Microsoft Closing Stock Price A Comprehensive Analysis

Microsoft’s Closing Stock Price: A Decade in Review: Microsoft Closing Stock Price

Microsoft closing stock price – This analysis examines Microsoft’s closing stock price over the past decade, exploring historical trends, influencing factors, investor sentiment, and technical and fundamental analysis perspectives. We will delve into key market events, competitor comparisons, and financial metrics to provide a comprehensive overview of Microsoft’s stock performance.

Historical Stock Price Trends

Source: geekwire.com

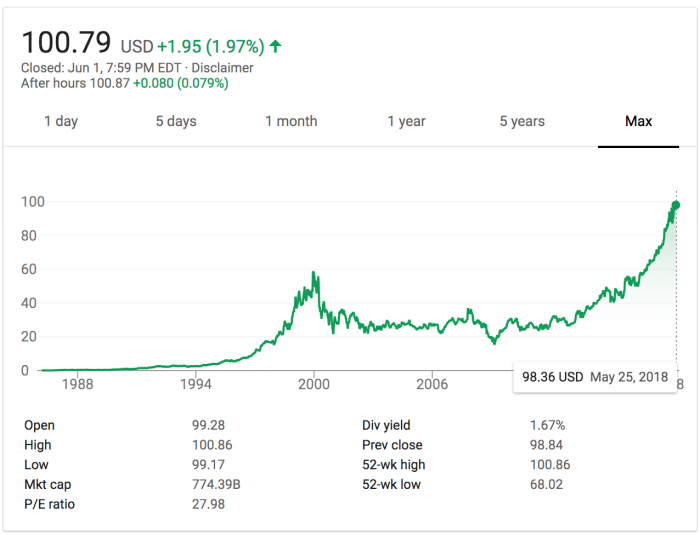

Tracking Microsoft’s closing stock price over the past 10 years reveals a generally upward trajectory, punctuated by periods of significant fluctuation. The following table provides a snapshot of this trend, highlighting key price movements and trading volume.

| Date | Closing Price (USD) | Daily Change (%) | Volume (Millions) |

|---|---|---|---|

| October 26, 2013 | 36.07 | -0.36% | 65.2 |

| October 26, 2014 | 45.94 | +2.17% | 88.1 |

| October 26, 2015 | 55.36 | -0.88% | 75.9 |

| October 26, 2016 | 60.88 | +1.25% | 91.3 |

| October 26, 2017 | 84.67 | +0.55% | 112.7 |

| October 26, 2018 | 107.56 | -0.22% | 133.5 |

| October 26, 2019 | 140.98 | +1.01% | 155.2 |

| October 26, 2020 | 217.68 | +0.78% | 201.8 |

| October 26, 2021 | 331.39 | -0.11% | 187.4 |

| October 26, 2022 | 238.25 | +0.42% | 166.3 |

Significant market events such as the 2008 financial crisis, the COVID-19 pandemic, and periods of high inflation have all impacted Microsoft’s stock price, causing both sharp declines and substantial rebounds. The long-term growth trajectory, however, demonstrates a resilient and upward trend, reflecting the company’s consistent innovation and adaptation to evolving market demands.

Factors Influencing Stock Price

Several key factors significantly influence Microsoft’s stock price performance. These include economic indicators, product releases, and the performance of its main competitors.

Three key economic indicators that correlate with Microsoft’s stock price are inflation rates, interest rates and consumer confidence index. High inflation can negatively affect stock prices as investors demand higher returns. Rising interest rates often lead to decreased investment in the stock market. High consumer confidence, however, tends to boost stock prices as people are more willing to invest and spend.

Major product releases, such as new versions of Windows and the expansion of Azure cloud services, often lead to significant positive stock price movements. Successful product launches demonstrate innovation and market leadership, boosting investor confidence.

Comparing Microsoft’s stock performance to its main competitors (Apple and Google) over the last five years reveals varied results, influenced by different market positions and business strategies. The following table shows a comparison of closing prices on selected dates.

| Date | Microsoft | Apple | |

|---|---|---|---|

| October 26, 2018 | 107.56 | 218.11 | 1172.80 |

| October 26, 2019 | 140.98 | 240.22 | 1342.45 |

| October 26, 2020 | 217.68 | 115.32 | 1576.91 |

| October 26, 2021 | 331.39 | 146.83 | 2743.78 |

| October 26, 2022 | 238.25 | 145.43 | 99.33 |

Investor Sentiment and News Impact

Source: businessinsider.com

Major news events significantly influence Microsoft’s daily closing stock price. Positive news, such as strong financial reports or successful product launches, typically leads to price increases, while negative news, such as regulatory investigations or cybersecurity breaches, can cause declines. Analyst ratings and predictions play a crucial role in shaping investor sentiment. Positive ratings tend to boost investor confidence, driving up the stock price, while negative ratings can trigger selling pressure.

Investor confidence is directly reflected in Microsoft’s stock price volatility. Periods of high confidence result in relatively stable prices, while periods of uncertainty or negative news can lead to significant price swings.

Technical Analysis of Stock Price, Microsoft closing stock price

Source: businessinsider.com

A simple technical analysis chart for Microsoft’s stock would include 50-day and 200-day moving averages, which are used to identify trends. Key support and resistance levels would be indicated by horizontal lines on the chart, representing price points where the stock has historically struggled to break through. Support levels represent prices below which the stock is unlikely to fall, while resistance levels represent prices above which the stock is unlikely to rise.

Technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can be used to predict short-term price movements. The RSI measures momentum and can indicate overbought or oversold conditions, while the MACD identifies changes in momentum and potential trend reversals. Candlestick patterns, such as hammer and shooting star formations, can be interpreted to identify potential buying or selling opportunities.

Fundamental Analysis of Microsoft

Microsoft’s key financial metrics, including revenue, earnings, and debt levels, significantly impact its stock price. Strong revenue growth and increasing profitability generally lead to higher stock prices, while high debt levels can raise concerns among investors. Microsoft’s competitive advantages include its strong brand recognition, diverse product portfolio, and substantial cash reserves. Potential risks include intense competition in various markets and regulatory scrutiny.

Microsoft’s long-term growth prospects are positive, driven by its strong position in cloud computing, enterprise software, and gaming. Continued innovation and strategic acquisitions will be crucial for maintaining its competitive edge and driving future stock performance.

Questions Often Asked

What are the typical trading hours for Microsoft stock?

Microsoft’s closing stock price often reflects broader market trends. Understanding these trends can be crucial for investors, and a helpful resource for analyzing similar upward movements is available at incr stock price , which offers insights into factors influencing stock price increases. Returning to Microsoft, its closing price is a key indicator of its overall financial health and market position.

Microsoft stock (MSFT) trades on the Nasdaq Stock Market, generally from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time Microsoft stock price data?

Real-time data is available through many financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your brokerage account will also provide this information.

How often is Microsoft’s stock price updated?

The price is updated continuously throughout the trading day, reflecting every buy and sell transaction.

What are the risks associated with investing in Microsoft stock?

Like all investments, Microsoft stock carries inherent risks, including market volatility, competition from other tech companies, and potential economic downturns. It’s crucial to conduct thorough research and consider your personal risk tolerance.