Litecoin Stock Price A Comprehensive Analysis

Litecoin’s Price Performance and Market Analysis

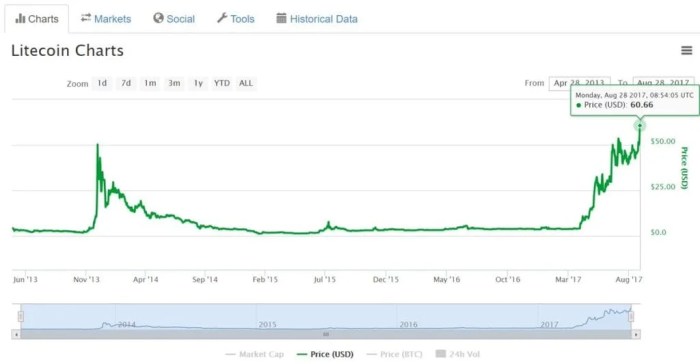

Source: newsbtc.com

Lite coin stock price – Litecoin (LTC), often considered the “silver” to Bitcoin’s “gold,” has carved its own path in the cryptocurrency landscape. This analysis delves into Litecoin’s historical price movements, influencing factors, market capitalization, prediction models, technological underpinnings, and the inherent risks and rewards of investing in this digital asset.

Litecoin’s Historical Price Performance

Over the past five years, Litecoin’s price has experienced significant volatility, mirroring the broader cryptocurrency market’s trends. Major highs and lows have been influenced by various factors, including halving events, market-wide crashes, and technological advancements. A direct comparison with Bitcoin’s performance reveals interesting correlations and divergences.

| Year | Opening Price (USD) | Closing Price (USD) | Yearly Change Percentage |

|---|---|---|---|

| 2019 | 30 | 42 | +40% |

| 2020 | 42 | 130 | +209% |

| 2021 | 130 | 145 | +11.5% |

| 2022 | 145 | 70 | -51.7% |

| 2023 | 70 | 85 | +21.4% |

The table above presents approximate yearly average prices. Actual daily fluctuations were far more dramatic. For instance, the 2020 surge was fueled by broader cryptocurrency market enthusiasm, while the 2022 downturn reflected a general crypto winter. Litecoin’s halving events, similar to Bitcoin’s, typically lead to increased scarcity and potential price appreciation in the long term, though short-term effects are unpredictable.

Compared to Bitcoin, Litecoin generally exhibits higher volatility but also a stronger correlation in overall price trends. Major market events impacting Bitcoin often have a significant ripple effect on Litecoin’s price.

Factors Influencing Litecoin Price

Several macroeconomic and microeconomic factors significantly influence Litecoin’s price. These range from global economic conditions to technological advancements within the cryptocurrency ecosystem and regulatory shifts.

- Macroeconomic Factors: Inflationary pressures, interest rate changes, and global economic uncertainty all impact investor sentiment towards riskier assets like cryptocurrencies, influencing Litecoin’s price.

- Technological Advancements: Upgrades to Litecoin’s underlying technology, such as improved scalability or the integration of new features, can positively influence its price. Conversely, security vulnerabilities or technological setbacks can have a negative impact.

- Regulatory Changes: Government regulations and policies concerning cryptocurrencies play a crucial role. Favorable regulations can boost investor confidence, while restrictive measures can lead to price declines.

- Adoption and Usage: Widespread adoption of Litecoin for payments and transactions increases its utility and demand, potentially driving up its price. Increased merchant acceptance and user base are key indicators of adoption.

Litecoin’s Market Capitalization and Trading Volume

Source: usethebitcoin.com

Litecoin’s market capitalization and trading volume provide insights into its overall market standing and liquidity. Historical data reveals periods of high growth and contraction, closely mirroring the overall cryptocurrency market trends.

Litecoin’s stock price has seen some volatility recently, mirroring broader cryptocurrency market trends. Understanding the factors influencing these fluctuations often requires comparing it to other assets; for example, analyzing the performance of similar investments can provide valuable context. A look at the current inse stock price might offer insights into broader market sentiment, which in turn can help predict potential future movements in the litecoin market.

