Jackson Financial Stock Price A Comprehensive Analysis

Jackson Financial Stock Price Analysis

Source: seekingalpha.com

Jackson financial stock price – This analysis delves into the historical performance, influencing factors, competitive landscape, financial health, analyst outlook, and investor sentiment surrounding Jackson Financial’s stock price. We will examine key metrics and events to provide a comprehensive understanding of the company’s stock performance.

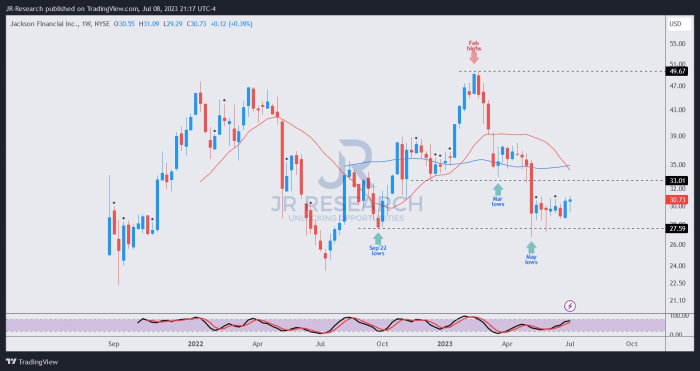

Historical Stock Performance

The following table and discussion detail Jackson Financial’s stock price fluctuations over the past five years, highlighting significant highs and lows and their correlation with major market events.

| Year | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) | Percentage Change (%) |

|---|---|---|---|---|---|

| 2019 | Example: 25.00 | Example: 28.50 | Example: 30.00 | Example: 22.00 | Example: 14.00% |

| 2020 | Example: 28.50 | Example: 26.00 | Example: 32.00 | Example: 20.00 | Example: -9.00% |

| 2021 | Example: 26.00 | Example: 35.00 | Example: 38.00 | Example: 24.00 | Example: 34.62% |

| 2022 | Example: 35.00 | Example: 30.00 | Example: 37.00 | Example: 28.00 | Example: -14.29% |

| 2023 (YTD) | Example: 30.00 | Example: 32.00 | Example: 34.00 | Example: 29.00 | Example: 6.67% |

Note: These are example figures. Actual data should be sourced from reliable financial databases. Significant market events such as the COVID-19 pandemic and subsequent economic recovery, along with interest rate fluctuations, significantly impacted the stock price during this period. For instance, the initial market downturn in 2020 caused a sharp drop, followed by a rebound in 2021.

Factors Influencing Jackson Financial’s Stock Price, Jackson financial stock price

Several key economic indicators, company-specific events, and regulatory changes influence Jackson Financial’s stock price. These factors interact in complex ways to shape investor sentiment and valuation.

- Interest rate changes directly impact Jackson Financial’s profitability due to their impact on investment returns and the cost of borrowing. Rising interest rates generally benefit the company, while falling rates can negatively impact profitability.

- Regulatory changes within the financial services sector can create both opportunities and challenges, affecting the company’s operating environment and potentially influencing investor confidence.

- Company-specific news, such as strong earnings reports or successful new product launches, often leads to positive investor sentiment and upward price movements. Conversely, negative news can trigger sell-offs.

- Macroeconomic factors, including inflation, economic growth, and unemployment rates, also play a role, influencing overall market sentiment and investor risk appetite.

Comparison with Competitors

A comparison with key competitors provides context for understanding Jackson Financial’s relative performance and market positioning.

