Lynas Rare Earths Stock Price Analysis

Lynas Rare Earths: A Deep Dive into Stock Performance: Lynas Rare Earths Stock Price

Lynas rare earths stock price – Lynas Rare Earths is a significant player in the global rare earth market, offering investors exposure to a sector crucial for various technological advancements. Understanding its business model, market position, and financial performance is vital for assessing its stock price trajectory. This analysis explores key factors influencing Lynas’s stock price, providing insights into its financial health, market outlook, and associated risks.

Lynas Rare Earths Company Overview

Source: com.au

Lynas Rare Earths Limited is a leading producer of separated rare earth materials. Its business model centers around the mining, processing, and marketing of these materials, crucial components in numerous high-tech applications, including electric vehicles, wind turbines, and consumer electronics. Key operations involve extracting rare earth minerals from ore, separating individual rare earth elements, and refining them into high-purity products tailored to specific customer needs.

This vertically integrated approach provides significant control over the supply chain.

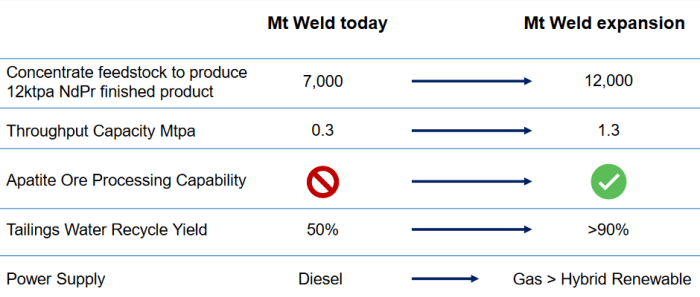

Lynas’s primary production facilities are located in Mount Weld, Western Australia (mining and cracking and leaching), and Gebeng, Malaysia (separation and refining). This geographic footprint presents both advantages and disadvantages. While the Australian mine secures access to a rich rare earth deposit, the Malaysian processing plant is subject to local regulations and potential geopolitical risks. Competitive advantages stem from Lynas’s integrated operations, technological expertise in separation and purification, and its position as one of the few significant non-Chinese producers of separated rare earth materials.

However, disadvantages include its dependence on specific geographic locations, the cyclical nature of rare earth demand, and the intense competition from Chinese producers who dominate the market.

Factors Influencing Lynas Stock Price

Several factors influence Lynas’s stock price, ranging from macroeconomic conditions to geopolitical events and market supply-demand dynamics. These factors are interconnected and often reinforce or counteract each other, creating a complex interplay that shapes investor sentiment and stock valuation.

Macroeconomic factors such as global economic growth, inflation, and interest rates significantly impact Lynas’s stock price. Strong global economic growth generally boosts demand for rare earth materials, positively influencing Lynas’s revenue and profitability. Conversely, high inflation and interest rates can increase operational costs and reduce investor appetite for riskier assets, potentially depressing the stock price. Geopolitical events, particularly those involving China (a dominant player in the rare earth market), can create significant volatility.

Trade tensions, sanctions, or disruptions to supply chains can impact Lynas’s access to markets and its operational efficiency, leading to stock price fluctuations. Supply and demand dynamics within the rare earth market are paramount. Increased demand from the renewable energy and electronics sectors can drive up prices and boost Lynas’s profitability, while oversupply can lead to price declines and pressure on margins.

A comparison with competitors is crucial. While precise figures fluctuate, a snapshot comparison (hypothetical data for illustrative purposes) is presented below:

| Company | Stock Price (USD) | Market Cap (USD Billion) | Revenue (USD Billion) | Profit Margin (%) |

|---|---|---|---|---|

| Lynas Rare Earths | 10.50 | 5.0 | 1.2 | 15 |

| Competitor A | 8.00 | 3.5 | 0.8 | 12 |

| Competitor B | 12.00 | 6.0 | 1.5 | 18 |

Lynas’s Financial Performance and Projections

Lynas’s recent financial reports (note: replace with actual data from Lynas’s financial statements) have shown a trend of increasing revenue and profitability, driven by rising demand for rare earth materials. Revenue streams primarily come from the sale of separated rare earth oxides and other downstream products. Profitability is influenced by factors such as production costs, selling prices, and operating efficiencies.

Return on investment (ROI) is expected to remain strong given the increasing demand for its products.

Projected financial statement for the next fiscal year (hypothetical, based on current trends and market forecasts): Revenue is projected to increase by 15% due to expanding demand, while profit margins are expected to improve slightly due to operational efficiencies and favorable pricing. These projections are subject to various uncertainties, including macroeconomic conditions, geopolitical events, and competition.

Investor Sentiment and Market Analysis

Current investor sentiment towards Lynas Rare Earths is generally positive, reflecting the growing demand for rare earth materials and Lynas’s strategic position as a key non-Chinese producer. However, concerns remain regarding geopolitical risks, regulatory hurdles, and the cyclical nature of the rare earth market. Analyst ratings and price targets vary, but a general consensus points towards a positive outlook, with many analysts forecasting further growth in the coming years.

Recent news events, such as new supply contracts or technological breakthroughs, have positively influenced investor sentiment.

Long-Term Growth Prospects for Lynas, Lynas rare earths stock price

Source: com.au

The long-term demand outlook for rare earth materials is robust, driven by the increasing adoption of electric vehicles, renewable energy technologies, and advanced electronics. Technological advancements, such as improved extraction and processing techniques, will enhance Lynas’s efficiency and competitiveness. However, risks remain, including competition from established players and new entrants, as well as potential disruptions to supply chains.

Lynas’s long-term growth strategy focuses on expanding production capacity, diversifying its customer base, and investing in research and development to maintain a technological edge.

Projected market share and revenue growth (hypothetical illustration): Lynas is projected to increase its market share by 5% over the next five years, resulting in a corresponding increase in revenue. This growth will be driven by increased demand, strategic partnerships, and successful implementation of its growth strategy. A visual representation would show an upward-sloping curve for both market share and revenue, reflecting a steady and sustained growth trajectory.

Risk Assessment for Lynas Stock

Investing in Lynas Rare Earths involves several risks. Geopolitical risks, particularly those related to China and its influence on the rare earth market, are significant. Regulatory risks, such as changes in environmental regulations or trade policies, can impact Lynas’s operations and profitability. Competition from established players and new entrants presents a constant challenge. These risks can significantly impact Lynas’s stock price.

Mitigation strategies include diversifying its geographic footprint, securing long-term supply contracts, and investing in research and development to maintain a technological advantage.

Questions Often Asked

What are the major risks associated with investing in Lynas Rare Earths stock?

Key risks include geopolitical instability affecting supply chains, price volatility in the rare earth market, and competition from other producers. Regulatory changes and environmental concerns also pose significant challenges.

How does Lynas compare to its competitors in terms of profitability?

A direct comparison requires a detailed financial analysis of Lynas and its competitors, examining profit margins, return on investment, and revenue growth. This would vary based on the reporting period.

What is the current analyst consensus on Lynas’s stock price target?

Analyst ratings and price targets fluctuate frequently. Refer to reputable financial news sources for the most up-to-date information.

Tracking Lynas Rare Earths stock price requires considering various market factors. Understanding future growth projections often involves comparing it to other high-growth sectors, such as the burgeoning air taxi market, where you can find analyses of the joby stock price target and its implications for investor sentiment. Ultimately, Lynas’s performance will depend on its own operational efficiency and global demand for rare earth materials.

Where can I find Lynas’s financial reports?

Lynas’s financial reports are typically available on its investor relations website and through major financial data providers.