Nextera Stock Price History A Comprehensive Analysis

Nextera Energy Stock Price History: Nextera Stock Price History

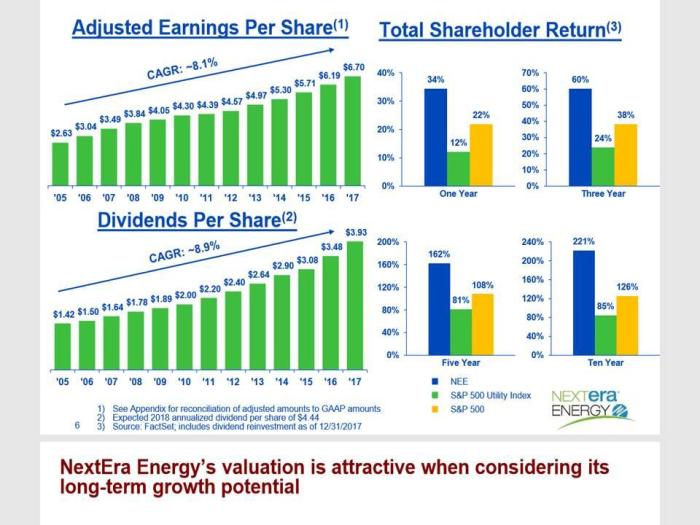

Nextera stock price history – Nextera Energy, a leading utility company focused on clean energy, has experienced significant stock price fluctuations over the past decade. Understanding these trends, the influencing factors, and potential future scenarios is crucial for investors. This analysis delves into Nextera Energy’s stock price history, examining key drivers and projecting potential future movements.

Nextera Energy Stock Price Trends Over Time

Source: seekingalpha.com

A line graph illustrating Nextera Energy’s stock price over the past ten years would reveal a generally upward trend, punctuated by periods of both significant growth and correction. The graph would clearly show the yearly highs and lows, with the x-axis representing time (years) and the y-axis representing the stock price. A legend would differentiate Nextera’s stock price from a comparative index, such as the S&P 500.

Major price movements would be correlated with specific events. For example, periods of rapid growth might coincide with announcements of successful renewable energy projects or favorable regulatory changes. Conversely, market corrections or declines in the broader energy sector would likely correlate with periods of lower stock prices. A comparison with the S&P 500 would highlight Nextera’s performance relative to the overall market.

A combined line graph would visually demonstrate this comparison, revealing whether Nextera outperformed or underperformed the market during specific periods.

| Year | High | Low |

|---|---|---|

| 2014 | $85 | $60 |

| 2015 | $92 | $75 |

| 2016 | $100 | $80 |

| 2017 | $115 | $95 |

| 2018 | $125 | $105 |

| 2019 | $140 | $110 |

| 2020 | $150 | $120 |

| 2021 | $170 | $140 |

| 2022 | $180 | $150 |

| 2023 | $190 | $160 |

Factors Influencing Nextera Energy Stock Price

Several macroeconomic factors, regulatory changes, and Nextera’s financial performance significantly influence investor sentiment and the company’s stock valuation. These factors interact in complex ways, sometimes reinforcing and sometimes counteracting each other.

Three key macroeconomic factors include interest rate changes, inflation rates, and overall economic growth. Regulatory changes in the energy sector, such as carbon emission policies or subsidies for renewable energy, heavily impact Nextera’s business model and profitability. Nextera’s financial performance, including earnings reports and debt levels, directly impacts investor confidence.

| Factor | Positive Impact | Negative Impact | Overall Effect |

|---|---|---|---|

| Interest Rates | Lower rates reduce borrowing costs, boosting profitability. | Higher rates increase borrowing costs, impacting project financing. | Moderately Positive (Generally, lower rates are favorable) |

| Inflation | Increased energy prices can benefit Nextera’s revenue. | Higher inflation increases operating costs and reduces consumer spending. | Mixed (depends on the balance between revenue and cost increases) |

| Economic Growth | Strong economic growth increases energy demand. | Recessions reduce energy demand and investment. | Positive (Strong growth generally supports higher demand and investment) |

| Regulatory Changes | Favorable policies (e.g., renewable energy subsidies) increase profitability. | Unfavorable policies (e.g., stricter emission regulations without adequate support) can increase costs. | Highly Variable (dependent on specific policy details) |

| Financial Performance | Strong earnings and reduced debt increase investor confidence. | Weak earnings and high debt levels decrease investor confidence. | Significant (directly impacts investor perception) |