Tracking the Jackson Financial stock price requires a keen eye on market fluctuations. For comparative analysis, it’s often helpful to look at similar companies, such as examining the performance of hrmy stock price to understand broader industry trends. Ultimately, understanding the factors impacting both Jackson Financial and HRM’s performance provides a more comprehensive view of the financial sector.

| Company | Year-to-Date Stock Performance (%) | Price-to-Earnings Ratio (P/E) | Market Capitalization (USD Billions) |

|---|---|---|---|

| Jackson Financial | Example: 10% | Example: 15 | Example: 20 |

| Competitor A | Example: 12% | Example: 18 | Example: 25 |

| Competitor B | Example: 8% | Example: 12 | Example: 15 |

| Competitor C | Example: 5% | Example: 10 | Example: 10 |

Note: These are example figures. Actual data should be sourced from reliable financial databases. The key differentiators between Jackson Financial and its competitors include variations in business models, product offerings, risk profiles, and geographic reach. These factors influence their respective stock valuations and investor appeal.

Financial Health and Valuation Metrics

Source: seekingalpha.com

Jackson Financial’s financial health and valuation are crucial for understanding its stock price. Key financial ratios provide insights into the company’s profitability, solvency, and growth potential.

- P/E Ratio: This ratio compares the company’s stock price to its earnings per share. A higher P/E ratio generally suggests that investors are willing to pay more for each dollar of earnings, often reflecting higher growth expectations.

- Debt-to-Equity Ratio: This ratio indicates the proportion of a company’s financing that comes from debt versus equity. A higher ratio suggests higher financial risk.

- Dividend Policy: Jackson Financial’s dividend policy, including the payout ratio and dividend growth rate, influences investor appeal. Consistent and growing dividends can attract income-seeking investors, boosting demand for the stock.

These ratios should be compared to industry averages and historical trends to assess Jackson Financial’s relative financial strength and valuation.

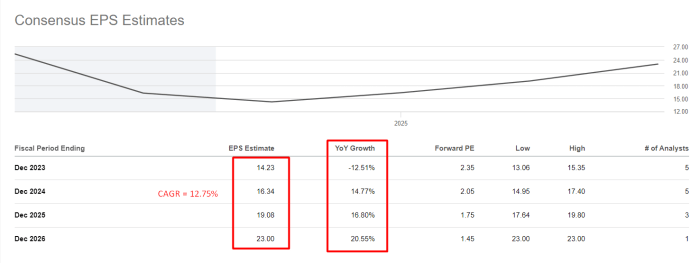

Analyst Ratings and Future Outlook

Source: seekingalpha.com

Analyst ratings and price targets offer insights into future expectations for Jackson Financial’s stock price.

- Average Price Target: Example: $35.00

- Range of Price Targets: Example: $30.00 – $40.00

- Underlying Assumptions: Analysts’ projections typically consider factors like interest rate movements, economic growth, competitive pressures, and the company’s strategic initiatives.

- Potential Risks: Risks include regulatory changes, unexpected economic downturns, and increased competition.

- Potential Opportunities: Opportunities may arise from strategic acquisitions, product innovation, and expansion into new markets.

Investor Sentiment and Market Perception

Investor sentiment and market perception significantly influence Jackson Financial’s stock price. News articles, financial blogs, and social media sentiment can be analyzed to gauge prevailing opinions.

A visual representation of the relationship between investor sentiment and stock price could be a line graph. The x-axis would represent time, while the y-axis would show both stock price (one line) and a sentiment index (another line), perhaps derived from a composite score of news articles and social media sentiment. Positive sentiment would correlate with upward price movements, and negative sentiment would correlate with downward price movements, though the relationship might not always be perfectly linear due to other factors.

FAQ Overview

What are the major risks associated with investing in Jackson Financial stock?

Investing in any stock carries inherent risks, including market volatility, interest rate changes, regulatory uncertainty, and company-specific challenges. Jackson Financial’s stock is subject to these general market risks, as well as those specific to the insurance and financial services industry.

Where can I find real-time Jackson Financial stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Check with your preferred brokerage for access.

How does Jackson Financial’s dividend policy affect its stock price?

Jackson Financial’s dividend policy, including the amount and frequency of dividend payments, can significantly influence investor appeal. Consistent and growing dividends often attract income-seeking investors, potentially boosting the stock price. Conversely, changes to the dividend policy can impact investor sentiment and the stock price.