No Bull Stock Price A Deep Dive

Understanding “No Bull Stock Price”

The phrase “no bull stock price” refers to a stock’s valuation that is considered genuinely reflective of its intrinsic value, free from market hype or speculation. It implies a price that is justified by the company’s fundamentals, rather than driven by short-term market trends or emotional investor behavior. Different investors may interpret this differently, with value investors seeking deeply undervalued stocks, while others might consider a fairly valued stock as “no bull.”

Interpretations of “No Bull” Stock Price

The interpretation of a “no bull” stock price varies significantly depending on the investor’s perspective. A value investor might define it as a stock trading significantly below its intrinsic value, offering a substantial margin of safety. A growth investor, on the other hand, might consider a stock with strong future growth prospects fairly priced, even if its current valuation seems high relative to its current earnings.

A contrarian investor might see a “no bull” price in a stock that the market has unfairly punished, presenting a buying opportunity.

Examples of Stocks Often Associated with “No Bull” Pricing

Identifying stocks definitively as “no bull” is subjective and depends on the individual investor’s assessment. However, companies with consistent earnings growth, strong balance sheets, and a history of prudent financial management are often associated with this term. Examples might include companies in stable, mature industries with predictable cash flows, or those with a proven track record of innovation and market leadership.

Conversely, companies with high debt, inconsistent earnings, or facing significant competitive threats are less likely to be considered “no bull.”

Comparing “No Bull” with “Undervalued” and “Fairly Priced”

“No bull” stock price, “undervalued,” and “fairly priced” are related but distinct concepts. A “no bull” price suggests a valuation free from market noise, aligning with the company’s intrinsic value. “Undervalued” implies the price is below its intrinsic value, suggesting a potential bargain. “Fairly priced” indicates the price reflects the company’s current value, without significant upside or downside potential.

A stock can be “no bull” and still be fairly priced or even slightly undervalued, depending on the investor’s assessment.

Factors Influencing “No Bull Stock Price”

Several factors, both macroeconomic and company-specific, influence whether a stock price aligns with the “no bull” description. Market sentiment and investor psychology play a significant role in shaping the perception of a stock’s price, often leading to short-term deviations from its intrinsic value.

Macroeconomic and Company-Specific Factors

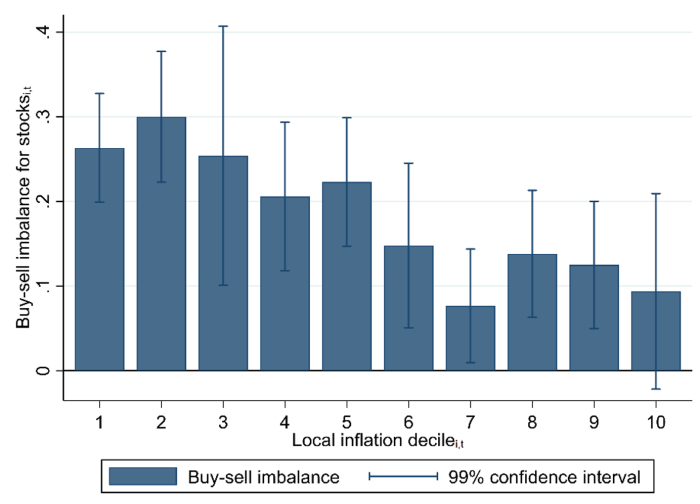

Macroeconomic factors, such as interest rates, inflation, and economic growth, can significantly impact stock valuations. A strong economy generally supports higher stock prices, while economic downturns can lead to lower valuations. Company-specific factors, such as earnings reports, management changes, and new product launches, also play a crucial role. Positive news often leads to price increases, while negative news can cause declines.

Market Sentiment and Investor Psychology

Market sentiment and investor psychology heavily influence stock prices. Periods of optimism can lead to inflated valuations, while pessimism can cause prices to fall below intrinsic value. Fear, greed, and herd behavior can cause significant deviations from fundamental valuations, making it challenging to identify “no bull” stocks during periods of extreme market volatility.

Short-Term vs. Long-Term Factors

| Factor | Short-Term Impact | Long-Term Impact | Example |

|---|---|---|---|

| Earnings Report | Significant price movement based on the beat or miss | Limited impact if the long-term trend remains positive | A one-time unexpected loss may cause a short-term drop but won’t necessarily affect the stock price long-term if the company’s fundamentals are strong. |

| Management Change | Potential price volatility depending on market perception of the new management | Long-term impact depends on the new management’s success in executing their strategy | A highly respected CEO stepping down may initially cause a temporary dip, but the long-term impact will depend on their successor’s performance. |

| Market Sentiment | Dramatic swings based on news and speculation | Less influential as the market focuses on the company’s actual performance | A sudden surge in investor fear can cause a sharp drop, but this will likely be temporary if the company’s fundamentals are solid. |

| Interest Rate Changes | Immediate impact on valuation, particularly for growth stocks | Significant impact on long-term growth prospects and discount rates | A sudden increase in interest rates can cause a temporary decline in valuations, particularly for high-growth companies relying on future earnings. |

Identifying Potential “No Bull” Stocks

A systematic approach is crucial for identifying potential “no bull” stocks. This involves screening stocks based on several key financial metrics and ratios, considering both quantitative and qualitative factors.

Financial Metrics for Identifying “No Bull” Stocks

- Price-to-Earnings Ratio (P/E): A low P/E ratio relative to industry peers and historical averages can suggest undervaluation.

