Lomlf Stock Price Analysis and Outlook

Lomlf Stock Price Analysis

Source: cheggcdn.com

Lomlf stock price – This analysis provides an overview of Lomlf’s current stock price, influencing factors, financial performance, investor sentiment, potential risks and opportunities, and illustrative scenarios under varying market conditions. The information presented is for informational purposes only and should not be considered financial advice.

Current Lomlf Stock Price and Recent Trends

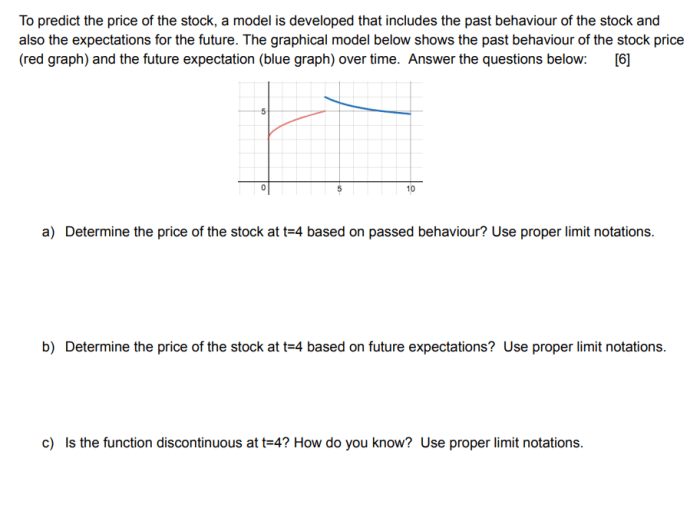

Determining the precise current Lomlf stock price requires real-time data from a financial market data provider. However, we can analyze recent trends to understand the stock’s behavior. The price fluctuates daily, influenced by various factors discussed later in this analysis. Below is a hypothetical example of price movements for illustrative purposes.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | $15.20 | $15.50 | $14.90 | $15.30 |

| Tuesday | $15.35 | $15.70 | $15.20 | $15.60 |

| Wednesday | $15.65 | $15.80 | $15.40 | $15.55 |

| Thursday | $15.50 | $15.65 | $15.30 | $15.45 |

| Friday | $15.40 | $15.55 | $15.25 | $15.35 |

Significant price movements can be attributed to factors such as news releases, economic indicators, or changes in investor sentiment. For example, a positive earnings report might lead to a price increase, while negative news about the company’s operations could cause a decline.

Factors Influencing Lomlf Stock Price

Several factors influence Lomlf’s stock price. These include macroeconomic conditions, industry trends, competitive dynamics, and company-specific news.

- Economic Indicators: Interest rate changes, inflation rates, and GDP growth directly impact investor confidence and market sentiment, influencing Lomlf’s stock price.

- Industry Trends: Innovation within Lomlf’s sector, regulatory changes, and consumer demand shifts can all impact the company’s performance and thus its stock price.

- Competitive Landscape: The actions of Lomlf’s competitors, including new product launches or aggressive pricing strategies, can affect its market share and profitability, subsequently influencing its stock price.

- Company News and Announcements: Earnings reports, new product launches, mergers and acquisitions, or any significant changes in management can cause immediate and substantial stock price volatility.

Comparing Lomlf’s performance to its competitors requires analyzing key metrics such as revenue growth, profitability, and market share. A superior performance relative to competitors often translates to a higher stock valuation.

Lomlf’s Financial Performance and Stock Valuation

Source: cheggcdn.com

Analyzing Lomlf’s financial reports—including revenue, earnings, and debt levels—is crucial for understanding its financial health and future prospects. These reports provide insights into the company’s profitability, growth trajectory, and overall financial stability.

- Revenue: Consistent revenue growth indicates strong market demand and operational efficiency.

- Earnings: Profitability demonstrates the company’s ability to generate income after deducting all expenses.

- Debt: High levels of debt can indicate financial risk and may negatively impact the stock price.

- P/E Ratio: This metric compares the stock’s price to its earnings per share, providing insights into market valuation relative to profitability.

- Market Capitalization: This represents the total value of all outstanding shares, reflecting the market’s overall assessment of the company’s worth.

Investor Sentiment and Market Outlook for Lomlf

Investor sentiment, often reflected in analyst ratings and news articles, significantly impacts Lomlf’s stock price. Positive sentiment leads to higher demand and price increases, while negative sentiment can trigger sell-offs.

A summary of recent news articles and analyst reports would provide a comprehensive picture of current investor opinions. For instance, a predominantly positive outlook might suggest a bullish market sentiment, while a preponderance of negative reports could signal bearish sentiment.

Potential Risks and Opportunities Affecting Lomlf Stock

Several risks and opportunities could affect Lomlf’s stock price. Careful consideration of these factors is essential for informed investment decisions.

- Risks: Increased competition, economic downturns, regulatory changes, and negative publicity can all negatively impact Lomlf’s stock price.

- Opportunities: Successful product launches, expansion into new markets, technological advancements, and favorable economic conditions can drive positive price movements.

- Geopolitical Events: Global events, such as trade wars or political instability, can create uncertainty and volatility in the market, affecting Lomlf’s stock price.

These factors, when considered together, can help investors predict future stock price movements, although accuracy is never guaranteed.

Illustrative Scenario: Lomlf Stock Price in Different Market Conditions

Let’s consider two hypothetical scenarios to illustrate how Lomlf’s stock price might react to different market conditions. These scenarios are purely illustrative and based on general market behavior.

Scenario 1: Positive Market Event (Strong Economic Growth)

Assume a period of strong economic growth, characterized by increased consumer spending and business investment. In this scenario, Lomlf’s revenue and earnings are likely to increase, leading to a rise in its stock price. The increased investor confidence would further fuel demand for Lomlf shares. We might see a price increase of 15-20% over a six-month period.

Scenario 2: Negative Market Event (Recessionary Fears)

Conversely, if recessionary fears emerge, characterized by reduced consumer spending and decreased business investment, Lomlf’s revenue and earnings could decline. This would likely lead to a decrease in its stock price as investors become more risk-averse. In this scenario, we might see a price decline of 10-15% over a similar period.

Visual Representation: Imagine two lines on a graph. In Scenario 1 (positive market), the line shows a steady upward trend, reflecting the stock price increase. In Scenario 2 (negative market), the line displays a downward trend, illustrating the price decrease. The slope of each line would reflect the magnitude of the price change.

Top FAQs: Lomlf Stock Price

What is Lomlf’s current market capitalization?

The current market capitalization of Lomlf will vary and should be checked on a reputable financial website providing real-time market data.

Where can I find real-time Lomlf stock quotes?

Real-time quotes for Lomlf stock are available through major financial news websites and brokerage platforms.

Are there any significant upcoming events that could affect Lomlf’s stock price?

Information on upcoming events that might impact Lomlf’s stock price can be found in company press releases, financial news sources, and analyst reports. Always consult multiple sources.

Understanding the fluctuations in LOMLF stock price requires a broader look at the market. Investors often compare performance against similar companies, and a key benchmark could be the performance of limelight stock price , given their shared sector. Analyzing both these stocks can provide a more complete picture of the current investment climate and inform decisions regarding LOMLF’s future trajectory.

What is the typical trading volume for Lomlf stock?

Trading volume for Lomlf stock fluctuates daily. You can find historical and current trading volume data on most financial websites that track stock market activity.