Mirati Stock Price A Comprehensive Analysis

Mirati Therapeutics: A Deep Dive into Stock Performance

Source: seekingalpha.com

Mirati stock price – Mirati Therapeutics, a biopharmaceutical company focused on the discovery, development, and commercialization of innovative cancer therapies, has garnered significant attention in the investment world. This analysis explores the key factors influencing Mirati’s stock price, examining its company overview, financial performance, recent news, investor sentiment, and potential risks.

Mirati Therapeutics Company Overview

Founded with a mission to transform cancer treatment, Mirati Therapeutics has rapidly advanced its pipeline of targeted therapies. The company’s strategic goals center on bringing innovative treatments to patients battling various cancers. Key leadership includes experienced professionals with extensive backgrounds in oncology drug development and commercialization. Their expertise is crucial to navigating the complexities of the pharmaceutical industry.

Mirati’s main product pipeline currently focuses on developing and commercializing targeted therapies, primarily focused on various types of cancer.

Factors Influencing Mirati Stock Price

Several economic factors, industry trends, competitive dynamics, and Mirati’s own performance significantly impact its stock valuation. Macroeconomic conditions, such as interest rates and overall market sentiment, play a role. Industry trends, including advancements in oncology research and regulatory changes, influence the company’s growth prospects. The competitive landscape, characterized by other biopharmaceutical companies developing similar therapies, affects Mirati’s market share and pricing power.

Direct comparisons with competitors provide a valuable perspective on Mirati’s performance and potential.

| Metric | Mirati Therapeutics | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (USD Millions) | [Insert Data] | [Insert Data] | [Insert Data] |

| Market Cap (USD Billions) | [Insert Data] | [Insert Data] | [Insert Data] |

| P/E Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

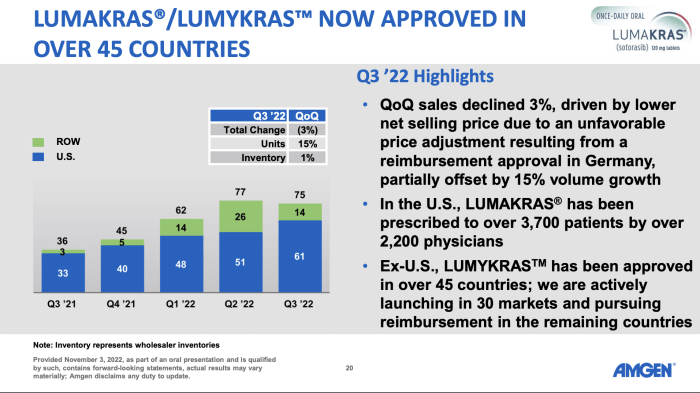

Recent News and Events Affecting Mirati

Source: seekingalpha.com

Recent announcements, clinical trial results, and regulatory updates have significantly influenced Mirati’s stock price. A timeline of these key events helps illustrate the impact on investor sentiment and market reactions. For example, positive clinical trial data typically leads to a price increase, while regulatory setbacks can cause a decline. Analyzing the market’s response to each event provides valuable insights into investor behavior and expectations.

Mirati Therapeutics’ stock price performance has been a subject of much discussion lately, particularly concerning its volatility. Investors are often comparing it to other biotech companies, and a quick check of the current inogen stock price today can provide a useful benchmark for understanding the broader biotech market trends. Ultimately, understanding Mirati’s trajectory requires a detailed analysis beyond simple comparisons.

- [Date]: [Event Description and Market Reaction]

- [Date]: [Event Description and Market Reaction]

- [Date]: [Event Description and Market Reaction]

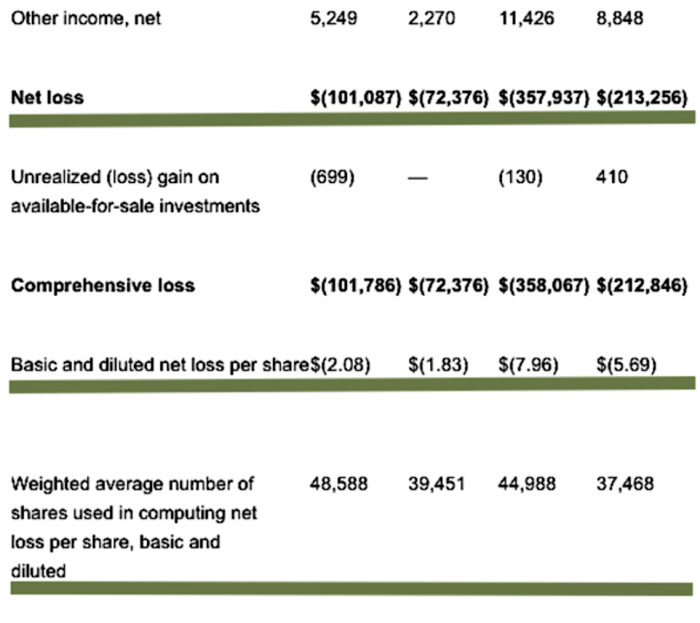

Financial Performance and Projections

Mirati’s financial performance, including revenue growth, profitability, and debt levels, provides a clear picture of the company’s financial health. The company’s financial projections and guidance offer insights into its future prospects. Analyzing these factors in conjunction with historical performance helps assess the company’s long-term sustainability and potential for growth. A textual representation of the company’s financial performance over the past five years offers a clear visualization of trends.

For example, Mirati’s revenue might have shown a steady increase over the past five years, from [Year 1 Revenue] to [Year 5 Revenue], with profitability improving in [Specific Year(s)]. Debt levels may have decreased or remained stable during this period, reflecting responsible financial management.

Investor Sentiment and Analyst Ratings

Investor sentiment towards Mirati Therapeutics is a crucial factor influencing its stock price. Analyst ratings and price targets provide a valuable gauge of market expectations. A range of opinions exists among financial analysts, reflecting the inherent uncertainty in the biotechnology sector. News articles and reports often reflect the prevailing sentiment and can help to understand the overall market perception of the company.

Risk Factors and Potential Challenges, Mirati stock price

Mirati Therapeutics faces several potential risks and challenges that could impact its stock price. These risks need to be considered when evaluating the company’s investment potential. The company likely employs strategies to mitigate these risks, but investors should remain aware of the potential for negative impacts.

- Competition from other pharmaceutical companies.

- Uncertainty surrounding clinical trial outcomes.

- Regulatory hurdles and potential delays in drug approvals.

FAQ Resource: Mirati Stock Price

What is Mirati Therapeutics’ primary focus area?

Mirati Therapeutics focuses primarily on the development and commercialization of cancer therapies.

Where can I find Mirati’s financial reports?

Mirati’s financial reports are typically available on their investor relations website and through major financial news sources.

How volatile is Mirati’s stock price compared to the broader market?

Biotech stocks generally exhibit higher volatility than the overall market. Mirati’s stock price will likely reflect this inherent risk.

What are the main risks associated with investing in Mirati?

Key risks include the inherent uncertainties in drug development (clinical trial failures, regulatory hurdles), competition, and overall market conditions.