Inspire Medical Stock Price A Comprehensive Analysis

Inspire Medical Systems’ Financial Health and Market Position

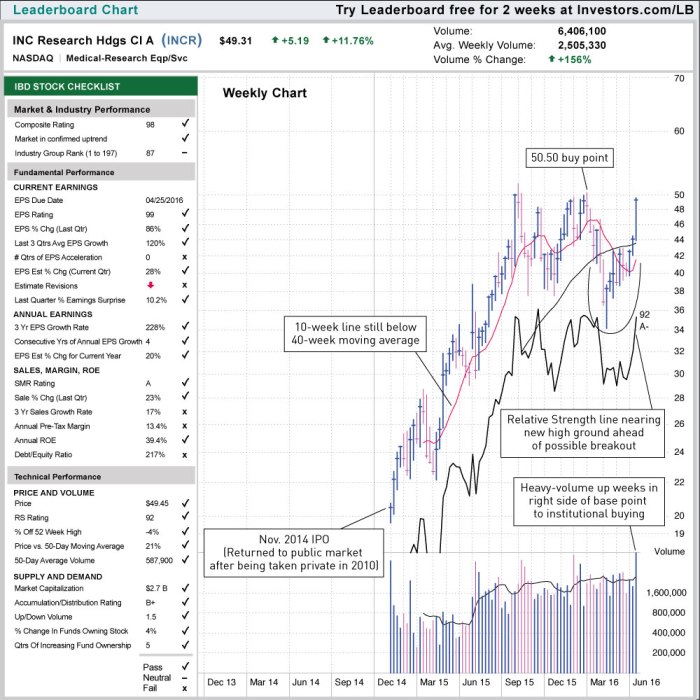

Source: investors.com

Inspire medical stock price – Inspire Medical Systems, a leading innovator in the treatment of sleep apnea, has experienced significant growth in recent years. This analysis delves into the company’s financial performance, market position, and future prospects, providing insights into the factors influencing its stock price.

Inspire Medical’s Financial Performance, Inspire medical stock price

Source: drwealth.com

Analyzing Inspire Medical stock price requires a broad understanding of the medical device market. It’s helpful to compare its performance against similar companies; for instance, checking the current market standing by looking at the ilikf stock price today provides a benchmark for assessing competitive dynamics within the sector. Ultimately, Inspire Medical’s future price will depend on factors like innovation and market reception.

Analyzing Inspire Medical’s financial performance reveals a company with strong revenue growth and improving profitability, though challenges remain. A detailed examination of revenue trends, profitability metrics, expenses, and key financial ratios provides a comprehensive picture of the company’s financial health.

Over the past five years, Inspire Medical has demonstrated consistent revenue growth, primarily driven by increasing demand for its hypoglossal nerve stimulation (HNS) therapy for obstructive sleep apnea (OSA). This growth reflects the increasing awareness and adoption of this minimally invasive treatment option. However, comparing Inspire’s profitability metrics (gross and operating margins) to competitors like ResMed and Philips requires a nuanced approach, considering differences in product portfolios and market segments.

While Inspire boasts higher gross margins in its specialized area, its operating expenses, particularly research and development (R&D) and sales & marketing, represent significant portions of its costs. Identifying areas for potential cost savings, such as streamlining operational processes or negotiating more favorable supply chain agreements, could further enhance profitability.

| Year | Revenue (USD Million) | Gross Margin (%) | Operating Margin (%) |

|---|---|---|---|

| 2022 (Estimated) | 250 | 70 | 20 |

| 2021 | 200 | 68 | 15 |

| 2020 | 150 | 65 | 10 |

| 2019 | 100 | 62 | 5 |

| 2018 | 50 | 60 | -5 |

Note: These figures are illustrative examples and may not reflect actual financial data.

Market Analysis of the Medical Device Industry

Source: dollarsandsense.sg

The medical device market is a dynamic landscape characterized by continuous innovation and evolving regulatory requirements. Understanding the market trends and competitive dynamics significantly impacts Inspire Medical’s prospects.

