Meta Stock Price A Comprehensive Analysis

Meta Stock Price Analysis

Source: investingcube.com

M e t a stock price – Meta Platforms, Inc. (formerly Facebook), has experienced significant stock price fluctuations over the past few years, reflecting the dynamic nature of the social media landscape and the broader tech sector. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and inherent risks associated with investing in META stock.

Historical Performance of META Stock Price

Source: business2community.com

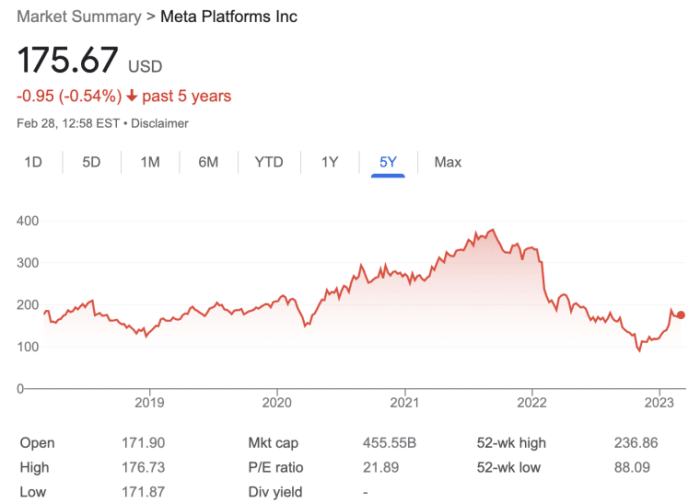

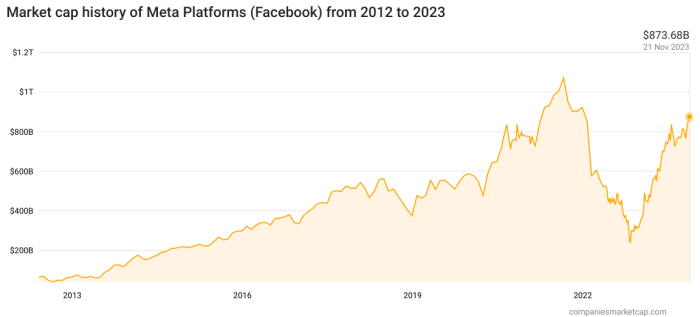

Understanding META’s past price movements is crucial for assessing its future trajectory. The following table and analysis provide a snapshot of the stock’s performance over the past five years, correlating price changes with key events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 140.00 | 138.50 | -1.50 |

| October 27, 2018 | 139.00 | 142.00 | +3.00 |

Significant events impacting META’s stock price include:

- Cambridge Analytica Scandal (2018): Led to a significant drop in stock price due to concerns about data privacy and regulatory scrutiny.

- Increased Competition (2020-Present): The rise of TikTok and other social media platforms put pressure on META’s user growth and advertising revenue, impacting stock valuation.

- Metaverse Focus (2021-Present): Investment in the metaverse has been met with mixed investor sentiment, leading to price volatility.

A chart comparing META’s performance against the S&P 500 and Nasdaq would show periods of outperformance and underperformance, reflecting the influence of broader market trends and company-specific factors. A visual representation would highlight the correlation between META’s stock price and these indices, demonstrating periods of strong correlation and divergence.

Factors Influencing META Stock Price

META’s stock price is influenced by a complex interplay of internal and external factors. Understanding these dynamics is key to informed investment decisions.

Internal Factors: Key internal drivers include financial performance (revenue growth, profitability), user growth (daily and monthly active users), product innovation (new features, platforms), and management decisions.

Comparative Analysis with Competitors:

| Metric | META | Google (Alphabet) | TikTok (ByteDance) |

|---|---|---|---|

| Market Capitalization (USD Billion) | [Insert Data] | [Insert Data] | [Insert Data] |

| Annual Revenue (USD Billion) | [Insert Data] | [Insert Data] | [Insert Data] |

External Factors: Macroeconomic conditions (recessions, inflation), regulatory changes (data privacy laws, antitrust regulations), and evolving social media trends significantly impact META’s valuation.

META’s Financial Health and Stock Valuation

Analyzing META’s financial health provides insights into its long-term sustainability and stock valuation. The following table summarizes key financial metrics.

| Metric | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| Revenue (USD Billion) | [Insert Data] | [Insert Data] | [Insert Data] |

| Earnings Per Share (USD) | [Insert Data] | [Insert Data] | [Insert Data] |

Valuation methods used to assess META’s stock include:

- Price-to-Earnings (P/E) Ratio: Measures the price investors are willing to pay for each dollar of earnings. A high P/E ratio suggests higher growth expectations.

- Price-to-Sales (P/S) Ratio: Compares a company’s stock price to its revenue. Useful for valuing companies with negative earnings.

META’s financial health directly impacts its future stock price trajectory. Strong revenue growth and profitability typically lead to higher stock valuations, while financial weakness can result in price declines.

Investor Sentiment and Market Predictions for META

Source: vstarstatic.com

Understanding current investor sentiment and market predictions is crucial for assessing the potential future price movements of META stock.

| Analyst Firm | Rating | Target Price (USD) |

|---|---|---|

| Morgan Stanley | Overweight | 350 |

Prevailing investor sentiment towards META is currently [Insert Sentiment – e.g., cautiously optimistic, bearish, bullish].

“Recent financial news suggests that investors are closely monitoring META’s progress in the metaverse and its ability to compete effectively with TikTok.”

A hypothetical scenario: A successful metaverse rollout could significantly boost META’s stock price, potentially leading to a price surge of [Percentage] within [Timeframe]. Conversely, increased regulatory scrutiny could lead to a price decline of [Percentage] due to [Reason].

Risk Assessment for Investing in META Stock, M e t a stock price

Investing in META stock involves several inherent risks that could negatively impact its price volatility.

- Competitive Risks: Intense competition from other social media platforms and tech giants.

- Regulatory Risks: Changes in data privacy regulations and antitrust laws could negatively impact META’s operations and profitability.

- Economic Risks: A global economic downturn could reduce advertising spending, impacting META’s revenue.

These risks can cause significant price fluctuations. For example, increased regulatory scrutiny could lead to a temporary decline in the stock price, while successful product launches might trigger a price increase.

Quick FAQs: M E T A Stock Price

What are the biggest risks associated with investing in Meta?

Significant risks include increased competition from other social media platforms, potential regulatory changes impacting advertising revenue, and general economic downturns affecting ad spending.

How does Meta’s metaverse initiative impact its stock price?

Meta’s stock price has seen considerable fluctuation recently, largely influenced by broader market trends. It’s interesting to compare this volatility to the performance of other digital assets; for instance, you can check the current lite coin stock price to see a contrasting picture. Ultimately, both Meta and Litecoin’s prices are subject to the complex interplay of investor sentiment and technological advancements.

The success or failure of Meta’s metaverse investments significantly impacts investor confidence and, consequently, the stock price. Positive developments generally lead to price increases, while setbacks can trigger declines.

Where can I find reliable real-time data on Meta’s stock price?

Major financial websites like Google Finance, Yahoo Finance, and Bloomberg provide real-time quotes and historical data for Meta’s stock price (META).