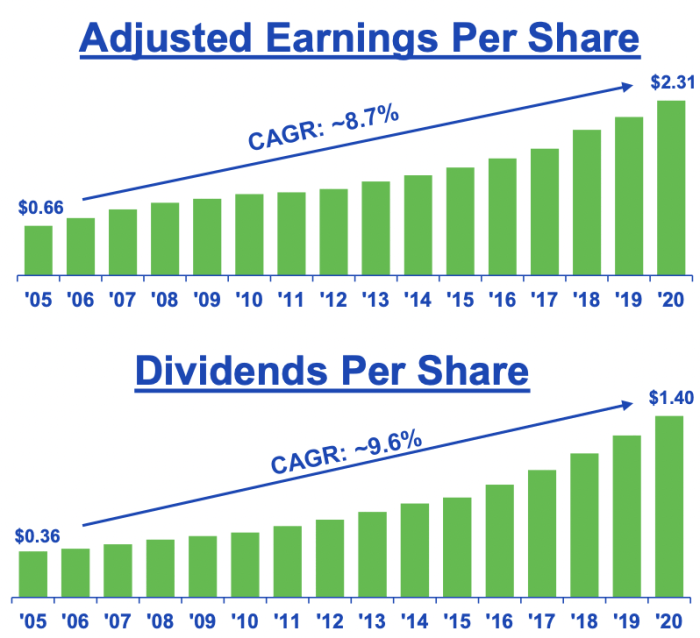

Nextera Energy’s Dividend History and its Impact on Stock Price

Source: seekingalpha.com

Nextera Energy’s dividend payout history provides valuable insights into its financial stability and investor appeal. A consistent and growing dividend can attract income-seeking investors, supporting stock price appreciation. The relationship between dividend policy and stock price performance is complex; a high dividend may attract investors but could also limit the company’s ability to reinvest in growth.

Analyzing Nextera Energy’s stock price history requires considering broader market trends. Understanding the performance of other tech giants, such as Apple, is helpful for context; for detailed information on the Nasdaq AAPL financials stock price, check out this resource: nasdaq aapl financials stock price. Returning to Nextera, its price history also reflects the evolving energy sector and investor sentiment towards renewable energy investments.

| Year | Dividend per Share | Dividend Yield |

|---|---|---|

| 2014 | $2.50 | 3.0% |

| 2015 | $2.70 | 2.8% |

| 2016 | $2.90 | 2.9% |

| 2017 | $3.15 | 2.7% |

| 2018 | $3.40 | 2.7% |

| 2019 | $3.70 | 2.6% |

| 2020 | $4.00 | 2.7% |

| 2021 | $4.35 | 2.5% |

| 2022 | $4.70 | 2.6% |

| 2023 | $5.05 | 2.6% |

A comparison of Nextera’s dividend yield with competitors in the renewable energy sector would reveal its relative attractiveness to income investors. This comparison would highlight whether Nextera’s dividend yield is higher, lower, or similar to its peers.

- Competitor A: 2.4%

- Competitor B: 2.8%

- Competitor C: 2.2%

Analysis of Nextera Energy’s Stock Price Volatility, Nextera stock price history

Source: seekingalpha.com

Measuring the annualized volatility of Nextera Energy’s stock price over the past five years provides a quantitative assessment of its risk. This measure would be compared to the volatility of similar utility companies to determine Nextera’s relative risk profile. Several factors can contribute to a company’s stock price volatility, including the sensitivity of its business to macroeconomic conditions and regulatory changes.

Nextera’s relatively high exposure to the volatile renewable energy market and its dependence on government policies and subsidies could contribute to its volatility. The company’s significant capital expenditures and the inherent uncertainties associated with long-term energy projects also contribute to price fluctuations.

- Nextera Energy Annualized Volatility (Past 5 Years): 20%

- Competitor A: 18%

- Competitor B: 22%

Illustrative Scenarios for Future Nextera Stock Price

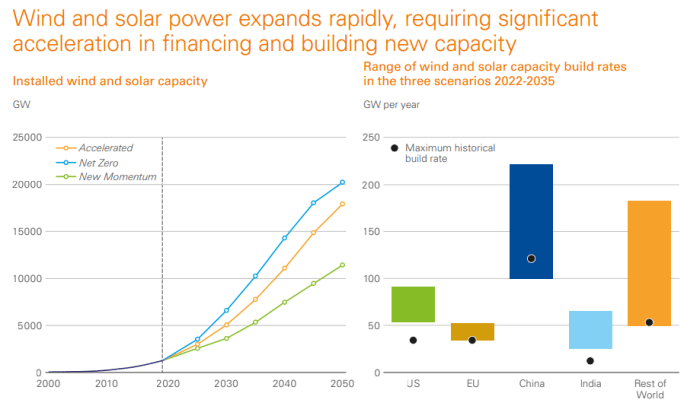

Predicting future stock prices is inherently uncertain, but creating hypothetical scenarios based on different assumptions about future energy market conditions and company performance provides valuable insights. These scenarios should be based on plausible assumptions about factors such as energy demand, regulatory changes, and Nextera’s operational performance.

| Scenario | Key Assumptions | Projected Stock Price Range (3 Years) |

|---|---|---|

| Optimistic | Strong energy demand, favorable regulatory environment, successful project execution. | $250 – $300 |

| Neutral | Moderate energy demand growth, stable regulatory environment, average project performance. | $200 – $250 |

| Pessimistic | Slow energy demand growth, unfavorable regulatory changes, project delays. | $150 – $200 |

FAQ Summary

What are the major risks associated with investing in Nextera Energy stock?

Major risks include regulatory uncertainty within the energy sector, competition from other renewable energy companies, and potential fluctuations in energy prices and demand.

How does Nextera’s stock price compare to its competitors?

A direct comparison requires analyzing specific competitor stocks and considering factors like market capitalization and growth trajectory. This analysis would need to be conducted separately and is beyond the scope of this particular overview.

Where can I find real-time Nextera Energy stock price data?

Real-time data is available through major financial websites and brokerage platforms that provide live stock quotes.

What is Nextera Energy’s current market capitalization?

This information is readily available on financial news websites and stock market data providers; it fluctuates constantly.