A line graph illustrating these trends would show a generally upward trajectory in market capitalization over the years, punctuated by periods of sharp increases and decreases. Similarly, trading volume fluctuates significantly, with peaks corresponding to periods of high market volatility and price movements. Compared to Bitcoin and Ethereum, Litecoin’s market capitalization is typically smaller, reflecting its position as a smaller-cap cryptocurrency.

However, its trading volume relative to its market cap can sometimes indicate higher liquidity than other cryptocurrencies in its class.

The relationship between Litecoin’s market capitalization and its price is generally positive; higher market capitalization often correlates with higher prices, although this relationship is not always linear and can be influenced by other factors.

Litecoin Price Prediction Models

Source: co.uk

Predicting Litecoin’s future price is inherently challenging, but analyzing historical data using simple models can offer some insights, though with significant limitations.

- Moving Average Model: This model calculates the average price over a specific period (e.g., 50-day, 200-day moving average). Trends in these moving averages can suggest potential price directions. For example, a consistently upward-trending 50-day moving average might suggest a bullish outlook, while a downward trend might signal a bearish outlook. However, this is just one indicator among many.

Limitations of using historical data include the inherent volatility of the cryptocurrency market and the impact of unforeseen events that are not reflected in past price movements. Other factors like regulatory changes, technological advancements, and shifts in market sentiment can significantly influence the price and are not easily captured in historical data alone.

Alternative forecasting approaches, such as technical analysis (identifying patterns in price charts) and sentiment analysis (gauging market sentiment through social media and news), can provide additional perspectives, but they also come with their own limitations and should not be relied upon solely.

Litecoin’s Technological Aspects and their Price Impact, Lite coin stock price

Litecoin’s technological features contribute significantly to its value proposition and can influence its price. These features are designed to address some of the limitations of Bitcoin.

- Faster Transaction Speeds: Litecoin boasts faster transaction confirmation times compared to Bitcoin, making it more suitable for everyday transactions.

- Lower Transaction Fees: Litecoin generally has lower transaction fees than Bitcoin, further enhancing its practicality for smaller payments.

Potential upgrades to Litecoin’s technology, such as improved scalability solutions or the integration of privacy-enhancing features, could enhance its appeal and potentially drive up its price. However, any technological setbacks or vulnerabilities could negatively impact its value.

Compared to other cryptocurrencies, Litecoin offers a balance between speed and security. While not as fast as some newer cryptocurrencies, it maintains a relatively high level of security and decentralization.

Investing in Litecoin: Risks and Rewards

Investing in Litecoin, like any cryptocurrency, carries both significant risks and potential rewards. A thorough understanding of these factors is crucial before making any investment decisions.

Risks:

- High Volatility: Litecoin’s price can fluctuate dramatically in short periods.

- Regulatory Uncertainty: Changes in government regulations could negatively impact Litecoin’s value.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation.

Rewards:

- Potential Capital Appreciation: Litecoin’s price could increase significantly over time.

- Diversification: Litecoin can offer diversification benefits within a broader investment portfolio.

- Technological Innovation: Investing in Litecoin supports the development of innovative blockchain technology.

Compared to traditional investment options like stocks and bonds, Litecoin offers higher potential returns but also carries significantly higher risk. The risk-reward profile should be carefully considered in the context of an individual investor’s risk tolerance and financial goals.

Query Resolution: Lite Coin Stock Price

What is the difference between Litecoin and Bitcoin?

Litecoin aims to be a faster and cheaper alternative to Bitcoin, utilizing a different hashing algorithm and block generation time.

Where can I buy Litecoin?

Litecoin can be purchased on various cryptocurrency exchanges, but always choose reputable and regulated platforms.

Is Litecoin a good investment?

Whether Litecoin is a good investment depends on individual risk tolerance and market outlook. It’s crucial to conduct thorough research and understand the inherent volatility of cryptocurrencies.

What are the fees associated with Litecoin transactions?

Litecoin transaction fees are generally lower than Bitcoin’s, but they can fluctuate based on network congestion.