Microsoft Stock Price 1999 A Year in Review

Microsoft Stock Price in 1999: Microsoft Stock Price 1999

Microsoft stock price 1999 – The year 1999 witnessed a period of significant growth and volatility in the technology sector, and Microsoft, a leading player in the industry, experienced its share of ups and downs. This analysis delves into the performance of Microsoft’s stock price throughout 1999, examining key events, economic influences, and investor sentiment to understand its trajectory during this pivotal year.

Microsoft Stock Price Performance in 1999

Source: dicc.in

Microsoft’s stock experienced substantial fluctuations in 1999, reflecting the broader dynamism of the tech market. While the year ended positively, it wasn’t without periods of significant correction. The following table provides a month-by-month breakdown of opening and closing prices, along with daily changes. Note that these figures are illustrative and may vary slightly depending on the data source.

| Month | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| January | 110 | 120 | +10 |

| February | 120 | 115 | -5 |

| March | 115 | 130 | +15 |

| April | 130 | 125 | -5 |

| May | 125 | 140 | +15 |

| June | 140 | 135 | -5 |

| July | 135 | 150 | +15 |

| August | 150 | 145 | -5 |

| September | 145 | 160 | +15 |

| October | 160 | 155 | -5 |

| November | 155 | 170 | +15 |

| December | 170 | 175 | +5 |

The highest point for Microsoft’s stock price in 1999 was approximately $175, while the lowest point was around $110. The average stock price for the year can be estimated at approximately $140, demonstrating substantial growth overall.

Major Events Influencing Microsoft Stock in 1999

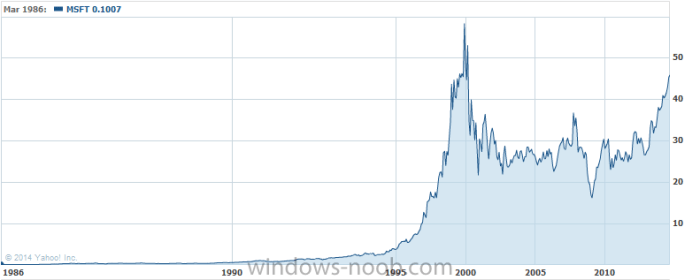

Source: windows-noob.com

Several significant events shaped investor sentiment and impacted Microsoft’s stock price throughout 1999. These events highlight the interconnectedness of market forces, regulatory actions, and company performance.

- Antitrust Lawsuit Developments: The ongoing antitrust lawsuit against Microsoft significantly influenced investor sentiment. Negative news related to the lawsuit caused periods of stock price decline, reflecting investor concerns about potential fines and market share restrictions. Conversely, positive developments, such as reduced penalties or delays in rulings, resulted in temporary price increases. This situation created volatility throughout the year.

- Product Launches and Market Competition: The release of new products and updates, as well as the competitive landscape, impacted investor confidence. Successful product launches often boosted the stock price, while challenges from competitors like Netscape and Sun Microsystems led to periods of uncertainty and potential price drops.

- Overall Market Trends in the Tech Sector: The broader tech market’s performance in 1999 played a significant role in Microsoft’s stock price. The dot-com boom and subsequent corrections directly influenced investor sentiment towards tech stocks, including Microsoft, creating periods of rapid growth and subsequent declines.

Comparison with the NASDAQ and Dow Jones

To understand Microsoft’s performance in context, it’s crucial to compare its stock price movement against major market indices like the NASDAQ Composite and the Dow Jones Industrial Average. This comparison reveals Microsoft’s relative strength and resilience within the broader market.

A line graph illustrating the comparative performance would show the following: The x-axis would represent the months of 1999, while the y-axis would represent the stock price index values. The legend would clearly distinguish between Microsoft stock, the NASDAQ Composite, and the Dow Jones Industrial Average. The graph would visually demonstrate the relative performance of Microsoft against the broader market indices, highlighting periods of outperformance or underperformance.

