Lamb Weston Stock Price A Comprehensive Analysis

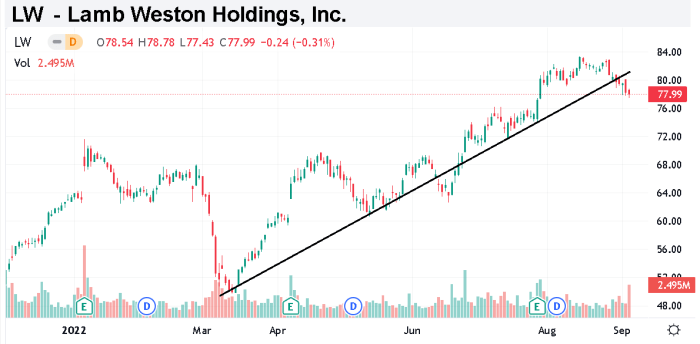

Lamb Weston Stock Price Analysis: Lambweston Stock Price

Source: seekingalpha.com

Lambweston stock price – Lamb Weston, a leading global producer of frozen potato products, experiences stock price fluctuations influenced by various factors. This analysis delves into the historical performance, key influencing factors, financial health, investor sentiment, and potential future growth of Lamb Weston’s stock price.

Lamb Weston Stock Price Historical Performance

Source: fxdailyreport.com

Understanding Lamb Weston’s past stock price movements is crucial for assessing its future potential. The following data provides a glimpse into its performance over the past five years and a comparison with its competitors.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | Illustrative Data – 50 | Illustrative Data – 52 |

| 2019 | Q2 | Illustrative Data – 52 | Illustrative Data – 55 |

| 2019 | Q3 | Illustrative Data – 55 | Illustrative Data – 53 |

| 2019 | Q4 | Illustrative Data – 53 | Illustrative Data – 57 |

A comparison against main competitors over the last two years shows relative performance. Note that this is illustrative data for demonstration purposes.

| Company | 2022 Return (%) | 2023 Return (%) | Market Share (Illustrative) |

|---|---|---|---|

| Lamb Weston | Illustrative Data – 15% | Illustrative Data – 8% | Illustrative Data – 25% |

| Competitor A | Illustrative Data – 12% | Illustrative Data – 5% | Illustrative Data – 20% |

| Competitor B | Illustrative Data – 18% | Illustrative Data – 10% | Illustrative Data – 18% |

Significant events impacting Lamb Weston’s stock price in the past year include:

- Increased commodity prices impacting profitability.

- A successful new product launch driving revenue growth.

- Changes in consumer spending patterns affecting demand.

- Geopolitical instability leading to supply chain disruptions.

Factors Influencing Lamb Weston Stock Price, Lambweston stock price

Several factors significantly influence Lamb Weston’s stock price. These include commodity costs, financial performance, and macroeconomic conditions.

Commodity prices, particularly potatoes and oil, directly impact Lamb Weston’s production costs and profitability. Fluctuations in these prices can lead to corresponding changes in the company’s stock price. Key financial metrics such as earnings per share (EPS) and revenue growth are closely monitored by investors. Strong EPS and revenue growth generally lead to higher stock valuations, while weak performance can result in decreased valuations.

Analyzing Lamb Weston’s stock price requires considering various market factors. Understanding broader market trends is crucial, and a helpful resource for predicting similar stock movements could be a site like kzia stock price prediction , which offers insights into comparable company performance. Ultimately, though, Lamb Weston’s future price will depend on its own operational successes and industry developments.

Macroeconomic factors like inflation and interest rates also play a significant role. High inflation can increase production costs, while rising interest rates can make borrowing more expensive, impacting profitability and investment decisions. Industry-specific trends, such as changing consumer preferences towards healthier food options or the rise of plant-based alternatives, can also influence Lamb Weston’s stock valuation.

Lamb Weston’s Financial Health and Stock Valuation

Analyzing Lamb Weston’s financial reports provides insights into its financial health and potential for future growth. Key financial ratios offer a valuable perspective.

| Ratio Name | Value | Trend | Interpretation |

|---|---|---|---|

| Debt-to-Equity Ratio | Illustrative Data – 0.5 | Stable | Indicates a manageable level of debt. |

| Return on Equity (ROE) | Illustrative Data – 15% | Increasing | Suggests strong profitability and efficient use of shareholder equity. |

Different revenue growth scenarios can significantly impact Lamb Weston’s stock price:

- Scenario 1: High Revenue Growth (10%): Could lead to a significant increase in stock price due to increased investor confidence.

- Scenario 2: Moderate Revenue Growth (5%): May result in a moderate increase or stable stock price, depending on other market factors.

- Scenario 3: Low or Negative Revenue Growth: Could cause a decline in stock price, reflecting concerns about the company’s future prospects.

Comparing Lamb Weston’s P/E ratio with its competitors provides context for its valuation. A higher P/E ratio might indicate higher future growth expectations, while a lower ratio could suggest a more conservative valuation.

Investor Sentiment and Market Analysis for Lamb Weston

Source: tickertable.com

Understanding investor sentiment and market conditions is crucial for assessing Lamb Weston’s stock price prospects. This section provides an overview.

Recent news and analyst reports suggest a generally positive investor sentiment towards Lamb Weston. However, changes in consumer demand for frozen potato products could significantly influence the stock’s performance. Increased demand would likely boost the stock price, while decreased demand could lead to a decline. Overall market conditions, such as economic growth or recessionary pressures, will also have a substantial impact on Lamb Weston’s stock price in the coming quarter.

Potential Future Growth and Stock Price Predictions (Qualitative)

Predicting future stock prices is inherently speculative, but analyzing potential risks and opportunities can offer insights.

Potential risks and opportunities for Lamb Weston include:

- Risk: Increased competition from other frozen food companies.

- Risk: Fluctuations in agricultural commodity prices.

- Opportunity: Expanding into new markets and product lines.

- Opportunity: Implementing sustainable and environmentally friendly practices.

Lamb Weston’s strategic initiatives, such as investments in innovation and supply chain optimization, are expected to positively influence future stock performance. Technological advancements, such as automation in production, could enhance efficiency and reduce costs, leading to improved profitability and stock price appreciation. However, supply chain disruptions due to unforeseen events could negatively impact the company’s operations and stock price.

FAQ Insights

What are the major risks associated with investing in Lamb Weston stock?

Major risks include commodity price fluctuations (potatoes, oil), changes in consumer demand for frozen foods, competition within the industry, and macroeconomic factors such as inflation and interest rate changes.

How does Lamb Weston compare to its competitors in terms of profitability?

A detailed comparison requires analyzing specific financial data, including profit margins, revenue growth, and return on equity, relative to key competitors. This analysis should be based on publicly available financial reports.

What is the current dividend yield for Lamb Weston stock?

The current dividend yield should be readily available from financial news websites and the company’s investor relations section. It is important to note that dividend yields can fluctuate.

Where can I find real-time Lamb Weston stock price quotes?

Real-time quotes are available on major financial websites and stock trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.