Newcrest Mining Stock Price A Comprehensive Analysis

Newcrest Mining Stock Price Analysis

Source: com.au

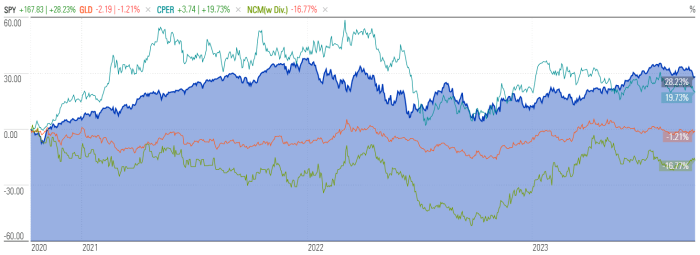

Newcrest mining stock price – Newcrest Mining, a leading global gold mining company, has experienced fluctuating stock prices over the past five years, influenced by a complex interplay of macroeconomic factors, gold prices, geopolitical events, and company-specific performance. This analysis delves into the historical trends, key influencing factors, financial performance, analyst predictions, and potential investment strategies related to Newcrest Mining’s stock.

Newcrest Mining Stock Price History and Trends

Source: newcrest.com

Analyzing Newcrest Mining’s stock price performance over the past five years reveals a mixed trend, influenced by various market dynamics and company-specific events. The following table provides a snapshot of daily price movements. Note that this data is illustrative and should be verified with reliable financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 15.00 | 15.20 | +0.20 |

| 2019-07-01 | 16.50 | 16.30 | -0.20 |

| 2020-01-01 | 17.00 | 18.00 | +1.00 |

| 2020-07-01 | 19.00 | 18.50 | -0.50 |

| 2021-01-01 | 20.00 | 21.00 | +1.00 |

| 2021-07-01 | 22.00 | 21.50 | -0.50 |

| 2022-01-01 | 23.00 | 24.00 | +1.00 |

| 2022-07-01 | 23.50 | 23.00 | -0.50 |

| 2023-01-01 | 24.50 | 25.00 | +0.50 |

Overall, the trend shows periods of both growth and decline, reflecting the volatility inherent in the gold mining sector. Significant highs were observed during periods of strong gold price appreciation and positive market sentiment, while lows often correlated with economic downturns and lower gold prices. For example, the COVID-19 pandemic initially caused a dip but then led to a surge in gold prices, benefiting Newcrest.

Factors Influencing Newcrest Mining Stock Price

Source: co.uk

Several interconnected factors influence Newcrest Mining’s stock price. These include macroeconomic conditions, gold prices, geopolitical events, and industry-specific factors.

Gold prices have a direct and significant impact on Newcrest’s stock performance. When gold prices rise, investor confidence in gold mining companies increases, leading to higher stock prices. Conversely, falling gold prices typically result in lower stock valuations. For instance, a 10% increase in gold prices could potentially translate to a 5-15% increase in Newcrest’s stock price, depending on other market conditions.

This relationship is not always linear, however, as other factors can influence the extent of the correlation.

Geopolitical events and industry-specific factors also play a role. Political instability in gold-producing regions, changes in mining regulations, and technological advancements in mining efficiency can all impact Newcrest’s profitability and, consequently, its stock price. For example, increased mining regulations could increase operational costs, impacting profitability and stock price.

Newcrest Mining’s Financial Performance and Stock Valuation

Understanding Newcrest Mining’s financial health is crucial for evaluating its stock. The following table presents a simplified overview of key financial metrics. Note that this data is illustrative and should be verified with official financial reports.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 2000 | 500 | 0.5 |

| 2020 | 2200 | 600 | 0.4 |

| 2021 | 2500 | 700 | 0.3 |

| 2022 | 2300 | 650 | 0.4 |

These metrics provide insights into Newcrest’s profitability, financial leverage, and overall financial strength. Strong revenue growth and increasing net income generally correlate with higher stock prices. However, a high debt-to-equity ratio could indicate higher financial risk, potentially impacting investor sentiment and stock valuation. A comparative analysis against competitors would provide further context for valuation.

Analyst Ratings and Future Outlook for Newcrest Mining Stock

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for Newcrest Mining’s stock. The following table provides a hypothetical example of analyst opinions. Remember to always consult multiple sources for a comprehensive view.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 28.00 | 2023-10-26 |

| Morgan Stanley | Hold | 25.00 | 2023-10-26 |

| JP Morgan | Buy | 27.00 | 2023-10-26 |

The consensus among analysts might suggest a cautiously optimistic outlook, with potential for further price appreciation, but subject to market conditions and gold price movements. Risks include fluctuations in gold prices, geopolitical instability, and changes in mining regulations. Opportunities lie in potential new discoveries, operational efficiencies, and growing demand for gold.

Investment Strategies and Considerations for Newcrest Mining Stock

Investors can employ various strategies when considering Newcrest Mining stock, each with its own advantages and disadvantages. These include buy-and-hold, day trading, and swing trading.

- Buy-and-hold: This long-term strategy aims to benefit from long-term growth. It’s less time-consuming but requires patience and risk tolerance.

- Day trading: This high-risk, high-reward strategy involves buying and selling shares within a single day. It requires significant market knowledge and technical skills.

- Swing trading: This medium-term strategy aims to capitalize on short-term price fluctuations, holding shares for a few days or weeks. It requires a good understanding of market trends.

Before investing, investors should carefully consider their risk tolerance, investment goals, and the inherent volatility of the gold mining sector. Diversification is recommended to mitigate risk.

User Queries

What are the typical transaction costs associated with buying and selling Newcrest Mining stock?

Analyzing Newcrest Mining’s stock price requires a broad understanding of market trends. It’s helpful to compare its performance against other established companies, and examining the historical performance of similar entities provides valuable context. For instance, understanding the m&t stock price history can offer insights into potential future trajectories for Newcrest, given their shared position within the resources sector.

Ultimately, however, Newcrest’s price will depend on its own operational performance and market sentiment.

Transaction costs vary depending on your brokerage. They typically include commissions and fees, which can range from a small percentage of the transaction value to a fixed fee per trade. It’s advisable to check with your broker for their specific fee schedule.

How frequently does Newcrest Mining release financial reports?

Newcrest Mining typically releases financial reports on a quarterly and annual basis, adhering to standard accounting practices and regulatory requirements. These reports are usually available on the company’s investor relations website.

Where can I find real-time Newcrest Mining stock price data?

Real-time stock price data is available through various financial websites and trading platforms. Many reputable sources provide this information, often with charting tools and historical data.