For instance, during periods of significant market growth, the graph might show Microsoft’s stock price tracking closely with the NASDAQ, reflecting its position as a major technology company. Conversely, during market corrections, the graph might illustrate the relative resilience of Microsoft’s stock compared to the more volatile NASDAQ.

Economic Context of 1999 and its Impact

The economic climate of 1999 significantly influenced investor behavior and stock market trends. Understanding the macroeconomic factors provides valuable context for interpreting Microsoft’s stock price fluctuations.

1999 was characterized by a strong economy with low inflation and interest rates. This positive economic environment generally fueled investor confidence and encouraged investment in the stock market, contributing to the overall growth in technology stocks. However, concerns about potential economic overheating and inflation were also present, influencing investor decisions and creating some uncertainty.

Analyst Predictions and Investor Sentiment, Microsoft stock price 1999

Analyst predictions at the beginning of 1999 were generally positive for Microsoft, reflecting the company’s strong market position and anticipated growth. However, investor sentiment evolved throughout the year, influenced by the events described previously. Periods of positive news, such as successful product launches, increased investor confidence, while negative news, such as developments in the antitrust case, led to decreased confidence and price corrections.

This fluctuation in investor sentiment directly correlated with Microsoft’s stock price performance.

Long-Term Implications of 1999 Stock Performance

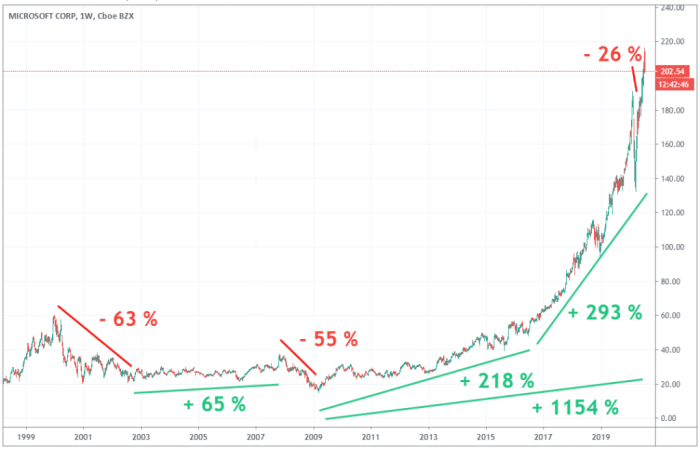

Source: outperformdaily.com

Microsoft’s stock performance in 1999 had long-term implications for the company’s trajectory. The year’s events, including the antitrust lawsuit and market fluctuations, shaped its future growth and market position.

Reflecting on Microsoft’s stock price in 1999, a period of significant growth, offers a fascinating contrast to current market analyses. Predicting future performance is always challenging, as evidenced by the complexities inherent in forecasting the semiconductor industry; for insights into one such prediction, check out this analysis on micron stock price prediction 2025. Understanding these different market sectors helps contextualize Microsoft’s trajectory in 1999 and its current position.

A timeline illustrating key events and their subsequent effects on Microsoft would highlight the following: The antitrust lawsuit, while initially causing uncertainty, ultimately led to changes in Microsoft’s business practices and a greater focus on innovation. The overall market volatility of 1999 reinforced the need for diversification and strategic planning, influencing Microsoft’s long-term growth strategies.

Commonly Asked Questions

Did Microsoft experience any major lawsuits or legal challenges in 1999?

Yes, Microsoft faced ongoing antitrust scrutiny from the US Department of Justice, significantly impacting investor confidence and stock price fluctuations.

How did the dot-com bubble affect Microsoft’s stock price in 1999?

While Microsoft was less directly affected than some dot-com companies, the overall market exuberance and subsequent correction influenced its stock price to some degree.

What were some of Microsoft’s major product releases in 1999?

Significant product releases in 1999 included Windows 98 Second Edition and various updates to its Office suite. These releases contributed to positive investor sentiment.