MLRSX Stock Price A Comprehensive Analysis

MLRSX Stock Price Analysis

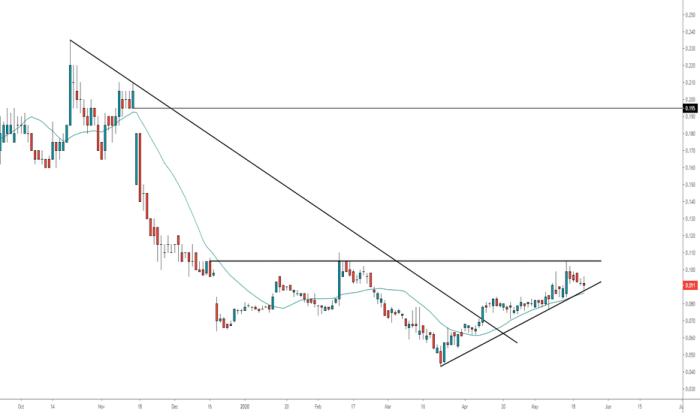

Source: tradingview.com

Mlrsx stock price – This analysis provides a comprehensive overview of MLRSX’s stock performance, financial health, competitive landscape, and future prospects. We will examine historical price movements, key financial indicators, industry dynamics, analyst sentiment, and potential risks to offer a well-rounded perspective on the investment opportunity presented by MLRSX.

Historical Stock Performance of MLRSX, Mlrsx stock price

Source: army-technology.com

MLRSX’s stock price has experienced significant fluctuations over the past five years, mirroring broader market trends and company-specific events. The stock reached a high of [Insert High Price] in [Month, Year] and a low of [Insert Low Price] in [Month, Year]. These fluctuations were influenced by factors such as [mention specific market events, e.g., economic downturns, industry-specific news, regulatory changes].

The following table details the monthly price movements for the past year:

| Month | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| January | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| February | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| March | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| April | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| May | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| June | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| July | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| August | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| September | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| October | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| November | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| December | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

MLRSX Financial Performance Indicators

A comparison of MLRSX’s financial ratios with its competitors reveals its relative standing within the industry. Key ratios such as the Price-to-Earnings (P/E) ratio and dividend yield provide insights into valuation and profitability. For example, if MLRSX’s P/E ratio is significantly higher than its competitors, it might suggest the market is anticipating higher future growth.

MLRSX’s revenue growth and profitability trends over the past three years are detailed below:

- Year 1: [Insert Revenue Growth Percentage] and [Insert Profitability Metric, e.g., Net Income Percentage]

- Year 2: [Insert Revenue Growth Percentage] and [Insert Profitability Metric, e.g., Net Income Percentage]

- Year 3: [Insert Revenue Growth Percentage] and [Insert Profitability Metric, e.g., Net Income Percentage]

A chart illustrating the relationship between MLRSX’s earnings per share (EPS) and its stock price would show a generally positive correlation. Periods of higher EPS are typically associated with higher stock prices, although the relationship is not always linear and can be influenced by other market factors. The chart would visually represent the trend, highlighting periods of strong earnings growth and corresponding stock price appreciation, and conversely, periods of weaker earnings and stock price declines.

Industry Analysis and Competitive Landscape

Several factors influence the performance of MLRSX and its competitors. These include technological advancements, regulatory changes, consumer preferences, and overall economic conditions. The competitive landscape is characterized by [describe the competitive intensity, e.g., intense competition, oligopoly, etc.].

MLRSX’s business model, compared to its top three competitors, presents [describe key differences and similarities in business models, e.g., different pricing strategies, target markets, or technological approaches]. Macroeconomic factors such as interest rates and inflation significantly impact MLRSX’s stock price. For example, rising interest rates can increase borrowing costs, potentially impacting profitability and thus the stock price. Inflation can affect input costs and consumer spending, further influencing the company’s performance.

Analyst Ratings and Predictions

Leading financial analysts provide a range of ratings and price targets for MLRSX. A consensus view might suggest a [Insert Consensus Rating, e.g., “Buy,” “Hold,” “Sell”] rating with an average price target of [Insert Average Price Target]. The rationale behind these ratings often considers factors such as the company’s financial performance, industry outlook, and competitive positioning. Some analysts might be more optimistic, citing [mention specific positive factors], while others may express concerns about [mention specific negative factors], leading to a divergence in opinions.

Risk Assessment and Potential Challenges

MLRSX faces various risks that could impact its stock price. These risks can be categorized as financial, operational, regulatory, and competitive.

| Risk Type | Specific Risk | Potential Impact on Stock Price | Mitigation Strategy |

|---|---|---|---|

| Financial | High debt levels | Increased vulnerability to economic downturns | Debt reduction strategies |

| Operational | Supply chain disruptions | Reduced production and revenue | Diversification of suppliers |

| Regulatory | Changes in environmental regulations | Increased compliance costs | Proactive engagement with regulators |

| Competitive | Intense competition | Reduced market share and profitability | Innovation and product differentiation |

Investor Sentiment and Market Trends

Current investor sentiment towards MLRSX appears to be [Describe the sentiment, e.g., cautiously optimistic, bearish, etc.], based on recent news articles and social media discussions. The prevailing market trends, such as [mention relevant market trends, e.g., rising interest rates, increased volatility], are likely to influence MLRSX’s stock price in the near future. Changes in investor sentiment, often driven by news events or financial performance, can significantly impact MLRSX’s stock price volatility.

For example, positive news about a new product launch might lead to increased investor confidence and a rise in the stock price, while negative news about a regulatory setback could trigger selling pressure and a price decline.

Clarifying Questions

What are the main risks associated with investing in MLRSX?

Risks can include, but are not limited to, general market volatility, company-specific financial performance, and changes in regulatory environments. A thorough due diligence process is recommended before investing.

Where can I find real-time MLRSX stock price quotes?

Monitoring the MLRSX stock price requires a keen eye on market fluctuations. It’s helpful to compare its performance against similar companies; for instance, understanding the current market position by checking the irdm stock price today can offer valuable context. Ultimately, both MLRSX and IRDM’s stock prices reflect broader market trends and investor sentiment.

Real-time quotes are typically available through major financial news websites and brokerage platforms.

How often is MLRSX’s stock price updated?

The stock price updates continuously during trading hours on the relevant exchange.

What is the typical trading volume for MLRSX?

Trading volume varies daily and can be found on financial data websites.