and Technological Advancements: Competition within the sector, technological disruptions, and evolving consumer preferences all influence Nebius’s stock price. For example, the emergence of disruptive technologies could negatively impact Nebius’s market share and valuation.

Company-Specific News: Financial reports (quarterly earnings, annual revenue), leadership changes, and strategic partnerships directly impact investor sentiment and the stock price. Positive news generally leads to increased demand and higher prices.

Risks and Opportunities:

- Risks: Increased competition, regulatory changes, economic downturn, failure to innovate.

- Opportunities: Expansion into new markets, successful product launches, strategic acquisitions, technological advancements.

Nebius Stock Price Prediction Models

Source: farmaciard.com

Predicting Nebius’s stock price involves using historical data and applying various forecasting models. The accuracy of these models depends on the underlying assumptions and the inherent volatility of the stock market.

Simple Forecasting Model (Illustrative Example): A simple moving average model, using the past three months’ average price, can provide a basic prediction. This method, however, does not account for external factors or significant events.

| Model Name | Predicted Price | Confidence Interval | Underlying Assumptions |

|---|---|---|---|

| Simple Moving Average (3-month) | $24 | $22 – $26 | Stable market conditions, no major events impacting Nebius. |

| Linear Regression (Past Year) | $25 | $23 – $27 | Consistent growth trend continues. |

More sophisticated models, such as regression analysis, could incorporate additional variables for improved accuracy but require more complex data analysis.

Investor Sentiment and Market Analysis, Nebius stock price

Current investor sentiment towards Nebius stock appears cautiously optimistic, based on recent financial news reports and social media discussions. However, this sentiment is subject to change based on future performance and market conditions.

Market Capitalization: Nebius’s current market capitalization (Illustrative Example: $5 billion) is higher than its historical low but lower than its peak. This is comparable to competitors, although direct comparisons require detailed data.

Trading Volume: A visual representation of Nebius’s trading volume over the past year would show periods of high volume coinciding with major news events (e.g., earnings announcements, product launches) and periods of low volume during quieter periods. Peaks in trading volume generally indicate heightened investor interest and activity.

Nebius’s Financial Health and Stock Valuation

Source: ycharts.com

Nebius’s recent financial performance (Illustrative Example) shows steady revenue growth, with improving profit margins and manageable debt levels. This positive financial outlook generally supports a higher stock valuation.

Valuation Methods: Several methods, including price-to-earnings ratio (P/E ratio) and discounted cash flow (DCF) analysis, can be used to assess Nebius’s stock valuation. The P/E ratio compares the stock price to earnings per share, while DCF analysis estimates the present value of future cash flows.

Nebius’s strong financial health, as reflected in its financial statements and ratios, directly influences its stock price. Investors are more likely to invest in companies with healthy financials, leading to increased demand and higher prices.

Answers to Common Questions: Nebius Stock Price

What are the major risks associated with investing in Nebius stock?

Major risks include market volatility, competition within the industry, potential regulatory changes, and the company’s dependence on key technologies or partnerships.

Where can I find real-time Nebius stock price updates?

Real-time updates are typically available through major financial news websites and brokerage platforms.

How does Nebius compare to its competitors in terms of profitability?

A detailed comparison of profitability requires reviewing financial statements and industry reports. This analysis would compare key metrics such as profit margins, revenue growth, and return on equity.

What is Nebius’s current market capitalization?

The current market capitalization can be found on financial news websites and stock market data providers.