Nifty50 Stock Price A Comprehensive Guide

Nifty50 Stock Price: A Comprehensive Analysis

Source: dailytrademantra.com

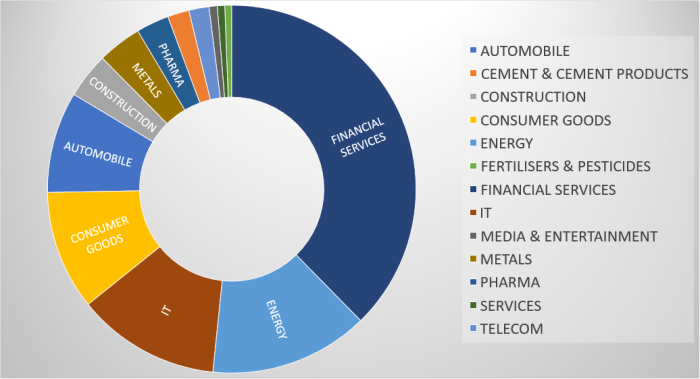

Nifty50 stock price – The Nifty50 index, a benchmark for Indian equities, reflects the performance of 50 of the largest and most liquid companies listed on the National Stock Exchange of India (NSE). Understanding its price movements is crucial for investors navigating the Indian stock market. This analysis delves into the historical performance, key drivers, and analytical techniques for interpreting Nifty50 price trends, along with an assessment of risk and volatility.

Nifty50 Stock Price Overview

Source: tradingview.com

The Nifty50 has experienced significant price fluctuations throughout its history, reflecting both domestic and global economic conditions. Its inception in 1996 saw a relatively nascent market, with subsequent growth mirroring India’s economic expansion. Periods of rapid growth have been punctuated by corrections, often linked to global events or domestic policy changes. The index is a free-float market capitalization-weighted index, meaning larger companies with more shares available for trading have a greater influence on the overall index value.

Key factors influencing Nifty50 stock prices include macroeconomic conditions (inflation, interest rates, GDP growth), global market sentiment, sector-specific performance, and individual company-specific news and earnings.

| Rank | Stock | Performance (Last Year) | Sector |

|---|---|---|---|

| 1 | (Example: Reliance Industries) | +XX% | Energy |

| 2 | (Example: HDFC Bank) | +YY% | Financials |

| 3 | (Example: Infosys) | +ZZ% | IT |

| 4 | (Example: Tata Consultancy Services) | +AA% | IT |

| 5 | (Example: Hindustan Unilever) | +BB% | Consumer Goods |

| 46 | (Example: Company with lowest performance) | -XX% | (Sector) |

| 47 | (Example: Company with lowest performance) | -YY% | (Sector) |

| 48 | (Example: Company with lowest performance) | -ZZ% | (Sector) |

| 49 | (Example: Company with lowest performance) | -AA% | (Sector) |

| 50 | (Example: Company with lowest performance) | -BB% | (Sector) |

Nifty50 Price Drivers

Source: seekingalpha.com

Monitoring the Nifty50 stock price requires a keen eye on various market indicators. Understanding the performance of individual companies within the index is crucial, and a good example to consider is the performance of infrastructure companies, like checking the metro pacific investments stock price , to gauge broader economic trends. Ultimately, a thorough analysis of Nifty50 stocks involves considering both macro and microeconomic factors.

Macroeconomic factors significantly impact Nifty50 prices. High inflation, rising interest rates, and global economic slowdowns tend to negatively affect the index, while low inflation, lower interest rates, and global growth typically lead to positive price movements. Sectoral performance also plays a crucial role; strong performance in key sectors like technology, financials, or consumer goods can boost the overall index, while weakness in these sectors can drag it down.

Key economic indicators like GDP growth, inflation rates, and industrial production correlate strongly with Nifty50 price movements. Global events, such as geopolitical instability or major economic shifts in other countries, can have a substantial impact, sometimes outweighing the influence of domestic factors.

Analyzing Nifty50 Price Trends

A five-year chart of the Nifty50 would show a generally upward trend, with periods of both significant gains and corrections. The X-axis would represent time (years), and the Y-axis would represent the Nifty50 index value. Trend lines could be drawn to illustrate the overall direction. Significant markers could include major economic events, policy changes, or global crises. Moving averages, such as 50-day and 200-day moving averages, would be plotted to identify potential support and resistance levels and to smooth out short-term price fluctuations.

Technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) would provide insights into momentum and potential trend reversals. Candlestick patterns, such as hammer, engulfing, or doji patterns, can offer clues about potential price direction.

Individual Nifty50 Stock Performance

A comparative analysis of three randomly selected Nifty50 stocks (e.g., Infosys, HDFC Bank, and Reliance Industries) over the past six months would reveal varying performance levels. The price movements of each stock would be influenced by factors specific to their industry, company performance, and investor sentiment. For example, Infosys’s price might be affected by global IT spending, HDFC Bank’s by interest rate changes, and Reliance Industries’ by oil prices and its diversification efforts.

- Stock A (e.g., Infosys): Strong performance driven by robust earnings and positive investor sentiment.

- Stock B (e.g., HDFC Bank): Moderate performance influenced by interest rate adjustments and economic growth.

- Stock C (e.g., Reliance Industries): Variable performance reflecting diverse business segments and global commodity prices.

These differing performances highlight the importance of diversification in an investment portfolio.

Risk and Volatility in Nifty50, Nifty50 stock price

The Nifty50 has exhibited periods of both high and low volatility throughout its history. High volatility periods are often associated with global crises, economic uncertainty, or major policy shifts. Strategies for managing risk include diversification across sectors, asset classes, and geographies. Using stop-loss orders can limit potential losses. Dollar-cost averaging can mitigate the impact of market timing.

A hypothetical risk-minimized portfolio might include a mix of large-cap, mid-cap, and small-cap stocks across different sectors, balancing potential for returns with risk mitigation. For example, a portfolio might include 30% in financials, 25% in technology, 20% in consumer goods, and 15% in energy, with the remaining 10% allocated to defensive sectors like pharmaceuticals or utilities. This allocation aims to balance growth potential with the relative stability of defensive sectors.

Clarifying Questions: Nifty50 Stock Price

What are the trading hours for Nifty50 stocks?

Trading hours for Nifty50 stocks typically align with the National Stock Exchange of India (NSE) hours.

How frequently is the Nifty50 index rebalanced?

The Nifty50 index undergoes periodic rebalancing, typically on a quarterly basis, to reflect changes in company performance and market capitalization.

Are there ETFs that track the Nifty50 index?

Yes, several exchange-traded funds (ETFs) track the Nifty50 index, providing investors with convenient access to the index’s performance.

What are the tax implications of investing in Nifty50 stocks?

Tax implications depend on factors such as your investment timeframe, the type of investment account, and applicable tax laws in India. Consult a tax professional for personalized advice.