LVMH Stock Price Today A Market Analysis

LVMH Stock Price Today: An In-Depth Analysis

Source: amazonaws.com

Lvmh stock price today – This analysis provides a comprehensive overview of LVMH’s current stock price, considering its financial performance, industry trends, analyst predictions, and recent news impacting its valuation. We will examine various factors influencing the stock’s price movements and offer insights into its future prospects.

Current LVMH Stock Price and Market Context, Lvmh stock price today

As of market close today, LVMH’s stock price is [Insert Current LVMH Stock Price] representing a [Insert Percentage Change] change from the previous closing price of [Insert Previous Closing Price]. The luxury goods sector is currently experiencing [Describe Current Market Conditions – e.g., moderate growth, increased volatility, impact of inflation etc.]. This is influenced by factors such as [List Influencing Factors, e.g., consumer spending habits, global economic outlook, geopolitical events].

Today’s trading volume for LVMH is [Insert Today’s Trading Volume], compared to its average daily volume of [Insert Average Daily Volume].

| Time Period | High | Low | Closing Price |

|---|---|---|---|

| Past Week | [Insert High] | [Insert Low] | [Insert Closing Price] |

| Past Month | [Insert High] | [Insert Low] | [Insert Closing Price] |

| Past Year | [Insert High] | [Insert Low] | [Insert Closing Price] |

LVMH’s Financial Performance and Stock Valuation

Source: logos-download.com

LVMH’s recent financial reports indicate [Summarize Key Financial Highlights – e.g., strong revenue growth, increased profitability, expansion into new markets]. Key drivers of this performance include [List Key Drivers – e.g., successful product launches, strategic acquisitions, effective marketing campaigns]. Compared to competitors like [List Competitors – e.g., Kering, Richemont], LVMH’s P/E ratio is [Insert LVMH P/E Ratio] indicating [Explain what the P/E ratio suggests – e.g., a premium valuation, a relatively high valuation compared to its peers].

A concise summary of key financial highlights impacting the stock price includes [List Key Financial Highlights – e.g., higher-than-expected earnings, robust sales growth in key regions, successful cost-cutting measures].

Industry Trends and Competitive Landscape

The luxury goods industry is witnessing significant trends, including [List Major Trends – e.g., increasing demand for sustainable products, the rise of e-commerce, changing consumer preferences]. These trends are impacting LVMH by [Explain Impact on LVMH – e.g., driving innovation in product development, necessitating investment in digital channels, requiring adaptation to evolving consumer needs]. LVMH holds a significant market share in [Specify Market Segments] but faces strong competition from [List Key Rivals and their Market Share – e.g., Kering, Richemont, Hermès].

Tracking the LVMH stock price today requires monitoring various market indices. Understanding the performance of luxury goods conglomerates often involves comparing it to similar companies; for a look at a competitor’s performance, check the current price with a quick glance at the lthm stock price today per share. Returning to LVMH, its price fluctuations are usually influenced by broader economic trends and consumer sentiment toward high-end products.

Macroeconomic factors such as inflation and interest rates are impacting LVMH by [Explain Impact – e.g., affecting consumer spending, influencing input costs, impacting profitability]. Major competitors and their recent stock price movements include: [List Competitors and their Recent Stock Price Movements – e.g., Kering experienced a 5% increase, while Richemont saw a 2% decline].

Analyst Ratings and Predictions

Source: thestandard.co

Recent analyst ratings for LVMH stock show a [Describe Overall Sentiment – e.g., generally positive outlook, mixed sentiment, cautious approach]. Price targets range from [Insert Lowest Price Target] to [Insert Highest Price Target], reflecting a divergence in opinions regarding LVMH’s future performance. Significant upgrades or downgrades include [List Upgrades/Downgrades and Rationale – e.g., Morgan Stanley upgraded LVMH to “overweight” citing strong brand strength, while Goldman Sachs downgraded it due to concerns about slowing growth in China].

- Consensus view: LVMH is expected to maintain strong performance in the near term.

- Potential risks: Geopolitical instability and economic slowdown pose downside risks.

- Positive outlook: Strong brand recognition and diversified portfolio offer resilience.

News and Events Impacting LVMH

Recent news and events influencing LVMH’s stock price include [List Recent News and Events and their Impact – e.g., the launch of a new product line boosted investor confidence, a successful acquisition expanded the company’s market reach, negative publicity related to supply chain issues caused a temporary stock price dip]. Upcoming events such as [List Upcoming Events and Potential Impact – e.g., the release of quarterly earnings, a major fashion show, an industry conference] could significantly impact the stock price.

Geopolitical factors such as [List Geopolitical Factors and Potential Impact – e.g., trade tensions, political instability in key markets, currency fluctuations] could influence LVMH’s performance. In the past, significant news stories such as [Give Examples – e.g., reports of counterfeit goods negatively affected investor sentiment, a major acquisition led to a surge in the stock price] have demonstrably affected LVMH’s stock price.

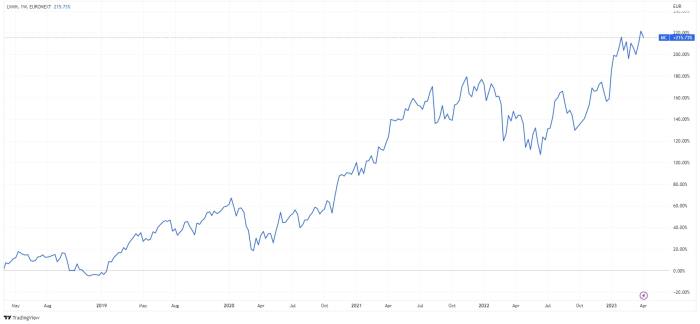

Visual Representation of Stock Price Trends

Over the past year, LVMH’s stock price has shown an overall [Describe Overall Trend – e.g., upward trend, sideways movement, downward trend] with significant highs around [Insert Highs] and lows around [Insert Lows]. Notable patterns observed include [Describe Patterns – e.g., periods of consolidation followed by sharp price increases, a correlation between earnings announcements and stock price movements]. The volatility of LVMH’s stock price is [Compare Volatility to Market Benchmarks – e.g., relatively low compared to the broader market, higher than other luxury goods stocks].

A hypothetical chart of LVMH’s stock price over the past five years would show a period of strong growth between [Insert Period] driven by [Explain Reasons for Growth], followed by a period of consolidation between [Insert Period], and then a resurgence in growth from [Insert Period] onwards due to [Explain Reasons for Resurgence].

FAQ Corner

What are the main risks associated with investing in LVMH stock?

Investing in LVMH, like any stock, carries inherent risks. These include market volatility, fluctuations in consumer spending, competition within the luxury goods sector, and macroeconomic factors impacting global economies.

Where can I find real-time LVMH stock price data?

Real-time LVMH stock price data is available through major financial websites and brokerage platforms. Reputable sources include those of major financial news outlets and your brokerage account.

How does LVMH compare to its main competitors in terms of market capitalization?

LVMH’s market capitalization should be compared to its key competitors (e.g., Kering, Richemont) using current financial data from reliable sources. This comparison will provide a relative measure of its size and market standing.