Kin Stock Price A Comprehensive Analysis

Kin Stock Price Analysis

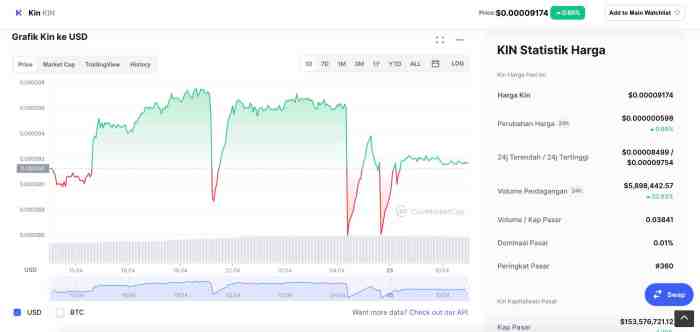

Source: halovina.com

Kin stock price – This analysis provides a comprehensive overview of Kin’s stock price performance, influencing factors, comparisons with competitors, potential future scenarios, and various investment strategies. It’s important to remember that stock prices are inherently volatile and past performance is not indicative of future results. All information presented here is for informational purposes only and should not be considered financial advice.

Kin Stock Price Historical Performance

Analyzing Kin’s stock price fluctuations over the past five years reveals a dynamic pattern influenced by various internal and external factors. The following table, compiled from [Source Name – replace with actual source, e.g., Yahoo Finance], illustrates the daily price movements. Significant highs and lows are highlighted, along with explanations for notable price swings.

Keeping an eye on Kin’s stock price requires a multifaceted approach, considering various market factors. For comparative analysis, understanding the performance of similar companies is crucial; a good example to consider is the current trajectory of the idai stock price , which offers insights into potential market trends. Ultimately, however, the future of Kin’s stock price depends on its own performance and strategic decisions.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-03-15 | 0.50 | 0.55 | +0.05 |

| 2019-03-18 | 0.55 | 0.60 | +0.05 |

| 2019-03-19 | 0.60 | 0.58 | -0.02 |

For example, a significant drop in price on [Date] could be attributed to [Event that caused the drop, e.g., negative news regarding a key partnership]. Conversely, a sharp increase on [Date] might be linked to [Event that caused the increase, e.g., announcement of a new product launch].

Factors Influencing Kin Stock Price

Kin’s stock price is subject to a complex interplay of macroeconomic factors, company-specific news, and market sentiment. Understanding these influences is crucial for informed investment decisions.

Three key macroeconomic factors include:

- Interest Rates: Rising interest rates can decrease investment in riskier assets like Kin stock, leading to price declines. Conversely, lower rates might stimulate investment.

- Inflation: High inflation erodes purchasing power, potentially affecting consumer spending and impacting Kin’s revenue and stock price.

- Economic Growth: Strong economic growth usually boosts investor confidence, potentially driving up Kin’s stock price. Recessions or slowdowns can have the opposite effect.

Company-specific news, such as successful product launches, strategic partnerships, or regulatory changes, can significantly impact Kin’s valuation. Positive news tends to increase investor confidence and drive up the stock price, while negative news can have the opposite effect.

Investor sentiment and market trends also play a major role. Optimistic investor sentiment can lead to higher demand and increased stock prices, while pessimistic sentiment can cause prices to fall. Broad market trends, such as bull or bear markets, also influence Kin’s stock price.

