Life Cycle Stock Price A Comprehensive Guide

Understanding Life Cycle Stock Prices

Life cycle stock price – The life cycle of a stock price mirrors the journey of a company itself, from its nascent stages to its eventual decline or maturity. Understanding this cycle is crucial for investors to make informed decisions, aligning their investment strategies with the inherent risks and rewards of each phase. This article will explore the various stages of a stock’s life cycle, offering insights into the characteristics, influencing factors, and potential investment strategies for each.

Introduction to Life Cycle Stock Prices

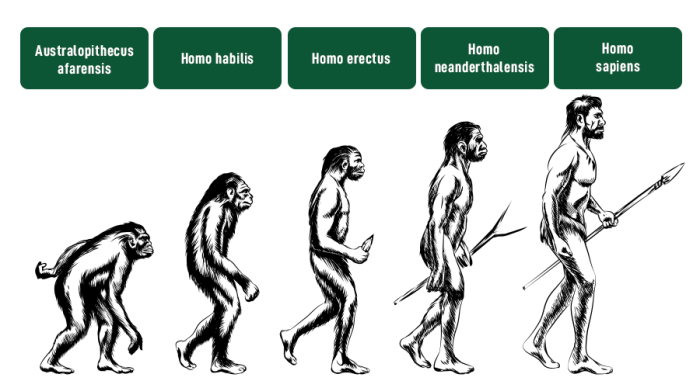

A stock’s life cycle typically encompasses several distinct phases: growth, maturity, and decline. During the growth phase, a company experiences rapid expansion, often leading to significant stock price appreciation. The maturity phase is characterized by slower growth and potentially increased competition, resulting in more stable (but potentially lower growth) stock prices. Finally, the decline phase signifies a deterioration in the company’s performance, often reflected in falling stock prices.

Examples include companies like Apple (growth to maturity), Coca-Cola (long-term maturity), and Blockbuster (decline). Factors influencing stock prices during each phase include market conditions, industry trends, company performance, and investor sentiment.

Growth Stage Stock Prices

Growth-stage stock prices are typically volatile, characterized by significant price swings driven by investor expectations of future performance. Companies like Tesla and Amazon, in their early years, demonstrated this pattern, experiencing periods of rapid appreciation followed by corrections. Investing in growth-stage companies carries high risk, but the potential rewards can be substantial. However, many growth companies never reach profitability, leading to significant losses for investors.

A hypothetical growth-stage portfolio could include companies in emerging technologies (e.g., renewable energy, AI) and innovative sectors. The justification for this selection rests on the potential for high growth and disruption within these sectors. Thorough due diligence, including an assessment of management, competitive landscape, and financial projections, is crucial for mitigating risks.

Maturity Stage Stock Prices

Mature-stage stocks generally exhibit lower volatility compared to growth-stage stocks. These companies have established market positions and predictable revenue streams. However, growth is often slower, and the potential for significant price appreciation is reduced. Risk management strategies for mature-stage companies might focus on diversification and dividend reinvestment, capitalizing on consistent returns rather than high-growth potential.

Understanding a company’s life cycle stock price involves analyzing various factors influencing its value over time. A key aspect is observing the trajectory of growth and stability, which can be illustrated by examining the performance of specific companies. For instance, a detailed look at the lgiq stock price can provide insights into how market forces impact a company’s valuation throughout its life cycle.

Ultimately, this analysis helps investors better predict future price movements and make informed decisions.

| Characteristic | Growth Stage | Maturity Stage |

|---|---|---|

| Volatility | High | Low |

| Growth Rate | High | Low to Moderate |

| Risk | High | Moderate |

| Return Potential | High | Moderate |

Decline Stage Stock Prices

Several factors contribute to a decline in stock prices, including poor management, increased competition, changing consumer preferences, and economic downturns. Companies like Kodak, which failed to adapt to the digital photography revolution, illustrate this decline. Mitigation strategies during this stage might involve selling the stock to limit losses or employing hedging techniques to protect against further declines.

A case study of Blockbuster’s decline reveals the impact of disruptive technologies and failure to adapt to changing market dynamics. The company’s inability to compete with Netflix led to its bankruptcy, highlighting the importance of innovation and adaptability in maintaining a competitive edge.

Analyzing Life Cycle Stock Price Patterns

Source: cheggcdn.com

Predicting stock price movements is inherently challenging, but various methods, including fundamental analysis and technical analysis, can provide valuable insights. Fundamental analysis involves evaluating a company’s financial health, competitive position, and management quality to determine its intrinsic value. However, even the most rigorous analysis cannot perfectly predict future stock prices, as unforeseen events can significantly impact market sentiment.

Macroeconomic factors, such as interest rates and inflation, significantly influence stock prices across all life cycle stages.

Illustrative Examples of Life Cycle Stock Prices

A typical life cycle price trajectory would be depicted as an upward sloping curve during the growth phase, followed by a plateau or slight upward trend during maturity, and finally a downward sloping curve during decline. The steepness of the initial upward slope would represent the speed of growth, while the length of the plateau would reflect the duration of the mature phase.

The rate of decline would indicate the severity of the downturn.

A hypothetical company, “InnovateTech,” might experience rapid growth in its initial years due to a revolutionary product, resulting in a steep upward trajectory of its stock price. As the market matures, its growth slows, leading to a less steep incline. If InnovateTech fails to adapt to emerging technologies, its stock price may eventually decline. Recessions could exacerbate the decline, while economic booms might temporarily boost the price even during the decline phase.

Investing Strategies Based on Life Cycle Stages

Source: ac.lk

Investment strategies should be tailored to the specific life cycle stage. Growth-stage companies warrant a higher risk tolerance and longer investment horizon. Mature-stage companies offer more stability and potential for dividend income. Decline-stage companies should be approached with caution, possibly only suitable for short-term trading strategies. Portfolio diversification is crucial to mitigate risk across different life cycle stages.

- Growth Stage: Invest in high-growth potential companies, accepting higher volatility.

- Maturity Stage: Focus on dividend-paying stocks and income generation.

- Decline Stage: Consider short-term trading strategies or exit the position to limit losses.

Q&A: Life Cycle Stock Price

How long does a typical company’s life cycle last?

There’s no fixed timeframe. It varies significantly depending on industry, competitive landscape, and management decisions. Some companies experience rapid growth and decline, while others enjoy sustained maturity for decades.

Can you predict with certainty which stage a company is in?

No, predicting with absolute certainty is impossible. Analysis combines quantitative data (financial statements) and qualitative factors (competitive analysis, market trends) to make educated estimations, but market dynamics are inherently unpredictable.

What are some common mistakes investors make regarding life cycle stock prices?

Common mistakes include ignoring macroeconomic factors, relying solely on past performance to predict future results, and failing to adequately diversify portfolios across different life cycle stages.