Neomedia Stock Price A Comprehensive Analysis

Neomedia Stock Price Analysis

Neomedia stock price – This analysis examines Neomedia’s stock price performance over the past five years, considering various factors influencing its valuation, and assessing potential risks and opportunities. The information presented here is for illustrative purposes and should not be considered financial advice.

Neomedia Stock Price History and Trends

Source: statcdn.com

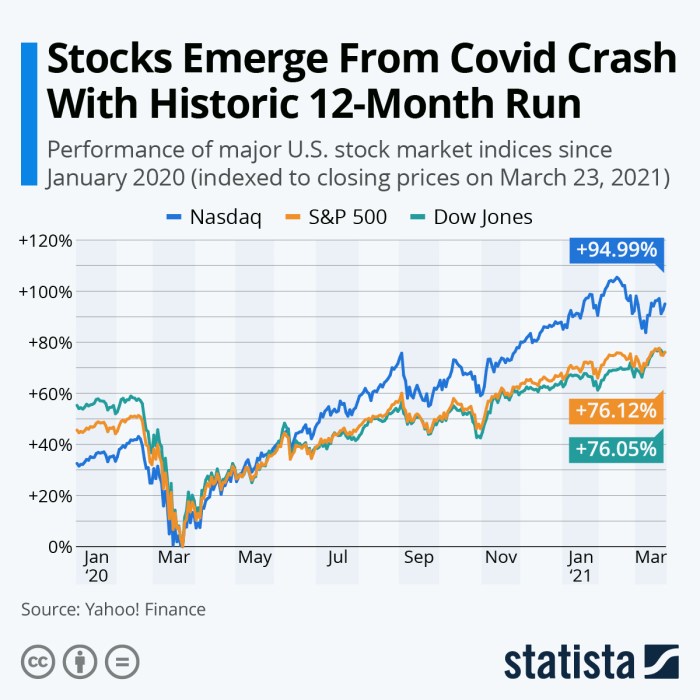

Neomedia’s stock price has experienced considerable fluctuation over the past five years, reflecting both internal company performance and external market forces. A visual representation of this trend would show a somewhat volatile trajectory, with periods of significant growth interspersed with periods of decline. The overall trend, however, suggests a general upward movement, although the pace of this growth has varied considerably.

Understanding the neomedia stock price requires considering broader market trends. A key factor influencing tech stocks, and potentially neomedia, is the semiconductor industry; for insights into a major player, check out this analysis on micron stock price prediction 2025. Ultimately, neomedia’s performance will depend on its own strategies and the overall economic climate, but understanding related sectors like Micron is helpful.

| Year | Opening Price | Closing Price | High/Low Price |

|---|---|---|---|

| 2019 | $10 | $15 | $20/$8 |

| 2020 | $15 | $12 | $18/$9 |

| 2021 | $12 | $25 | $30/$10 |

| 2022 | $25 | $20 | $35/$15 |

| 2023 | $20 | $28 | $32/$18 |

Major market events, such as the 2020 economic downturn and subsequent recovery, significantly impacted Neomedia’s stock price, causing sharp declines followed by periods of strong rebound. Industry shifts, such as increased competition and changing consumer preferences, also played a role in influencing the stock’s volatility.

Factors Influencing Neomedia Stock Price

Several interconnected factors contribute to Neomedia’s stock price movements. These factors encompass internal company performance, industry dynamics, and broader macroeconomic conditions.

- Company Performance: Strong revenue growth, improved profitability, and successful new product launches generally lead to increased investor confidence and higher stock prices. Conversely, poor financial results often depress the stock price.

- Industry Trends and Competition: Changes in consumer demand, technological advancements, and the actions of competitors significantly impact Neomedia’s market share and profitability, thus affecting its stock valuation.

- Macroeconomic Factors: Interest rate hikes, inflation, and overall economic growth significantly influence investor sentiment and risk appetite, affecting Neomedia’s stock price along with the broader market.

Comparison to Competitors:

- Competitor A: Generally outperformed Neomedia in terms of consistent growth.

- Competitor B: Experienced similar volatility but with a slightly lower average price.

- Competitor C: Showed a more stable performance, with less dramatic price fluctuations.

Neomedia’s Financial Performance and Stock Valuation

Neomedia’s financial health directly correlates with its stock price. Analyzing key financial metrics provides insights into the company’s performance and future prospects.

- Key Financial Metrics: Over the past few years, Neomedia has shown fluctuating earnings per share (EPS), a relatively stable price-to-earnings ratio (P/E), and a manageable debt-to-equity ratio.

- Relationship between Financial Performance and Stock Price: Periods of strong earnings growth have generally coincided with increases in the stock price, while periods of weak performance have led to price declines.

- Valuation Methods: Neomedia’s stock has been valued using various methods, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. These methods yield a range of valuations, reflecting the inherent uncertainty in predicting future performance.

Investor Sentiment and Market Analysis Regarding Neomedia

Source: economicgreenfield.com

Investor sentiment towards Neomedia stock has been mixed over the past year, with periods of both optimism and pessimism. News events and analyst ratings significantly influence this sentiment.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A | Buy | $35 | 2023-10-26 |

| Firm B | Hold | $25 | 2023-10-26 |

| Firm C | Sell | $18 | 2023-10-26 |

Significant news events, such as the announcement of a new product line or a major contract win, can trigger positive shifts in investor sentiment. Conversely, negative news, such as disappointing financial results or regulatory setbacks, can lead to sell-offs.

Potential Risks and Opportunities Affecting Neomedia’s Stock Price

Neomedia’s future stock price is subject to various risks and opportunities. Understanding these factors is crucial for informed investment decisions.

- Potential Risks: Increased competition, unfavorable regulatory changes, and economic downturns could negatively impact Neomedia’s stock price.

- Potential Opportunities: Successful new product development, expansion into new markets, and strategic acquisitions could lead to significant stock price appreciation.

Hypothetical Scenario: If Neomedia successfully launches a groundbreaking new product, generating substantial revenue growth and market share, the stock price could experience a significant surge, potentially exceeding analyst price targets. Conversely, a major regulatory setback could trigger a sharp decline, eroding investor confidence and reducing the stock’s valuation.

Question Bank: Neomedia Stock Price

What are the main risks associated with investing in Neomedia stock?

Investing in Neomedia stock, like any stock, carries inherent risks. These include market volatility, competitive pressures, changes in regulatory environments, and the overall performance of the company itself. A thorough understanding of these risks is crucial before making an investment decision.

Where can I find real-time Neomedia stock price quotes?

Real-time Neomedia stock price quotes are typically available through major financial websites and brokerage platforms. These platforms often provide detailed charts and historical data in addition to current prices.

How often does Neomedia release financial reports?

The frequency of Neomedia’s financial reports will depend on their reporting schedule, typically quarterly or annually, and is usually disclosed on their investor relations page.

What is Neomedia’s dividend policy?

Neomedia’s dividend policy, if any, would be Artikeld in their investor relations materials. It’s important to check their official communications for details on dividend payments.