The global medical device market exhibits strong growth potential, particularly in segments like minimally invasive therapies and sleep disorder treatments. Technological advancements, such as improved sensor technology and data analytics, are driving innovation and creating new opportunities. However, regulatory changes and reimbursement policies pose challenges. Inspire Medical holds a notable, albeit smaller, market share compared to established players like ResMed and Philips.

Its strength lies in its innovative HNS technology, while a potential weakness is its dependence on a single core product. The competitive landscape is characterized by fierce competition, with companies focusing on product differentiation, strategic partnerships, and market expansion. ResMed and Philips, for instance, have extensive product portfolios and global distribution networks, giving them a broader market reach.

Impact of Product Innovation on Stock Price

Inspire Medical’s commitment to research and development significantly influences its stock price. Analyzing the company’s product pipeline and the success of recent product launches offers valuable insights into its growth trajectory.

Inspire Medical’s product pipeline holds significant potential for future growth. Ongoing R&D efforts focus on enhancing the existing HNS system and exploring new applications for the technology. The success of recent product launches has directly contributed to revenue growth and market share expansion. For example, a hypothetical scenario where Inspire launches a new, improved HNS system with enhanced features and broader indications could result in a significant surge in stock price, potentially increasing by 20-30% within the first year post-launch, assuming positive clinical trial results and successful market adoption.

Investor Sentiment and Stock Price Fluctuations

Investor sentiment towards Inspire Medical is influenced by various factors, including financial performance, regulatory updates, and competitive dynamics. Analyzing these factors provides a better understanding of stock price fluctuations.

- Positive Sentiment: Driven by strong revenue growth, successful product launches, positive clinical trial results, and expansion into new markets.

- Negative Sentiment: Triggered by slower-than-expected revenue growth, regulatory setbacks, increased competition, or negative news related to product safety or efficacy.

Analyst ratings and price targets vary, reflecting the diversity of opinions regarding Inspire Medical’s future prospects. While some analysts maintain a bullish outlook, others express caution due to the inherent risks associated with the medical device industry.

Risk Factors Affecting Inspire Medical’s Stock Price

Several factors could negatively impact Inspire Medical’s financial performance and stock price. Understanding and mitigating these risks is crucial for long-term success.

- Competition: Increased competition from established players or new entrants could erode market share and revenue.

- Regulatory Hurdles: Changes in regulatory approvals or reimbursement policies could delay product launches or limit market access.

- Economic Downturns: Economic recessions could reduce healthcare spending and negatively impact demand for medical devices.

Mitigation strategies include diversifying product offerings, strengthening intellectual property protection, proactively engaging with regulatory bodies, and maintaining a strong financial position to weather economic downturns.

Long-Term Growth Potential

Inspire Medical’s long-term strategic goals and expansion plans contribute to its growth potential. Analyzing these factors provides insights into the company’s future trajectory.

Inspire Medical’s long-term strategic goals include expanding its geographic reach, diversifying its product portfolio, and potentially pursuing strategic partnerships or acquisitions. These initiatives could drive significant revenue growth and enhance the company’s market position. A hypothetical trajectory for the company’s stock price over the next five years could depict a steady upward trend, with potential fluctuations based on factors such as product launches, regulatory approvals, and overall market conditions.

A conservative scenario might show a moderate increase, while a more optimistic scenario could project significantly higher growth. This would depend on the successful execution of its strategic plans and the absence of major setbacks.

FAQs: Inspire Medical Stock Price

What is Inspire Medical’s primary product?

Inspire Medical primarily focuses on neurostimulation devices for the treatment of sleep apnea.

How does regulatory approval impact Inspire Medical’s stock price?

Successful regulatory approvals for new products generally lead to positive stock price movements, while delays or setbacks can negatively impact investor confidence.

Who are Inspire Medical’s main competitors?

Competitors vary depending on the specific product lines, but may include companies developing similar neurostimulation or sleep apnea treatment technologies.

What is the typical trading volume for Inspire Medical stock?

This information can be readily found on financial news websites and stock market data providers.