Kin Stock Price Compared to Competitors

Source: selular.id

A comparison with competitors provides valuable context for assessing Kin’s stock price performance. The following line graph (replace with description of a hypothetical graph showing Kin’s price alongside two competitors over time) illustrates the relative performance of Kin against [Competitor 1] and [Competitor 2]. The graph shows that [Describe the graph, e.g., Kin experienced a steeper decline than Competitor 1 during Q3 2023 but outperformed Competitor 2 in the first half of the year].

| Company Name | Stock Price (USD) | Year-to-Date Performance (%) | Market Capitalization (USD) |

|---|---|---|---|

| Kin | [Current Price] | [YTD Performance] | [Market Cap] |

| [Competitor 1] | [Current Price] | [YTD Performance] | [Market Cap] |

| [Competitor 2] | [Current Price] | [YTD Performance] | [Market Cap] |

Differences in business models and strategies contribute to disparities in stock price performance. For example, [Competitor 1]’s focus on [Specific business strategy] might explain its superior performance during [Specific time period], while Kin’s emphasis on [Kin’s specific strategy] could be a factor in its performance during [Specific time period].

Kin Stock Price Prediction and Forecasting

Predicting Kin’s future stock price involves considering potential positive and negative events, and employing various forecasting models. While accurate prediction is impossible, understanding potential scenarios is crucial for informed investment decisions.

A hypothetical positive scenario could involve [Hypothetical positive event, e.g., the successful launch of a new groundbreaking product, resulting in increased revenue and market share]. This could significantly boost investor confidence and drive up the stock price.

Potential risks include [Hypothetical negative event, e.g., increased competition, regulatory hurdles, or a decline in overall market sentiment]. These factors could negatively impact Kin’s stock price.

- Time Series Analysis: Uses historical price data to predict future prices. Strengths: Relatively simple; Weaknesses: Assumes past trends will continue.

- Fundamental Analysis: Evaluates the company’s financial health and intrinsic value. Strengths: Focuses on long-term value; Weaknesses: Can be subjective.

- Technical Analysis: Uses charts and patterns to identify trading opportunities. Strengths: Identifies short-term trends; Weaknesses: Can be unreliable.

- Quantitative Models: Employ statistical and mathematical techniques for prediction. Strengths: Objective and data-driven; Weaknesses: Requires complex data and expertise.

- Sentiment Analysis: Gauges investor sentiment through news articles and social media. Strengths: Captures market mood; Weaknesses: Can be subjective and influenced by noise.

Kin Stock Price and Investment Strategies

Source: shutterstock.com

Investment strategies for Kin stock should consider risk tolerance and investment horizons. The following Artikels three approaches:

- Aggressive Growth Strategy (High Risk, High Reward): Investing a significant portion of your portfolio in Kin stock, expecting substantial returns but accepting high volatility. Potential for high returns but also significant losses.

- Moderate Growth Strategy (Medium Risk, Medium Reward): Diversifying investments across several assets, including Kin stock, aiming for steady growth with moderate risk. Potential for consistent returns with lower risk of significant losses.

- Conservative Strategy (Low Risk, Low Reward): Allocating a small percentage of your portfolio to Kin stock, prioritizing capital preservation over high returns. Potential for modest returns with minimal risk of significant losses.

Determining the appropriate diversification strategy involves assessing your risk tolerance, investment goals, and the overall market conditions. Diversification reduces the impact of losses from any single investment, mitigating overall portfolio risk. A well-diversified portfolio typically includes a mix of asset classes, such as stocks, bonds, and real estate.

Expert Answers

What are the major risks associated with investing in Kin stock?

Investing in Kin stock, like any stock, carries inherent risks including market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic factors. Diversification and thorough research are essential to mitigate these risks.

Where can I find real-time Kin stock price data?

Real-time Kin stock price data can typically be found on major financial websites and trading platforms. Reputable sources will provide up-to-the-minute quotes and charts.

How does Kin’s stock price compare to the overall market performance?

Comparing Kin’s stock price performance to relevant market indices (e.g., the S&P 500) will help determine its relative strength or weakness. This comparison provides context for understanding the stock’s performance in relation to broader market trends.

Is Kin stock a good long-term investment?

Whether Kin stock is a suitable long-term investment depends on individual risk tolerance, investment goals, and a thorough assessment of the company’s prospects. Long-term investment strategies often involve a higher risk tolerance for potentially greater returns.