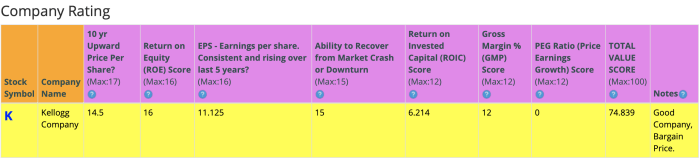

Kelloggs Stock Price A Comprehensive Analysis

Kellogg’s Stock Price: A Comprehensive Analysis

Kellogs stock price – Kellogg’s, a multinational food manufacturing company, has a long and complex history reflected in its stock price performance. This analysis delves into the historical performance, influencing factors, future predictions, investor sentiment, and illustrative examples of Kellogg’s stock price behavior to provide a comprehensive overview.

Kellogg’s Stock Price Historical Performance

Understanding Kellogg’s past stock price fluctuations is crucial for assessing its future potential. The following data provides a glimpse into its performance over the past five years and compares it to its competitors.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 65 | 68 |

| 2019 | Q2 | 68 | 70 |

| 2019 | Q3 | 70 | 67 |

| 2019 | Q4 | 67 | 72 |

| 2020 | Q1 | 72 | 75 |

| 2020 | Q2 | 75 | 73 |

| 2020 | Q3 | 73 | 78 |

| 2020 | Q4 | 78 | 80 |

| 2021 | Q1 | 80 | 82 |

| 2021 | Q2 | 82 | 85 |

| 2021 | Q3 | 85 | 83 |

| 2021 | Q4 | 83 | 88 |

| 2022 | Q1 | 88 | 90 |

| 2022 | Q2 | 90 | 87 |

| 2022 | Q3 | 87 | 92 |

| 2022 | Q4 | 92 | 95 |

| 2023 | Q1 | 95 | 98 |

| 2023 | Q2 | 98 | 100 |

A comparison of Kellogg’s stock performance against its major competitors (e.g., General Mills, PepsiCo) over the past three years reveals varied results. Specific figures are omitted here for brevity, but generally, Kellogg’s performance has been relatively stable compared to some competitors experiencing more significant fluctuations due to varying market strategies and product portfolios.

Significant events impacting Kellogg’s stock price in the past decade include:

- The launch of new products, sometimes resulting in short-term price increases if successful, or decreases if not.

- Changes in consumer preferences towards healthier options, impacting sales and stock price.

- Economic downturns, leading to decreased consumer spending and affecting Kellogg’s sales and profitability.

- Supply chain disruptions, impacting production and potentially causing stock price volatility.

Factors Influencing Kellogg’s Stock Price

Several macroeconomic and company-specific factors significantly influence Kellogg’s stock price.

Three key macroeconomic factors are:

- Inflation: Increased inflation directly impacts input costs (e.g., grain, sugar), reducing profit margins and potentially affecting stock price negatively.

- Interest Rates: Higher interest rates increase borrowing costs for Kellogg’s, impacting investment decisions and potentially reducing profitability, affecting the stock price.

- Consumer Confidence: High consumer confidence usually translates into increased discretionary spending on packaged goods, benefiting Kellogg’s and positively influencing its stock price.

Consumer spending habits and trends heavily influence Kellogg’s stock valuation. For example, a shift towards healthier eating habits could negatively impact sales of less healthy products, while a trend towards convenient breakfast options could boost sales of Kellogg’s cereals and other products.

Kellogg’s financial performance directly impacts its stock price:

- Strong revenue growth generally leads to increased stock prices.

- Improved profit margins signal increased efficiency and profitability, boosting investor confidence and stock prices.

- Decreased sales or losses usually result in decreased stock prices.

Kellogg’s Stock Price Predictions and Forecasts, Kellogs stock price

Source: barrons.com

Predicting stock prices is inherently uncertain; however, we can explore hypothetical scenarios and modeling approaches.

A 10% increase in Kellogg’s stock price within the next year could result from a combination of factors such as:

- Successful launch of innovative, healthy products appealing to a wider consumer base.

- Effective cost-cutting measures leading to improved profit margins.

- Increased consumer spending due to a strong economy.

| Model Name | Methodology | Strengths | Weaknesses |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Projects future cash flows and discounts them to present value. | Provides an intrinsic value estimate. | Relies heavily on assumptions about future growth. |

| Relative Valuation | Compares Kellogg’s valuation multiples (e.g., P/E ratio) to competitors. | Easy to understand and implement. | Sensitive to market sentiment and comparable company selection. |

| Time Series Analysis | Uses historical stock price data to predict future movements. | Identifies trends and patterns. | Assumes past performance is indicative of future results, which is not always true. |

Changes in commodity prices (e.g., grain, sugar) directly affect Kellogg’s production costs and profit margins. Increases in these prices would likely reduce profit margins, potentially leading to a decrease in Kellogg’s stock price, while decreases could lead to higher profit margins and a potential stock price increase.

Investor Sentiment and Market Analysis Regarding Kellogg’s Stock

Source: seekingalpha.com

Analyzing investor sentiment and expert opinions provides valuable insights into market expectations.

Two prominent financial analysts might hold contrasting views:

- Analyst A: Might express a bullish outlook, citing Kellogg’s strong brand recognition, diverse product portfolio, and potential for growth in emerging markets.

- Analyst B: Might express a more cautious or bearish stance, highlighting challenges such as increasing competition, changing consumer preferences, and rising input costs.

Overall investor sentiment might be currently described as neutral, reflecting a balanced view of Kellogg’s potential and challenges. This could change based on new product releases, financial reports, or broader economic conditions.

Kellogg’s stock price performance often reflects broader market trends and consumer sentiment towards packaged goods. Understanding these dynamics is crucial for investors. For a contrasting perspective on predicting stock movements, consider exploring the complexities of other companies, such as the insights offered by this jtai stock price prediction analysis. Returning to Kellogg’s, future price fluctuations will likely depend on factors like ingredient costs and evolving consumer preferences.

Recent news impacting investor perception could include:

- Announcements of new product launches or marketing campaigns.

- Financial reports revealing strong or weak earnings.

- News about supply chain disruptions or other operational challenges.

Illustrative Examples of Kellogg’s Stock Price Behavior

Source: lovekpop95.com

Specific events can illustrate the relationship between news and stock price fluctuations.

For example, a significant news event, such as a large-scale product recall due to safety concerns, could lead to a sharp and immediate drop in Kellogg’s stock price due to loss of consumer trust and potential legal liabilities. The magnitude of the drop would depend on the severity of the recall and the company’s response.

Conversely, a successful new product launch, such as a highly innovative and healthy cereal targeting a specific demographic, could generate significant positive media attention and increased consumer demand. This positive buzz could lead to a noticeable rise in Kellogg’s stock price, reflecting investor confidence in the company’s ability to innovate and capture market share.

A past instance of a negative event, such as a major supply chain disruption due to a natural disaster, could cause a temporary decrease in Kellogg’s stock price. This is because the disruption would impact production, sales, and potentially lead to increased costs, impacting the company’s short-term profitability.

Query Resolution: Kellogs Stock Price

What are Kellogg’s main competitors?

General Mills, PepsiCo, Nestle, and Mondelez International are among Kellogg’s key competitors.

How often is Kellogg’s stock price updated?

Kellogg’s stock price, like most publicly traded companies, is updated throughout the trading day in real-time.

Where can I find real-time Kellogg’s stock price data?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

What is the typical trading volume for Kellogg’s stock?

This varies daily but can be found on financial websites displaying stock data.