Meta Stock Price Live Tracking the Daily Fluctuations

Meta Stock Price: A Live Analysis: Meta Stock Price Live

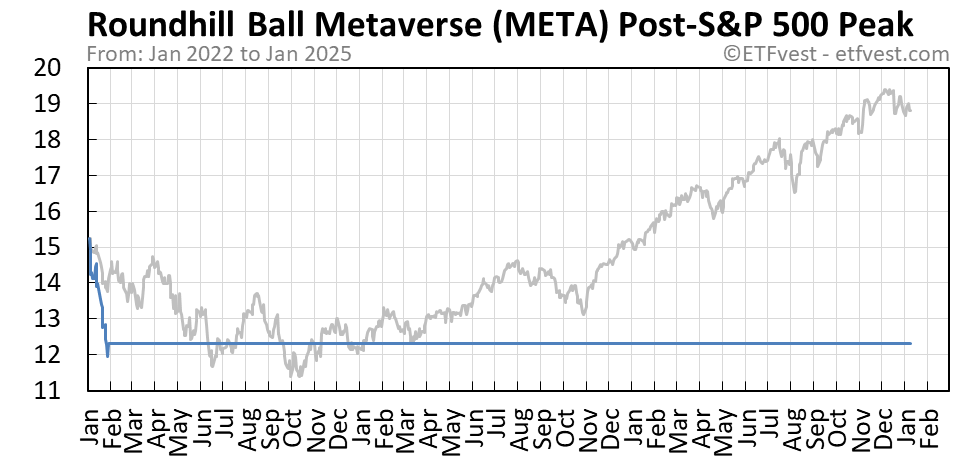

Source: etfvest.com

Meta stock price live – Meta Platforms, Inc. (META), formerly known as Facebook, is a behemoth in the social media and technology landscape. Understanding its stock price fluctuations requires analyzing various interconnected factors, from real-time market dynamics to long-term growth projections. This analysis delves into the key drivers shaping META’s stock price, offering insights into its current state and potential future trajectory.

Real-time Data Fluctuation

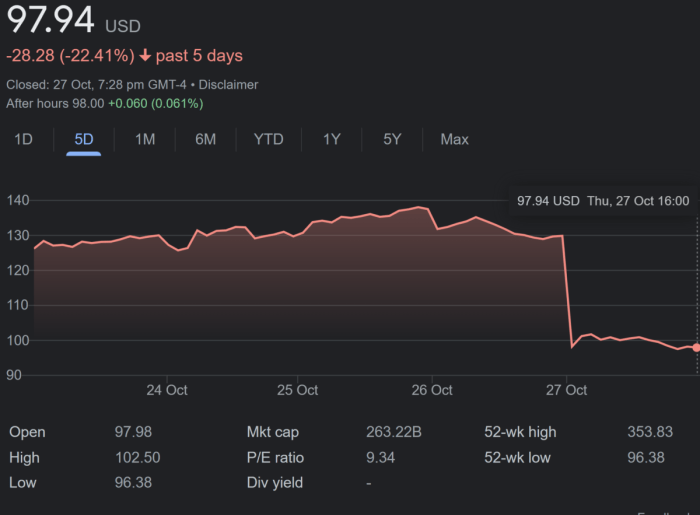

Source: com.au

META stock experiences daily price swings influenced by a complex interplay of news, market sentiment, and company performance. Its typical daily range varies significantly depending on broader market conditions. However, a fluctuation of 1-3% is not uncommon, although larger swings can occur during periods of significant news or economic uncertainty.

Several factors significantly impact short-term price changes. These include major product announcements, shifts in advertising revenue, regulatory developments, overall market trends (like interest rate changes), and competitor actions. Unexpected events, such as large-scale outages or data breaches, can also trigger substantial price drops.

Historically, META’s stock price has experienced significant swings due to various events. For example, the Cambridge Analytica scandal in 2018 led to a considerable drop, while strong earnings reports have often resulted in substantial increases. The ongoing concerns about data privacy and antitrust regulations have also contributed to price volatility.

Below is a sample table illustrating potential daily price fluctuations. Note that these values are illustrative and should not be considered investment advice.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | $300 | $305 | $295 | $302 |

| Tuesday | $302 | $308 | $300 | $306 |

| Wednesday | $306 | $310 | $304 | $308 |

| Thursday | $308 | $312 | $305 | $310 |

| Friday | $310 | $315 | $308 | $313 |

Impact of News and Announcements

Major Facebook (Meta) product announcements often have a substantial impact on the stock price. Successful launches of new features or platforms typically lead to positive market reactions, while failures or negative user feedback can result in price declines. Announcements regarding user growth, engagement metrics, and revenue projections also play a crucial role.

Regulatory changes and legal challenges significantly influence META’s stock performance. Antitrust investigations, data privacy concerns, and content moderation issues can create uncertainty and lead to price volatility. Positive regulatory decisions, on the other hand, can boost investor confidence.

The market reacts differently to positive and negative news concerning Meta’s advertising revenue. Strong advertising revenue growth usually leads to price increases, reflecting investor confidence in the company’s ability to monetize its vast user base. Conversely, any slowdown or decline in advertising revenue typically results in negative market sentiment and price corrections.