- Price-to-Book Ratio (P/B): A low P/B ratio can indicate that the market is undervaluing the company’s assets.

- Debt-to-Equity Ratio: A low debt-to-equity ratio suggests a strong financial position and reduced risk.

- Return on Equity (ROE): A consistently high ROE indicates efficient use of shareholder capital.

- Free Cash Flow (FCF): Strong and consistent FCF demonstrates the company’s ability to generate cash.

These metrics should be interpreted in conjunction with a thorough analysis of the company’s financial statements, competitive landscape, and industry trends. A low P/E ratio alone is not sufficient to declare a stock a “no bull” investment; it needs to be considered in the broader context of the company’s overall financial health and prospects.

Assessing Risk and Reward: No Bull Stock Price

Investing in stocks perceived as having a “no bull” price carries both risks and rewards. While the potential for undervaluation offers attractive returns, it’s crucial to understand the associated risks before investing.

Risk Profile of “No Bull” Stocks

Source: voxeu.org

The risk profile of “no bull” stocks varies depending on the specific company and market conditions. However, some common risks include the possibility of continued undervaluation, unexpected negative news, and macroeconomic factors impacting the company’s performance. Compared to growth stocks, “no bull” stocks may offer lower growth potential but potentially lower risk. Compared to high-yield bonds, they may offer higher growth potential but higher volatility.

Understanding the intricacies of “no bull” stock pricing requires a broad market perspective. For instance, analyzing the performance of related sectors, such as the burgeoning field of food automation, can offer valuable insights. A key player to watch in this space is NextGen Food Robotics, whose current stock price can be found here: nextgen food robotics stock price.

Ultimately, however, a thorough assessment of “no bull” stock prices necessitates a comprehensive analysis of individual company fundamentals.

Risk Mitigation Strategies

Diversification, thorough due diligence, and a long-term investment horizon can mitigate the risks associated with “no bull” stocks. Diversifying across different sectors and industries reduces the impact of negative news affecting a single company. Thorough due diligence involves carefully analyzing the company’s financial statements, competitive landscape, and management team before investing. A long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from the company’s long-term growth.

Rewards and Risks Across Different Market Conditions

| Market Condition | Potential Reward | Potential Risk | Mitigation Strategy |

|---|---|---|---|

| Bull Market | Moderate returns as the market generally lifts all boats | Potential for missing out on higher returns from growth stocks | Maintain a diversified portfolio, including some growth stocks |

| Bear Market | Reduced losses compared to growth stocks; potential for significant gains if the stock is truly undervalued | Still subject to price declines, particularly if the company’s fundamentals deteriorate | Invest only a portion of the portfolio in “no bull” stocks and maintain sufficient cash reserves |

| Sideways Market | Steady returns if the company’s fundamentals remain strong | Limited upside potential | Re-evaluate the investment periodically and consider shifting to growth stocks if the market turns bullish |

Illustrative Examples

Let’s consider two hypothetical companies to illustrate the concept of “no bull” stocks.

Company A: Exemplifying a “No Bull” Stock

Company A operates in a stable industry with predictable cash flows. It has a strong balance sheet, consistent earnings growth, and a history of prudent financial management. Its P/E ratio is significantly below its historical average and industry peers, suggesting undervaluation. Investor sentiment is cautiously optimistic, reflecting the company’s solid fundamentals. This profile suggests Company A’s stock price is likely a “no bull” price.

Company B: Not Exemplifying a “No Bull” Stock

Company B operates in a highly volatile industry with unpredictable earnings. It has high debt, inconsistent earnings growth, and a history of aggressive financial strategies. Its P/E ratio is high relative to its industry peers, and investor sentiment is highly speculative. This profile suggests Company B’s stock price is likely inflated and not a “no bull” price.

Scenario: Hidden Risks Revealed

Imagine a company initially perceived as a “no bull” stock due to its low P/E ratio and strong balance sheet. However, subsequent investigations reveal hidden liabilities or accounting irregularities, leading to a significant drop in the stock price. This highlights the importance of thorough due diligence before investing.

Successful Investment in a “No Bull” Stock, No bull stock price

Source: redd.it

Consider a scenario where an investor identifies a “no bull” stock based on a combination of fundamental analysis and market sentiment. The investor patiently holds the stock for several years, benefiting from the company’s consistent earnings growth and eventual market recognition. This example demonstrates the importance of patience and a long-term perspective when investing in “no bull” stocks.

Top FAQs

What is the difference between a “no bull” stock and an undervalued stock?

While often used interchangeably, “no bull” implies a more subjective assessment, factoring in market sentiment and potential for future growth beyond pure numerical undervaluation. Undervalued stocks are strictly based on quantitative analysis showing a price below intrinsic value.

How can I mitigate the risk of investing in “no bull” stocks?

Diversification, thorough due diligence, focusing on companies with strong fundamentals, and establishing a clear exit strategy are key risk mitigation strategies.

Are “no bull” stocks always a good investment?

No. Even stocks seemingly undervalued can underperform due to unforeseen circumstances or shifts in market dynamics. Careful analysis and risk assessment are crucial.

What are some common mistakes investors make when searching for “no bull” stocks?

Common mistakes include relying solely on price-to-earnings ratios, ignoring qualitative factors like management quality, and failing to adequately assess market sentiment and potential risks.