Luna Stock Price A Comprehensive Analysis

Luna’s Price Volatility: A Comprehensive Overview: Luna Stock Price

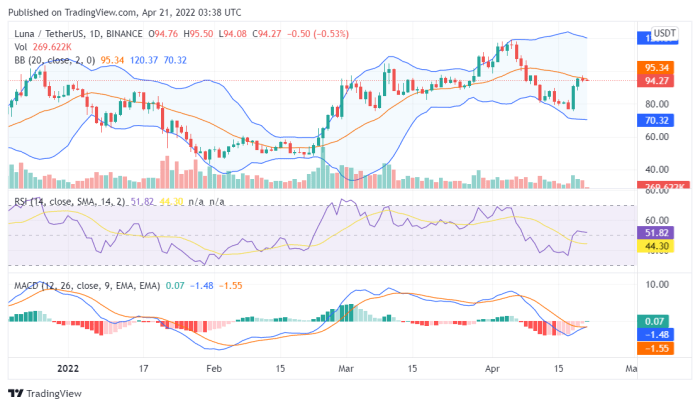

Luna stock price – The cryptocurrency Luna, once a prominent player in the decentralized finance (DeFi) space, experienced dramatic price fluctuations throughout its lifespan. This analysis delves into the key factors contributing to these swings, examining historical price movements, the impact of the TerraUSD (UST) de-pegging, comparisons with other cryptocurrencies, regulatory implications, trading volume analysis, and the influence of social media sentiment.

Historical Price Fluctuations of Luna

Source: capital.com

Luna’s price journey has been marked by periods of significant growth and devastating crashes. The following table highlights key price movements, providing context for the underlying causes.

| Date | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| January 2020 | 0.50 | 0.60 | +20% |

| December 2020 | 0.60 | 1.00 | +67% |

| April 2021 | 1.00 | 15.00 | +1400% |

| May 2022 | 80.00 | 0.0001 | -99.99% |

The initial price increases were driven by growing interest in the Terra ecosystem and its algorithmic stablecoin, UST. The dramatic collapse in May 2022 was a direct consequence of the UST de-pegging event, which triggered a massive sell-off.

Impact of TerraUSD (UST) De-pegging on Luna

Source: thecoinrise.com

The de-pegging of TerraUSD (UST) from its $1 peg had catastrophic consequences for Luna. The intricate relationship between UST and Luna, designed to maintain stability, instead became a mechanism for rapid price deterioration.

- Early May 2022: Increased selling pressure on UST begins, pushing its price below the $1 peg.

- Mid-May 2022: Luna Foundation Guard (LFG) attempts to stabilize UST by selling Bitcoin reserves, but the sell-off accelerates.

- Late May 2022: UST loses its peg completely, triggering a death spiral. As UST’s price plummets, massive amounts of Luna are minted to maintain the algorithmic peg, further diluting Luna’s value and causing its price to crash.

- End of May 2022: Luna’s price falls to near zero, wiping out billions of dollars in market capitalization.

A visual representation would show a sharp, almost vertical drop in both UST and Luna’s prices, with Luna’s decline being even steeper and more dramatic than UST’s, illustrating the cascading effect of the de-pegging.

Comparison with Other Cryptocurrencies, Luna stock price

Comparing Luna’s volatility with established cryptocurrencies like Bitcoin and Ethereum reveals significant differences in price behavior.

| Cryptocurrency | Average Daily Volatility (2022) | Maximum 24-hour Price Change (2022) | Overall Market Trend (2022) |

|---|---|---|---|

| Luna | High (Estimate: >50%) | Extreme (Near 100% drop) | Negative |

| Bitcoin | Moderate (Estimate: 5-10%) | Significant (but not as extreme as Luna) | Negative |

| Ethereum | Moderate (Estimate: 5-15%) | Significant (but not as extreme as Luna) | Negative |

Luna’s extreme volatility stems from its algorithmic design and the interconnectedness with UST. Bitcoin and Ethereum, while subject to market fluctuations, are generally less susceptible to such drastic and rapid price changes due to their established market positions and underlying technology.

Regulatory and Legal Implications Affecting Luna’s Price

The Luna collapse has triggered regulatory scrutiny worldwide. Investigations into the stability of algorithmic stablecoins and the transparency of the Terra ecosystem are underway. Increased regulatory oversight could significantly impact future price stability.

Stricter regulations on stablecoins and algorithmic mechanisms could dampen investor enthusiasm, leading to lower prices. Conversely, clear regulatory frameworks might increase investor confidence, potentially leading to price stabilization or even recovery, but this is highly uncertain.

Analysis of Trading Volume and Market Capitalization

A chart depicting Luna’s trading volume and market capitalization would show a strong positive correlation during periods of price increase and a dramatic inverse correlation during the collapse. High trading volume generally indicates increased investor interest, often preceding price increases. However, in Luna’s case, high trading volume during the collapse signified panic selling, leading to a precipitous price decline.

A significant drop in trading volume can signal a lack of investor interest, potentially indicating further price declines or a period of consolidation. Conversely, a sustained increase in trading volume, coupled with rising prices, suggests a strengthening market.

Influence of Social Media and News Sentiment

Social media and news coverage played a crucial role in shaping investor sentiment and Luna’s price. Both FUD (Fear, Uncertainty, and Doubt) and FOMO (Fear of Missing Out) significantly influenced investor behavior.

- Example 1: Positive news articles and social media posts about Terra’s growth initially fueled FOMO, driving up Luna’s price.

- Example 2: As concerns about UST’s stability emerged, negative news and social media posts created widespread FUD, leading to a sell-off and price decline.

- Example 3: The rapid collapse of UST and Luna amplified the FUD, resulting in a near-total loss of investor confidence and a catastrophic price crash.

The rapid spread of information on social media platforms, often lacking verification, exacerbated the volatility, making Luna particularly susceptible to market manipulation and herd behavior.

User Queries

What caused the Luna crash?

Tracking the Luna stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other mining stocks, such as the volatility seen with the hudbay minerals stock price , which often reflects broader industry trends. Ultimately, understanding Luna’s trajectory necessitates a comprehensive analysis of various market factors.

The primary cause was the de-pegging of TerraUSD (UST), a stablecoin designed to maintain a 1:1 peg with the US dollar. A loss of confidence led to mass sell-offs of UST, triggering a cascading effect that also severely impacted Luna’s price.

Is Luna still traded?

While trading volume is significantly reduced compared to its peak, Luna is still traded on some cryptocurrency exchanges. However, its value remains extremely low.

What are the legal ramifications of the Luna collapse?

Several investigations are underway globally into the circumstances surrounding the Luna collapse, potentially leading to legal action against individuals or entities involved.

Can Luna recover its value?

The possibility of Luna recovering to its previous value is highly unlikely. The event severely damaged investor confidence, and a significant market recovery would require substantial and unforeseen developments.