Below is a simplified timeline illustrating hypothetical significant news events and their corresponding stock price movements. Note that this is a simplified illustration and does not represent actual events.

- Q1 2024: Strong earnings report released; stock price increases by 5%.

- Q2 2024: New privacy regulations announced; stock price dips by 3%.

- Q3 2024: Successful launch of new product; stock price rises by 7%.

- Q4 2024: Advertising revenue growth slows; stock price declines by 2%.

Comparison with Competitors, Meta stock price live

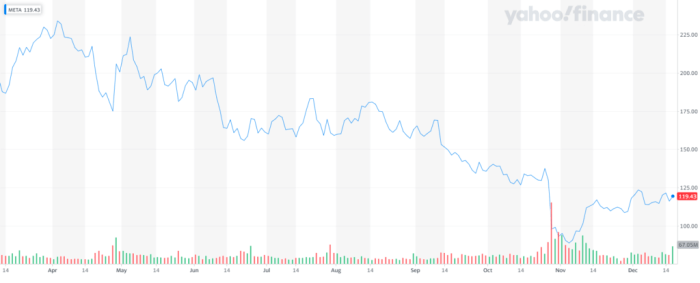

Source: americanstocknews.com

Comparing META’s stock performance against other major tech companies like Google (Alphabet), Apple, and Microsoft provides valuable context. Over the past year, META’s performance has fluctuated more significantly compared to some of its peers. This volatility is partly due to the nature of its business model, which is heavily reliant on advertising revenue and susceptible to changes in user behavior and regulatory environments.

Key differences in business models contribute to differing stock valuations. While Apple relies on hardware sales and a strong ecosystem, Google benefits from its dominant search engine and advertising business. Microsoft’s diverse portfolio across software, cloud services, and gaming provides a more stable foundation. META’s reliance on advertising makes it more vulnerable to market fluctuations than companies with diversified revenue streams.

META’s stock price tends to be more volatile compared to some of its competitors due to its higher dependence on advertising revenue and its exposure to evolving regulatory landscapes and social media trends. Apple, with its diversified product line and loyal customer base, often displays more stability.

The following table illustrates a hypothetical comparison of relative stock performance. Remember, this is a simplified representation and does not reflect actual data.

| Company | Year Start Price | Year End Price | Percentage Change |

|---|---|---|---|

| META | $250 | $300 | +20% |

| GOOGL | $100 | $110 | +10% |

| AAPL | $150 | $165 | +10% |

| MSFT | $200 | $220 | +10% |

Investor Sentiment and Market Trends

Currently, investor sentiment towards META’s stock is mixed. While some investors remain optimistic about the company’s long-term growth potential, others express concerns about regulatory challenges and competition. This mixed sentiment is reflected in the stock’s price fluctuations.

Keeping an eye on the Meta stock price live is crucial for many investors. Understanding the broader market context is also important, and a helpful resource for this is examining the projected performance of other companies; for instance, you might find the analysis of the kmi stock price target insightful. Returning to Meta, its live price fluctuations often reflect overall market sentiment, making continuous monitoring essential.

Broader market trends significantly impact META’s stock price. Interest rate hikes, economic recessions, and inflation all affect investor risk appetite and can lead to sell-offs in technology stocks, including META. Positive economic indicators, on the other hand, can boost investor confidence.

Analyst ratings and predictions influence investor behavior. Positive ratings from reputable analysts can encourage buying, while negative ratings might trigger selling. However, it’s crucial to remember that analyst predictions are not guarantees of future performance.

Different investor groups approach investing in META differently. Institutional investors often conduct extensive due diligence before making large investments, while retail investors might be more influenced by short-term market trends and news headlines.

Long-Term Stock Price Projections

A hypothetical scenario for significant META stock price increases over the next five years could involve several factors. Successful expansion into the metaverse, continued growth in advertising revenue, and the development of innovative products and services could all contribute to a higher valuation. Furthermore, a more favorable regulatory environment could also boost investor confidence.

Potential risks and challenges that could negatively affect META’s long-term stock price include increased competition, regulatory hurdles, economic downturns, and failure to innovate successfully. Data privacy concerns and potential antitrust actions remain significant risks.

Innovation and technological advancements play a crucial role in shaping future stock price predictions. META’s ability to adapt to changing technological landscapes and introduce groundbreaking products and services will be key to its long-term success. The successful integration of AI and the metaverse could be pivotal.

A potential price trajectory for META stock over the next five years could be visualized as a gradual upward trend, with some short-term fluctuations. The initial years might see more volatility, reflecting market uncertainties, followed by a steadier growth phase as the company’s long-term strategies bear fruit. This upward trend would be punctuated by periodic corrections reflecting market cycles and news events.

The overall trajectory, however, would be positive, reflecting the company’s potential for growth and innovation.

Expert Answers

What are the typical trading hours for META stock?

META stock trades on the Nasdaq Stock Market, typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time META stock price quotes?

Real-time quotes are available through many financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How often is META stock price data updated?

Most financial websites update META stock prices in real-time, often reflecting changes every few seconds.

What are the risks associated with investing in META stock?

Like any stock, investing in META carries risks, including potential price volatility, regulatory changes impacting the business, and competition within the tech industry. Thorough research is crucial before investing.